Query

Please provide an overview of corruption and anti-corruption in the energy sector with a focus on Ghana.

Caveat

The corruption examples and anti-corruption measures listed in this paper are meant to be illustrative and not exhaustive. Moreover, applying an anti-corruption measure requires a thorough understanding of the contextual realities (i.e., regulatory framework and socio-economic conditions, among others).

Sector-specific corruption risks

There are several ways of understanding and categorising corruption risks within the energy sector. For instance, oil and other fossil fuels as energy forms are riddled with widespread and endemic corruption, and countries with abundant non-renewable natural resources often suffer from a resource curse operating as a “paradox of plenty” (U4 Anti-Corruption Resource Centre n.d.). The renewable energy sector requiring substantial capital investments can also pose substantial corruption risks (Rahman 2020: 2). In general, the energy sector (both renewable and non-renewable) could face corruption-related risks stemming from “large infrastructure projects, non-competitive procurement processes, poor project planning and the use of public-private partnerships,” among others (Wheatland 2015: 5).

For the purpose of this paper, corruption risks will be highlighted as per the energy sector value chain as they present a detailed picture of the steps and stakeholders involved in delivering energy to end-users. However, it is important to understand that “corruption issues arising in the energy sector strongly depend on the location of the resources as well as the monopolistic nature of the undertakings or political decisions” (Rimšaitė 2019: 260). Thus, contextual understanding is key in delineating corruption risks and anti-corruption measures for the sector.

Energy sector value chain

A value chain illustrates a system of “activities that are performed in order to deliver value to a market” (Crofton, Wanless & Wetzel 2015: 9, 10). Differing from supply chains, which refer to the process and resources required to “move a product or service from supplier to customer”, the concept of a value chain builds on this to also include the way in which value is added along the chain, both to the product/service and the actors involved (University of Cambridge n.d.; SustainAbility, UNEP and UNGC 2008: 2).

Value chains also consider both internal and external stakeholders in the value creation process (Kaplinsky and Morris 2001: 4-6; SustainAbility, UNEP and UNGC 2008: 2). Moreover, the understanding of value may not always be limited to an economic sense but could also include “ethical and moral concerns as well as other non-monetary utility values such as closing material loops, the provision of ecosystem services and added customer value” (University of Cambridge n.d.). Thus, when applied to the energy sector, value chains showcase a way of looking at the various layers of often complex energy systems (Crofton, Wanless, Wetzel 2015: 19; Risk and Compliance 2014).

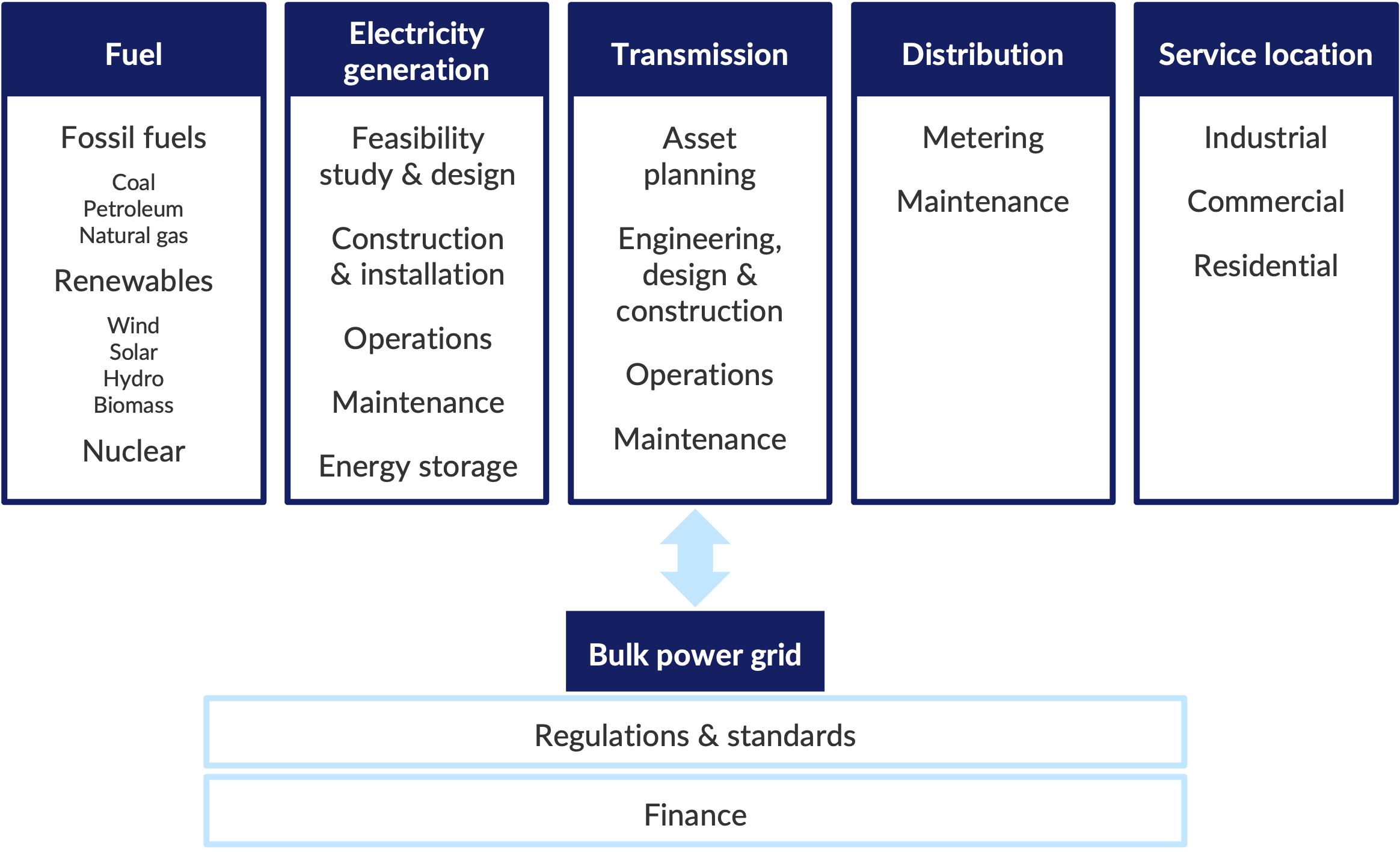

Typical value chains in energy sectors comprise five main steps (Posner and Tayari n.d.; Bamber, Guinn and Gereffi 2014: 3-6):

1. Primary energy acquisition of fuel: refers to obtaining the “primary” naturally occurring energy that will be used for power/electricity generation. This fuel can be divided into types or categories, such as fossil fuels, nuclear and renewables. It is important to note that each fuel type would have its own value chain. For instance, the value chain for gasolined6e6ab5ae692 would look like (Posner and Tayari n.d.):

- exploration: discovering oil

- development: drilling wells and constructing gathering systems

- production: operating wells to obtain oil

- field processing: removing undesired elements, such as water, sulphur and carbon dioxide, at or near the well

- transportation: transporting the crude oil from the oilfield to the refinery, usually by tanker or pipeline

- refining: transforming the crude oil into useful products like gasoline, diesel, heating oil and jet fuel

- distribution: transporting the products from the refineries to retail locations

- retailing: selling the product to end-users, who then burn it to obtain energy for heating, transportation or electricity generation

2. Energy generation: technologies and processes for generating energy are highly specific to the type of fuel being used. Thus, modalities of energy generation depend largely on the range of fuels available. Nevertheless, there are several activities in energy generation that are common to all fuel types, including (Bamber, Guinn and Gereffi 2014: 4):

Feasibility study and design: usually carried out by engineering services firms and led by a handful of highly skilled employees such as surveyors, geologists and civil engineers (Fernandez-Stark et al. 2010).

Construction and installation: involve building brick and mortar facilities and installation of power generation machinery such as turbines and photovoltaic (PV) panels (once again, depending on the fuel type). Given that these processes are labour intensive, they depend largely on a semi-skilled and unskilled workforce and are carried out by large-scale construction contractors (Bamber, Guinn and Gereffi 2014: 5).

Operation: this includes day-to-day activities associated with energy generation. For instance, running an electricity generator once it has been installed. It is typically carried out by utility companies (Bamber, Guinn and Gereffi 2014: 5).

Maintenance: energy generators are inspected and repaired. Specialised maintenance companies usually undertake these activities and involve technicians, manual labourers and a small contingent of engineers (Bamber, Guinn and Gereffi 2014: 5).

3. Transmission: transmission networks exist to connect generation plants with distribution systems, which, in turn, deliver energyc375cc20b5e6 (electrical energy or electricity) to service locations. Transmission takes place at high voltage levels to reduce inefficiencies; thus, the electrical voltage must be accordingly “stepped up” and then “stepped down” between the generation plant and when it reaches the distribution network. The step-up transformer is normally seen as a part of the generation segment of the value chain, while the step-down transformer usually comes under the distribution segment. Previously, transmission lines ran from a single power plant to a single load facility, such as an individual city or factory. Nowadays, individual transmission lines have been interconnected into vast transmission networks. This stage of the value chain typically involves private transmission companies, electrical engineers and network technicians (Bamber, Guinn and Gereffi 2014: 5).

4. Distribution: brings electrical energy from the transmission network to the service location (i.e., individual households, business establishments, etc.). The key difference between transmission and distribution is that the latter takes place at lower voltage levels than the former as the danger of efficiency losses is lower at the relatively short distances that distribution lines cover. Thus, both processes of transmission and distribution use different technologies, requiring somewhat different skills to install and implement. Large companies that are usually the main players in energy distribution.

A decentralised or “off-grid” generation has emerged as an alternative to centralised power generation. In this model, “distributed generation networks include multiple points of electricity generation, which, contrary to the centralised approach, are located very near to sources of demand”. Therefore, individual decentralised generation networks do not need a transmission grid. This, in turn, minimises the loss of energy between the generating facility and the service location. Nevertheless, decentralised networks may be interconnected; if an individual power generating facility fails, neighbouring residents and businesses can use an alternate/connected grid to fulfil their energy needs (Bamber, Guinn and Gereffi 2014: 6; Guerrero et al., 2010).

5. Service location: this is where energy is consumed by, for instance, industrial complexes, individual residences, businesses, clinics and schools, among others. Installation and maintenance of electrical systems at the service location are taken care of by trained electricians. Often overlooked in energy value chains are the benefits of upgrades at the service location, such as the implementation of efficiency improvements and conservation practices and the installation of pre-paid meters, among others (Bamber, Guinn and Gereffi 2014: 6).

Apart from the actors mentioned, international organisations, financial institutions, government bodies, public officials, civil society organisations and local community networks also play major roles at different stages of the energy sector value chain (Rahman 2020: 7).

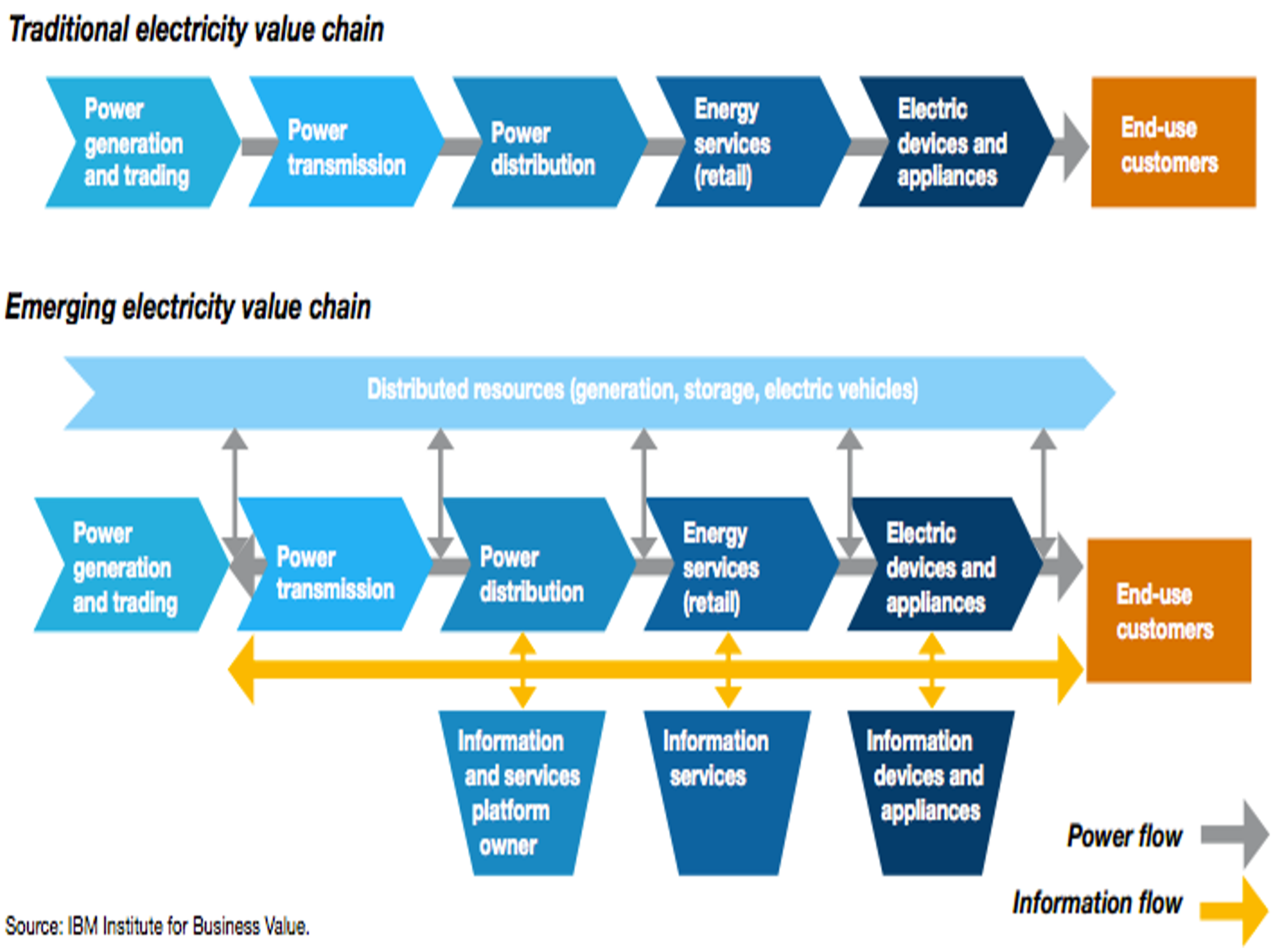

Traditional one-way energy value chains are also being “disrupted” by “information technology and distributed energy resources”, opening up possibilities that “companies that manage consumers’ interaction with the power grid and vice-versa will become the energy companies of the future”. For instance, Google aims to “empower consumers with control of their energy use, which can then be leveraged to provide power and information back to the grid” (Savenije 2014).

Figure 1: the electrical energy value chain

Source: Bamber, Guinn and Gereffi 2014: 3.

Figure 2: traditional vs emerging electricity value chains.

Source: Savenije 2014.

Corruption risks in the energy sector value chain

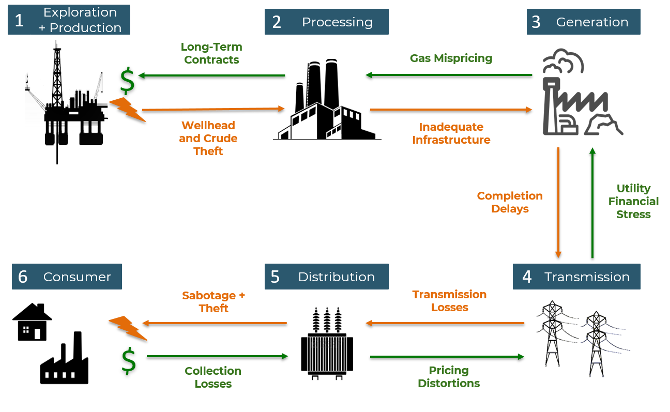

Each layer in the energy sector value chain faces its own set of challenges and corruption risks. Figure 3 describes some challenges occurring at each stage of energy value chains.

Figure 3: challenges at different stages of the energy value chain.

Source: Thurber (2018).

When attempting to understand corruption risks in the energy sector, it is crucial that it is “linked to the supply chain of specific energy sources and their significance in a given country” (Lu et al. 2019: 2). Moreover, corruption risks would largely depend on the “socio-political and institutional environment, in which extraction, transformation, and the use of energy carriers occur” (Lu et al. 2019: 2). As it happens, energy resources are also “mostly located in the countries that have underdeveloped infrastructure, institutions, and control systems which are unable to deal with the corruption risks” (Lu et al. 2019: 5).

In such contexts, as well as others, the strength of accountability institutions, regulation enforcement, as well as the level of public and civil society participation in decision-making processes contribute to the nature, extent and types of corruption risks in the energy sector. Transparency and accountability and the presence of sound legal and institutional systems can go a long way in creating conditions to curb abuse of power and impunity of decision-makers (Lu et al. 2019: 2).

The following sections highlight potential corruption risks at the different stages of the energy sector value chain.

1. Energy acquisition stage: companies in the sector are known to be frequently merged and acquired, including those that are controlled by the state, i.e., state-owned enterprises (SOE). Generally, such undertakings appoint public officials to the supervisory board or board of the company to protect shareholder interests (i.e., the state’s interest). Such appointments open the door for conflicts of interest to occur (Rimšaitė 2019: 2). For instance, “officials who work in the sector may own companies that supply fuel and use their influence and relationship to direct the contract award to their companies” (Rajwanshi 2019). Moreover, given the often “monopolistic environment of” infrastructure utilities, it provides opportunities for corruption risks in the procurement of energy resources (Rimšaitė 2019: 2). Collusion, bid-rigging and bribery in fuel contracts and mining licences (for fuel types such as coal) are also known to take place (Rimšaitė 2019: 2; Transparency International 2017).

2. Energy generation: major corruption risks in the sector could include undue influence (ranging from site selection to allocating costs and contractor selection), procurement fraud and bid-rigging, and bribery (Lu et al. 2019: 7). When it comes to undue influence, it is often “a function of the size of the rewards under a public officials’ control, the discretion that these officials have in allocating those rewards, and the accountability that the officials face for their decisions” (Lu et al. 2019: 6).

3. & 4. Transmission and distribution: undue influence, kickbacks in awarding of transmission and distribution network contracts (Rajwanshi 2019).

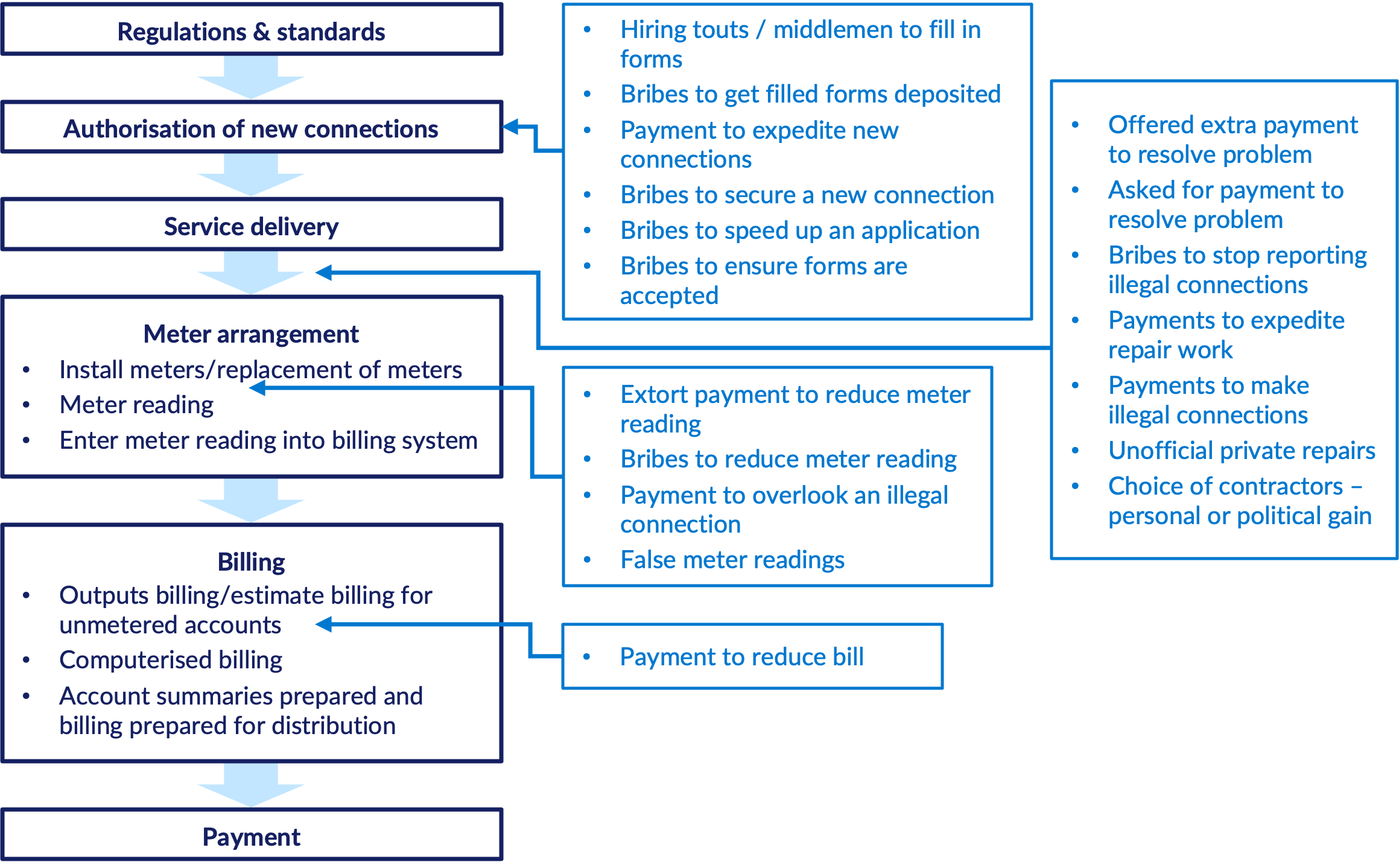

5. Service location: bribery by consumers and often extortion by service providers in obtaining electricity connections. At the consumption point, there can be theft of electricity in the form of direct supply without meters, and tampering with meters for inaccurate readings are some corruption risks (CISLAC Nigeria 2019; Jamil and Ahman 2014).

The potential impact of corruption on stakeholders in the energy sector (sourced from Lu et al. 2019)

|

Stakeholders |

Impact |

|

Energy consumers |

Higher energy prices; less affordable and reliable energy supply |

|

Local inhabitants and communities |

More negative environmental and social impact projects |

|

Energy companies |

Higher costs of energy supply; fewer financial resources for service expansion and quality improvement |

|

Governmental institutions and bodies |

Higher energy sector costs; higher budget spending |

|

Independent power producers, private business developers in the energy sector |

Distortion of competition; unfair competition and efficiency losses |

|

Financing institutions |

Higher risks and dangers of reputation; higher demand for borrowing; additional costs and fraudulent claims |

Sourced from Lu et al. 2019.

Figure 4: Corruption risk mapping in the energy sector.

|

Influence of the energy sector |

Selection of options |

Project planning |

Contracting |

Construction |

Operation and maintenance |

Decommiss-ioning |

|

All sectors: nuclear, oil, gas, renewables, electricity, heat, energy storage, etc |

Undue political influence in setting the site and type of installation |

Undue political influence on technical specifications and cost assessment biased to a particular technology |

Undue political influence on the selection of contractor |

Undue political influence on construction cycle |

Undue political influence on operation and maintenance |

Undue political influence on selection of options, contracting, etc |

|

Preconditions |

Non-transparent process; considered limited options; limited public involvement |

Poor Environmental Impact Assessment (EIA) following non-transparent EIA clearance |

Non-transparent prequalification; confusing tender documents; non-transparent selection procedures; tender clarifications not shared with other bidders |

Concealing sub-standard work; agreeing to unwarranted contract variations, delays, creating artificial claims; bribery to avoid delay payments; bribes for resettlement and compensation |

Commitments not kept; underfunding of environmental mitigations |

Non-transparent process; considered limited options; limited public involvement and non-transparent selection procedures |

|

Result |

Selection of unnecessary projects in wrong location |

Over or under design |

Deception and collusion, agent’s fee |

Delays; increased costs; construction environment violations |

Corruption in operation and maintenance procurement, insurance fraud on equipment and performance guarantees |

Delays; increase in costs; environmental violations |

|

Impact |

Negative environmental impact |

Waste of resources |

Waste of resources and selection of worse possible contractor |

Driving up costs, delaying of the project, lowering service quality and reliability |

Waste of resources, costs overruns, proper functioning at risk, increase in accident probability |

Driving up costs, delaying of implementation, lowering quality and reliability, negative environmental impact |

Source: Lu et al. (2019)

Figure 5: Corruption risks in the energy sector at the service location/energy delivery level.

Source: Cavill and Sohail (n.d.).

Energy sector in Ghana

With public and private companies being involved, Ghana has a “vibrant power generation sector” (ITA 2022). However, it is state agencies that have a “controlling presence” in energy generation and distribution (ITA 2022). The main sources of the country’s energy supply include hydro generation (33%) and thermal generation, which is fuelled by crude oil, natural gas and diesel (66%). The total installed capacity of the country is 5,134 megawatts (MW), with a dependable capacity of 4,710 MW (ITA 2022) (ITA 2022). The peak demand of the country is 2,700 MW. Thus, the installed capacity is double the peak demand (Sarkodie 2019).

The country’s electricity access rate374563c0ceb6 has been growing – from 84% 2018 to 85.9% in 2020 and finally 86.63% in 2021 (ITA 2022; World Bank 2020; Boamah 2019: 7). Fifty per cent of the rural and 91% of the urban population is connected to the electricity grid (ITA 2022). Despite these achievements, the sector is yet to show sustainability and resilience in providing value to the state and consumers (TI Ghana 2022: 1). Thus, the quality of electricity sector management is a “significant factor in presidential and parliamentary election outcomes” (Boamah 2019: 7).

Several agencies (including state and non-state actors) are involved in Ghana’s energy value chain, responsible for generating, transmitting, distributing and regulating electricity. For instance (Boamah 2019: 7, 8; ITA 2022; TI Ghana 2022: 2,3; Allotey 2019):

- Energy Commission (EC) regulates sector planning and issuing licences across generation, transmission and distribution, and private independent power projects (IPPs). There is also a provision to maintain a publicly available register of awarded licences.

- Public Utilities and Regulatory Commission (PURC) develops the tariff guidelines, approves tariff rates, ensures competition among public utilities, monitors standards of performance of public utility service provision and oversees the protection of consumer rights.

- Volta River Authority (VRA) is in charge of power generation (both hydroelectric and thermal).

- Bui Power Authority (BPA) takes care of hydropower generation.

- Electricity Company of Ghana (ECG) –– distributes electric power to the southern part of the country. Power Distributor Services (PDS) had taken over the task briefly; however, after the termination of the concession agreement between the Ghanaian government and PDS in 2019, ECG is once again the distributor.

- Northern Electricity Department (NEDCo) distributes electricity to the northernmost parts of Ghana.

- Enclave Power Company, a private entity, plays a minor role in the country’s energy distribution.

- The Ghana Grid Company Limited (GRIDCo) manages power generation, whereas PURC regulates tariffs.

- Ghana also established the National Electrification Scheme (NES) in 1990 to enable universal electricity access by 2020. It is the NES and complementary programmes such as Self-help Electrification Program which contribute to the country’s high electricity access rate.

Corruption in Ghana’s energy sector

Boamah (2019: 2) suggests that the drivers and impact of both “real and perceived” corruption in power sectors across Africa require serious academic debate. The author adds:

“Corruption is undoubtedly deeply ingrained in the power sector across Africa – driven by a dangerous combination of centralised organisation and distribution of electricity, governmental pressure to achieve universal electricity access, high societal demand for electricity, as well as highly opportunistic political office-holders” (Boamah 2019: 2).

In Ghana, corruption in the energy sector occurs in several forms across the value chain. Boamah, Williams and Afful (2021: 9) state:

“The great strides in national electrification rates in Ghana have, however, occurred amidst grand corruption in the energy sector. Governments, politicians, and energy sector agencies have all employed diverse means – both legal and illegal – to advance certain strategic interests through the introduction of corruption-riddled power purchasing agreements, controversial energy billing systems and other questionable energy policy initiatives. Electricity users have also employed diverse means, including meter tampering, defaulting on tariff payments, and other clandestine avenues, to gain or enhance energy access.”

Select corruption challenges in the Ghanaian energy sector are elaborated on below.

Power purchasing agreements: corruption challenges at the decision-making stage

Currently, there are 32 power purchase agreements (PPAs) in force in the country for electricity generation. The background to the existence of such contracts was the period between 2011-2016 when Ghana “experienced the dumsorb9c892bdf443 emergency of extended blackouts” (Ackah et al. 2021: 2).

Such PPAs are problematic for a host of reasons. First, Ghana depended almost entirely on unsolicited proposals for new energy projects and the negotiation of PPAs. Such practice “limits competition and risks higher prices” (Ackah et al. 2021: 2). Second, most of the PPAs were arranged in accordance with the “take or pay” model in which the government would have to pay for the generation capacity even if no electricity was consumed (Ackah et al. 2021: 2). Lastly, there is a lack of transparency around PPAs, with the names of the project, contract type, technology/fuel, location, and total project cost being the only available details. Non-disclosure practices around PPAs hinder the evaluation of project viability as well as the understanding of the financial implications of new power procurement. A lack of transparency also contributes to poor coordination and planning in the sector (Ackah et al. 2021: 2).

Several of these PPAs were hastily signed in the run-up to the 2016 elections to assuage the public on the energy crisis. The new government was then left to deal with the consequences of these deals, which were providing excess generation capacity. The catch in this situation was that as per the “take or pay” clause, the government had to pay for the unused excess. In light of these fiscal strains, existing PPAs were reviewed under the Energy Sector Recovery Program (ESRP) of 2019 and renegotiated or restructured by the incumbent government. Eleven PPAs signed by ECG under the previous administration were terminated. In some cases, the “take-and-pay” model replaced the “take or pay” one, wherein there was no obligation to pay for unused capacity. Tariffs were increased, and some planned projects were delayed (Ackah et al. 2021: 3).

One such project which stands out is the sole-sourcing agreement with Africa & Middle East Resources Investment Group LLC (called the AMERI deal) signed in 2015. On the basis of allegations of corruption levied by energy policy institutes, energy experts and the Ghanaian media, investigations were carried out revealing that the cost of the power plants under the deal was inflated by US$150 million (Boamah 2019: 8). At the time, “a 17-member committee advised the Ghanaian government to either renegotiate terms of the contract to protect public finances or abrogate it entirely” (Boamah 2019: 8). The deal was priced at US$510 million when it was first agreed upon in 2015. It was later renegotiated that AMERI plants would supply power for the five-year term of the agreement until 2021 at the cost of US$459 million (Dzawu 2018). In 2022, the Ghanaian government took full ownership of the 250-megawatt (MW) plant (Aklorbortu 2022).

Under the ESRP and the Energy Sector Transformation Initiative Project (GESTIP), supported by the World Bank the government has taken steps to ensure competitiveness in tendering and increase transparency on future PPAs (Ackah et al. 2021: 6). However, energy experts opine that publishing PPAs ought to be the first step toward greater transparency (Moss and Kenny 2021). At the moment, there is a moratorium on the signing of new PPAs for both renewable and conventional/thermal power plants (ITA 2022).

Moreover, the Ministry of Energy has developed a policy guidance for least cost fuel procurement and the policy for competitive procurement of energy supply and services contracts, which mandates the procurement of electricity to align with demand and supply forecasts, and ensures that additional capacities are subject to open, competitive processes (MoE 2019).

The role of the legislature in PPA processes could be further explored and strengthened. For instance, “Article 181(5) [of Ghana’s constitution] requires that international business and economic transactions must obtain parliamentary approval before they become binding”; however, “in practice, this provision has not always had teeth” (Peterson 2017).

Corruption in procurement throughout the energy value chain

Given that agreements across the energy sector typically operate under tender processes, the “incentive to pay bribes is often high” (Risk Compliance 2014). For instance, energy contracts tend to be long term with significant potential rewards; thus, individuals could “perceive that the potential reward outweighs the risk of paying a bribe to win this contract” (Risk Compliance 2014). There are also some known cases of this type of corruption risk in procurement in the Ghanaian energy sector.

The auditor-general’s (AG) report has unearthed embezzlement of GH¢632,207 (approximately US$82,000) at the head office of NEDCo. The AG’s office has called for NEDCo to “intensify its supervisory role over the activities of the Area Managers, the Finance Officers and Account Assistants” and work towards the recovery of the embezzled sum from the accused parties (Ghana Web 2021). The outcome of this matter is yet to be decided as the Public Accounts Committee of parliament is currently holding sittings on AG’s report (TI Ghana 2022: 17).

In the past, GRIDCo faced corruption allegations in the purchase of 14 transformers from an Indian company, Crompton Greaves Ltd., in 2011. A consultant at GRIDCo blew the whistle after noticing discrepancies resulting from over-invoicing by the entity. Crompton Greaves company claimed to have received US$4,170,330 million for the first batch of six transformers, whereas GRIDCO claims to have paid US$6,581,376 million, thus creating a difference of US$2,411,376 million. The matter was investigated by the Economic and Organised Crimes Office (My Ghana 2013; Ghana Web 2013). However, there was no available information in the public domain on the results of the investigation.

More recently, Aksa Energy, one of the largest power companies in Turkey, faced allegations of corruption over a deal with Ghana, which was brokered by a Goldman Sachs banker. “The company allegedly funnelled about $2.5m in bribes to Ghanaian officials before it was awarded the contract to build an electricity plant” (Pitel, Noonan and Munshi 2020). Goldman continued to own 16.6% of the stake in Aksa Energy even after it had terminated its involvement in the power project in Ghana in 2016 when it discovered discrepancies in the deal. Kazanci Holding, the parent company of Aksa Energy, bought back the stake from Goldman in 2018 at “$300m — almost three times its market value — thanks to a put option that was agreed six years earlier” (Pitel, Noonan and Munshi 2020).

Theft and bribery at the service delivery level

Initially, it was the post-paid metering model dominating electricity revenue collection systems in both ECG and NEDCo. Under the post-paid metering systems, customers pay for energy after use, generally by the end of the month. However, officials from ECG or electricians were often bribed to “adjust meters to read slower than usual and hence record lower tariffs or even evade payment of electricity tariffs” (Boamah 2019: 10). Such challenges resulted in a situation wherein the World Bank projected that Ghana’s VRA would face “imminent collapse without adequate electricity tariff increases” (Boamah 2019: 10).

Pre-paid meters were subsequently introduced to counter such challenges, and they were erected in public spaces to prevent meter by-pass or tampering within households. However, the large-scale introduction of the pre-paid metering system coincided with increases in tariffs. Given the “limited understandings of the new tariff systems led to perceived faulty meters claimed to be reading faster than units of power consumed”. Customers thought that either these pre-paid meters were faulty or deliberated calibrated to give higher readings “to subtly extort money from customers” (Boamah 2019: 11). Around the same time, Usain Bolt had become a household name due to his “sterling performance in the 2016 global athletic showpiece”. Soon, the term Usain Bolt Meters was being widely used in a satirical manner to refer to such pre-paid meters (Boamah 2019: 11).

To deal with such challenges, ECG set up a utility court and prosecution and revenue protection units. The idea was to ensure that “utility thieves” were “swiftly dealt with by the court” (Boamah 2019: 10). A few ECG employees and customers have been prosecuted over theft of power (Boamah 2019: 10).

However, corruption in the energy sector in Ghana at the service delivery level ought also to be understood in the context of “deep structural inequalities in energy provision and access” (Boamah, Williams and Afful 2021: 13).

The net metering system as a part of the solar energy transition, for instance, emerged as means to offset high energy consumption in urban and elite areas. However, several residential as well as commercial customers, did not receive credits in return for power exports to the grid. Customers defaulting on tariffs, either deliberately or out of ignorance, then became commonplace, (Boamah, Williams and Afful 2021: 11, 12). In such a scenario, ECG’s “threats to disconnect net-metered customers who had defaulted on monthly tariff payments and its refusal to credit the customers for their power exports into the grid smack of perpetrating injustice or bullying behaviour” (Boamah, Williams and Afful 2021: 13). Thus, Boamah, Williams and Afful (2021: 13) opine that both ECG and energy consumers were engaged in “problem-solving corruption”.

Anti-corruption approaches

Given that the “causes and consequences of and remedial measures to corruption [in the energy sector] are inextricably intertwined”, an in-depth understanding of pre-existing conditions is required to identify “useful entry points for effective anti-corruption interventions and the treatment of energy justice concepts” (Boamah, Williams and Afful 2021: 13).

Moreover, in anti-corruption policymaking in the energy sector, it is important to note that delivering energy justice in the Global South differs from the practices of the Global North and ought to be treated as such (Boamah, Williams and Afful 2021: 14).

Based on their study of corruption in the energy sectors in Kenya and Ghana and highlighting the AMERI case, Boamah (2019: 11) states that “in situations where corrupt practices are deliberately crafted, ‘normalised’ and collectively maintained to undermine the effectiveness of anti-corruption institutions, initiatives such as monitoring and sanctioning corrupt behaviour may not yield any promising results or even be counter-productive”. Thus, in anti-corruption programming, the focus ought to be on guiding the formulation of preventive measures (such as proper planning) and not just managing the outcomes of corruption (Boamah 2019: 2).

The first step in applying anti-corruption strategies to the energy sector in any context is “mapping the corruption risk exposure…to identify and analyse the specific corruption risk[s]” (Rimšaitė 2019: 263). Understanding energy value chains (as mentioned in the earlier sections) can support this, helping to identify gaps, areas for improvement and relevant target stakeholders.

The following anti-corruption approaches drawn from good practices from across the world are only meant to be illustrative and not exhaustive. For the effectiveness of these anti-corruption measures, they would have to be customised to the energy sector, and the context in which they would be implemented, as what works in context A may not work in context B.

Structural reforms

The energy sector is unique in a sense due to its strategic significance for economies which usually entails it being governed or controlled at the highest political levels, i.e., by the executive. In contexts characterised by weak regulatory and accountability institutions, the control of the energy sector could fall into the hands of elites with limited external control. Thus, reforming structural issues to enable enhanced accountability of the executive is also needed outside of the energy sector for corruption within the sector to be reduced. For instance, a recent report looking at Zambia’s anti-corruption regime 2001–2021 in the renewable energy sector suggests that structural reforms are key to addressing corruption risks in the sector. It recommends, among other things, “reducing the executive powers of the president, debarring corrupt renewable energy companies, enhancing the role of international organisations, and promoting investigative journalism to track and expose corruption in the energy sector” (Kaaba and Hinfelaar 2021).

However, in the context of Ghana,af7fd23aa864 Boamah and Williams (2017: 128) note that improving structures by strengthening institutions and policies against corruption does not simply work by “tightening rules and regulations or increasing bureaucracy”. Instead, what is often required is a collaborative approach where the “limits of powers and specific roles of different actors are clearly defined and legally binding” (Boamah and Williams 2017: 128).

Proper planning of energy projects

A counter to “problem-solving” corruption in the energy sector may need to focus on the planning stages of electrification initiatives to “minimise corrupt practices by proactively tying up loose ends that usually provide a leeway for people to engage in corruption” (Boamah 2019: 2). The idea is to thus address those conditions that provide opportunities for solving problems through corruption (Boamah 2019: 2). Such planning at the decision-making stage could go a long way in curbing risks of corruption emerging at different stages of the energy sector value chain. For instance, the case of dealing with energy shortages in Ghana shows what could go wrong when planning is inadequate. In the context of energy shortages, PPAs were signed to remedy the situation; however, a lack of proper planning resulted in excessive energy generation causing further losses for the government.

Moreover, planning for anti-corruption programming aimed at any sector ought to consider social norms operating within a given context. The imposition or assumption of external values and norms should be avoided to prevent doing harm. For instance, some approaches, such as those focused on law enforcement, can further “marginalise already disadvantaged groups”, forcing “individuals or groups into difficult choices between closely-held values and the expectations of their positions” (Mullard 2020: 6).

Addressing risks with unsolicited proposals

Unsolicited proposals (USPs) are “an exception to the norm, where infrastructure projects are initiated by the public sector”. In such cases, private firms reach out to the government with a proposal for an infrastructure or service project without having received an explicit call to do so (World Bank 2018; Bullock 2019: 3). Issues of low transparency and a lack of competition raise questions of accountability for USPs. Given that Ghana has “relied almost entirely on unsolicited proposals to source new energy projects and negotiate PPAs”, corruption risks in this area ought to be addressed (Ackah et al. 2021: 2).

To counter these corruption challenges in USPs, governments can, as a first step, streamline and centralise USP policymaking in one agency. Other measures to counter corruption risks include streamlining the bidding process, opening up the proposed USP to competitive tender, avoiding directly negotiated deals and employing fair bonuses, among others (Bullock 2020: 7-11). A good example is the case of Chile which has a Public Works Ministry (Ministerio de Obras Públicas) acting as a single federal agency which processes and then approves or rejects all USPs. Transparency around the submission and evaluation process is also maintained, and reports are made publicly available (Bullock 2013: 13). Moreover, in the context of Ghana, TI Ghana (2022) notes that parliamentary scrutiny of USP processes could also be an additional accountability measure.

For more details on managing corruption risks with USPs, please refer to Corruption and Unsolicited Proposals: Risks, Accountability and Best Practices (Transparency International 2020).

Preventing corruption in public procurement

Corruption is often cited as the bane of “public procurement” (OECD 2016: 6). Anti-corruption measures aimed at public procurement could be customised to relevant corruption risks faced by the Ghanaian energy sector. Some of these measures include:

- Establishing codes of conduct: in Canada, the Code of Conduct for Procurement in Canada clearly lists mutual expectations for public officials and vendors to make certain a common basic understanding among all participants in procurement (OECD 2016: 11).

- Use of integrity pacts: Transparencia Mexicana has implemented integrity pacts in over 100 contracts, worth approximately US$30 billion in total (OECD 2016: 14).

- Enabling transparency through disclosure of information in the procurement process: Australia has a procurement information system, AusTender, which provides a platform for centralised publication of the government’s business opportunities, as well as annual procurement plans, and multi-use lists and contracts awarded (OECD 2016: 17).

- Making the flow of government funds transparent: the Federal Public Administration in Brazil has a transparency portal (www.portaldatransparencia.gov.br) which was created to make revenue and expenditure data available (OECD 2016: 17).

- E-procurement: in Korea, the implementation of a national e‑procurement system (KONEPS) has resulted in considerable improvement in the transparency and integrity of public procurement administration (OECD 2016: 22). Ghana is also in the process of launching an electronic procurement system (GHANEPS). The roll out phase, which started in November 2019, is targeted for completion by October 2023 (Maryan 2022).

- Maintaining oversight and control: public procurement reforms in South Africa created the office of chief procurement officer to monitor and evaluate government public procurement performance and modernise procurement systems for greater efficiency and transparency (OECD 2016: 26).

For more details, please refer to Preventing Corruption in Public Procurement (OECD 2016).

Information disclosure and access to information

By empowering citizens to obtain information held by public bodies, access to information can play a key role in anti-corruption efforts aimed at any sector or context (UNCAC Coalition n.d.). South Africa’s Renewable Energy IPP Procurement Program (REIPPPP), for example, used a PPA, which was developed via a transparent and participatory process. This allowed for the emergence of a non-negotiable contract with widespread “support from developers, bankers, and civil society organisations, all of which resulted in a significantly shortened contracting process and historically low power prices” (Badissy, Kenny and Moss 2021: 7).

Furthermore, pursuant to the right to information (RTI) of 2019, several players in Ghana’s energy value chain have produced manuals to inform and assist the public of their organisational structure, responsibilities and activities. The VRA Information Manual, for instance, “clearly indicates that the individual can access information on contracts awarded, agreements and procurement plan among others. The manual also explains the application for information process with reference to section 18 of the RTI Law” (TI Ghana 2022: 11).

Use of information and communications technology (ICT)

Matching ICT tools with the local context (including building support for and skills in using technology) can strengthen anti-corruption efforts in utility services. Through the digitalisation process, ICT could allow for fewer opportunities for corruption at the service delivery level, enable reporting on corruption, and facilitate citizen participation and government-citizen interactions, among others (Adam and Fazekas 2021). However, when using ICT for anti-corruption efforts, steps should be taken to ensure that ICT does not provide new corruption avenues (for example, through the misuse of technologies such as centralised databases) (Adam and Fazekas 2021).

In March 2022 in Ghana, for instance, the Millennium Challenge Corporation2867adb56bc1 (MCC), announced that ECG had acquired a utility geographical information system, which would aim at “providing a digital platform for the tracking of primary and secondary substations, power lines, transformers, and customer service wires for enhanced service delivery” (Arthur-Mensah 2o22).

Moreover, under the Electronic Document Records Management System (EDRMS) project, VRA has introduced Laserfiche, a computer enterprise content management software to enable transition from the standard paper-working environment to a digital format. In the long term, the project would enable the capturing, storage and management of records to allow for a complete audit trail of documents (TI Ghana 2022: 11).

Social accountability measures

Provision of information about government and business activities in the energy sector and enabling inclusive and participatory platforms for citizen feedback is imperative to strengthen transparency and accountability measures. For instance, citizen report card surveys could be a useful tool in gathering feedback from end consumers and using this evidence to build a groundswell of public support and advocate for reform. For a note on its methodology, please refer here (OKR n.d.). Ensuring stakeholder participation can be done by other means as well. In Mexico, for instance, as a way to promote public scrutiny, social witnesses are required to participate in all stages of public tendering procedures (above certain thresholds) (OECD 2017: 19).

Improving corruption reporting channels and whistleblower protection

“By speaking out against wrongdoing such as corruption, fraud, mismanagement and illegal or hazardous activities, whistleblowers play a crucial role in protecting the public interest” (Khoshabi 2017: 4). Streamlining corruption reporting mechanisms is thus imperative, requiring clear procedures, commitment from leadership, adequate allocation of resources, proper promotion, communication and training, and whistleblower protection (Khoshabi 2017: 5-8). Moreover, given the increasing awareness of the gendered effects of corruption and gendered forms of corruption (such as sextortion), the whistleblowing mechanism ought to be designed to be sensitive to gender differences (Zúñiga 2020).

The presence and state of implementation of anti-corruption and whistleblower protection legal frameworks in a given context are also crucial to the success of corruption reporting channels. Ghana, for instance, “has a whistleblower protection law that, on paper, is considered among the strongest in Africa” (PPLAAF 2020). The Whistleblower Act of 2006 protects those who report “impropriety”, including but not limited to the occurrence or probability of occurrence of “economic crimes, violation of law, miscarriages of justice, misappropriation of public resources, dangers to public health or the environment” (PPLAAF 2020). However, the law suffers from shortcomings such as a lack of anonymous reporting and no requirements for an internal reporting mechanism for employers, among others (PPLAAF 2020).

- The value chain described here outlines the steps of acquiring, processing and retailing the primary energy source (in this case, gasoline).

- For the purpose of this answer, the value chain of the energy sector focuses on the transmission and distribution of electrical energy.

- “Electricity access refers to the percentage of people in a given area that have relatively simple, stable access to electricity. It can also be referred to as the electrification rate” (Boechler et al. 2021).

- In Ghana, dumsor (Akan pronunciation: [dum sɔ] 'off and on') is a persistent, irregular and unpredictable electric power outage. Such a scenario was caused by frequent power shortages in the country.

- The authors looked at biofuel deals in Ghana to find avenues for strengthening institutions against corruption.

- MCC is helping the government of Ghana improve the power sector through investments that will provide more reliable and affordable electricity to Ghana’s businesses and households (MCC USA 2021).