Query

Please provide an overview of the relationship between business integrity and commercial success.

Background

The relationship between integrity, or the lack thereof, on firm performance has been the subject of research across a number of disciplines. Much has been written from either an intuitive perspective, on the assumption that corporate bribery can enhance access to markets or safeguard existing access from interlopers, or from a normative angle, that bribery is an immoral act and should be condemned.

Over the past three decades, a sizeable evidence base has begun to emerge to add substance to the debate. Studies can be roughly divided into two camps. On one hand, a large body of research at the aggregate level has evaluated the impact of corruption on markets’ competitiveness and growth. Here, there is a nearly unanimous consensus that corruption is bad for business.

On the other hand, an increasing number of researchers have begun to examine the benefits and costs of engaging in bribery and other corrupt practices at firm level, namely: what impact does corporate bribery have on a firm’s profitability, sales, competitiveness, growth and staff morale? Partly due to a ‘dearth of firm-level empirical data on the consequences of paying bribes’ (Nichols 2012: 329), the evidence at firm level is more contested (Williams and Martinez-Perez 2016; Athanasouli et al. 2012; De Rosa et al. 2010; Gaviria 2002; Teal and McArthur 2002).

Nonetheless, more sophisticated analysis of corruption as a diachronic relationship between bribe payers and bribe takers rather than a static, one-off exchange indicates that in the long run the costs of bribery outweigh the benefits for firms. Corruption begets corruption; firms with a propensity to pay bribes not only find themselves spending more time and money dealing with the bureaucracy but also suffering from the indirect costs such as lower productivity, slower growth, employee theft and more expensive access to capital.

Where incidences of corruption are detected by regulators or law enforcement, the financial penalties and loss of investor confidence can cripple a firm.c46a171ddb79

Within the firm-level studies there exists a second cleavage. While there is now substantial literature considering the impact of integrity failings, particularly corporate bribery, on firm performance, there are fewer pieces on the effect of robust and proactive integrity measures on a company’s bottom line.

After briefly summarising the evidence at the aggregate level, this Helpdesk Answer concentrates on firm-level implications, first in terms of the effects of the absence or failure of integrity (largely in the form of bribery), before considering the costs and benefits of proactive and robust integrity measures.

The impact of corruption on business at the aggregate level

The claim that corruption acts as a ‘grease in the wheels’ contributing to a country’s economic development has been comprehensively laid to rest. There is now an overwhelming consensus that high levels of background corruption in a given country or market are harmful to business in two mutually reinforcing ways.

First, such background corruption has adverse effects on a country’s economic performance by reducing institutional quality, undermining competitiveness and entrepreneurship, distorting the allocation of credit and acting as a barrier to trade (Ali and Mdhillat 2015; De Jong and Udo 2006; Horsewood and Voicu 2012; Musila and Sigue 2010; Rodrik, Subramanian & Trebbi 2004; Zelekha and Sharabi 2012).

A sizeable body of scholarship at the turn of the millennium established that corruption is positively and significantly correlated with lower GDP per capita, less foreign investment and slower economic growth (Ades and Di Tella 1999; Anoruo and Braha 2005; Kaufmann et al. 1999; Knack and Keefer 1995; Hall and Jones 1999; Javorcik and Wei 2009; Méndez and Sepúlveda 2006; Méon and Sekkat 2005; Rock and Bonnett 2004). In fact, some studies argued that in transition economiesee518540f0c4 corruption was the most important determinant of investment growth, ahead of firm size, ownership, trade orientation, industry, GDP growth, inflation and the host country’s openness to trade (Asiedu and Freeman 2009; Batra, Kaufmann and Stone 2003).

The consensus that corruption is “sand” rather than “grease” in the wheels of the economy that was established around two decades ago remains largely intact among scholars. Numerous empirical studies supporting the “sand” hypothesis, particularly in economies with low investment and poor quality governance (see D'Agostino et al., 2016; Huang 2016; Chang and Hao, 2017, Cieślik and Goczek 2018). Gründler and Potrafke (2019), for instance, found that the “cumulative long-run effect of corruption on growth is that real per capita GDP decreased by around 17%” per one standard deviation increase in CPI score.

Second, on average, enterprises operating in countries with high levels of background corruption have relatively lower firm performance than those operating in markets with lower risks of corruption (Donadelli and Persha 2014; Doh et al. 2003; Faruq and Webb 2013; Gray et al. 2004; Mauro 1995; Wieneke and Gries 2011). Empirical research has, for instance, found a significant negative correlation between background levels of corruption in US states and the value of firms located in that state (Dass, Nanda and Xiao 2014).75dd90d8134d

The fact that, at an aggregate level, corruption is detrimental to firm performance is implicitly acknowledged by business leaders who, surveys show, almost unanimously agree that corruption undermines a level playing field to the benefit of less competitive firms (KPMG 2011).638c9113f366

The impact of corruption on firm performance

Before detection

Corruption as beneficial to firm performance

Evidently, some businesspeople continue to view bribery as constituting a commercial advantage in terms of ‘lower costs, greater efficiencies, or access to relationships or markets’ (Nichols 2012: 334). The evidence for such an assumption, however, is patchy, even where such activity is not detected by relevant authorities or regulators.

Intuitively, bribery may appear to some firms as a sure-fire means of entering a market or protecting their market position from competitors. Pelizzo et al. (2016) found in a survey of businesses in sub-Saharan Africa, for instance, that the most significant motivation to pay bribes was to secure a government contract.

Some researchers have argued that, although corruption has an overall detrimental impact on a country’s economic performance, for individual firms ‘participation in corrupt practices with public officials is a rational economic choice’ (Williams and Martinez-Perez 2016: 10). A few isolated studies side with this view.

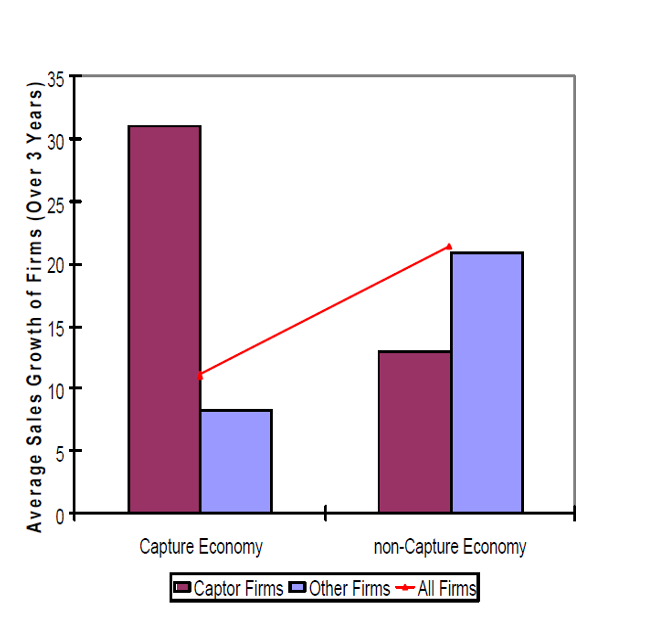

Dutt and Traca (2010) find some indication that collusion with corrupt officials can help firms negotiate barriers to trade in extremely corrupt or bureaucratic environments.cb18b8d27e42 Where collusion becomes state capture, in which an insider section of the business community is able to dictate the formulation or implementation of policies, laws and regulations, then ‘captor’ firms appear to benefit significantly from their insider status, with their sales growth being much higher than outsider firms. However, as shown in Figure 1 below, aggregate sales growth of all firms in markets characterised by state capture is markedly lower than in markets without state capture (Batra, Kaufmann and Stone 2003).

Figure 1: The effect of state capture on enterprise growth.

Source: Batra, Kaufmann and Stone (2003)

A cross-national study used 2006 World Bank Enterprise Survey data to construct a stratified random sample of formal private sector businesses with five or more employees from 132 countries. The authors found that business owners who viewed corruption as necessary to ‘get things done’ are positively associated with higher annual sales and productivity growth rates than those companies which did not view corruption as necessary (Williams and Martinez-Perez 2016: 10). Vial and Hanoteau (2010) likewise find a positive relationship between corruption, firm output and labour productivity.

Similarly, a recent study of Central and Eastern European countries found that corruption (as proxied by a firm’s internal inefficiency) is associated with financial gain for firms (Ferris et al. 2021), though the validity of equating corporate corruption with inefficiency in the model is debatable.

Other studies provide a more nuanced view. A survey of 480 large multinational firms by Healy and Serafeim (2016) finds that, while companies with weaker integrity mechanisms are associated with greater sales growth in high corruption risk markets, the propensity to engage in bribery incurs additional costs with the result that their return on equity (ROE) actually declines.

In other words, while more corrupt large multinational firms may enjoy stronger sales in riskier markets, they actually become less profitable as the additional costs incurred from paying bribes are not fully recovered from higher prices or greater sales. Paying bribes can be a considerable expense; in the case of Siemens, for instance, they amounted to 3% of total sales (Healy and Serafeim 2016: 494).

Corruption as detrimental to firm performance

While static analysis of corporate bribery as a one-off interaction might indicate a positive correlation with firm performance, there are two methodological issues to consider before turning to other empirical research that corruption imposes considerable costs on firms even where it remains undetected.

First, more sophisticated analysis of bribery treats it as a relationship, rather than a single interaction. This is not a trivial distinction; corruption’s effects must be evaluated dynamically in order to fully understand their implications. Corruption is not exogenous to the wider relationship between a firm, its business partners, customers and the bureaucracy; willingness to pay bribes affects not merely a given transaction but the nature of the entire relationship (Nichols 2012: 334).

Viewed in this light, most scholars concur that the long-term costs of bribery outweigh any short-term benefits accrued from by-passing bureaucratic or regulatory processes. Earning a reputation as a corrupt or dishonest company occurs over the course of several interactions and can have severe consequences for a firm’s performance.

Evidence suggests that where a firm gains a reputation for paying bribes, not only do demands multiply over time from the original bribe-taker who uses the initial transgression as leverage to continue extracting rent (Wrage 2007; Almond and Syfert 1997), but other actors begin to demand bribes, incentivised to try and line their own pockets at the firm’s expense (Earle and Cava 2009; Krever 2008: 87). Globally, 45% of 10,032 enterprises included in the World Bank Enterprise Survey agreed that it was always, mostly or frequently the case that if an illicit payment was made to one official, another government official would request payment for the same service (Batra, Kaufmann and Stone 2003: 9). This finding appears to be significant for firms of all sizes; small and medium-sized enterprises made up 80% of the sample, with large firms accounting for the remaining 20% (Batra, Kaufmann and Stone 2003: 3).e3bf7f3bf7a6

Indeed, public officials have been shown to function as bribe price discriminators, demanding higher bribes from firms that are willing and able to pay and lower bribes from companies which credibly threaten to exit the market or attain the service using alternative means (Reinikka and Svensson 2002).

This brings us to the second methodological issue with studies that point to positive correlations between firm bribery and performance. Some of these correlations may suffer from endogeneity issues; rapidly growing or successful firms may be more likely to be targeted by officials looking to extract bribes because of their increasing ability to pay (Fisman and Svensson 2007; Wu 2009). Svensson (2003) finds that, in Uganda, the higher a firm’s profits the more it has to pay in bribes, while Clarke and Xu (2004) come to a similar conclusion in a study on firm performance in Eastern Europe and Central Asia.

Direct costs

Kaufman and Wei (1999) propose a theoretical model predicting that bribe-paying firms are likely to encounter more harassment and demands for bribery than companies which act with integrity. Where a firm has demonstrated its willingness to expend its chief resource – money – in exchange for services, resources or permissions provided at the discretion of a public official, that official has an incentive to construct new delays to continue to extract bribes (Nichols 2012: 335).

This suggests that bribery may actually increase the direct costs a firm incurs due to bureaucratic interference. Testing their model against business surveys conducted for the Global Competitiveness Report and World Development Report, they find that once other factors are held constant, ‘firms that pay more bribes, in equilibrium, experience more, not less, time wasted with the officials on matters related to regulations’ (Kaufman and Wei 1999).

This conclusion is corroborated by a number of other studies. Gaviria (2002) directly compares firms which pay bribes with those that do not in Latin America, finding that bribery increases a firm’s costs. De Rosa et al. (2010) interrogated business environment and enterprise performance survey data, finding no evidence to support the notion that bribery proved advantageous to firms looking to avoid bureaucratic red tape, but rather that paying bribes incurred greater costs on firms than bureaucratic delay. Significantly, they also concluded that bribery entailed greater costs in countries with high levels of corruption than in less corrupt countries, indicating that even where bribery is an expected behaviour, those companies which commit bribery still incur costs rather than benefits relative to firms which do not pay bribes (De Rosa et el. 2010).

Even in absolute terms, bribery is an expensive activity; a study of transition economies in Europe and Central Asia found that, on average, firms spent 1.1% of their revenues on bribes, equating to 8% of their profits (Anderson and Gray 2006: 16). A more recent OECD study (2014: 8) reports that bribery and the often protracted negotiation that accompanies it raises the costs of doing business; bribes average 10.9% of the value of a given transaction and a staggering 34.5% of profits.

Indirect costs

In addition to the direct cost in time and money attributable to corporate bribery, there are a number of indirect costs of bribery which detract from firm performance.

Productivity

An increasing number of studies have analysed the impact of bribery on firm productivity, with a growing body of literature showing a negative relationship between the two. Country-level studies demonstrate positive correlations between corruption and low productivity (Lambsdorff 2003; Dal Bó and Rossi 2007). Svensson (2001) argues that, in Uganda, paying bribes damages firm operations, while Lavallée and Roubaud (2011) find no significant association between corruption and firm output. Teal and McArthur (2002) find that, in sub-Saharan Africa, firms which pay bribes to public officials have 20% lower output per worker, while Faruq and Webb (2013) observe a vicious cycle: not only are less productive firms more likely to turn to bribery but corruption further reduces firm productivity. Martins, Cardeira and Teixeira (2020) reviewed ten recent empirical studies and found that seven articles reported a negative impact on firm productivity, while three suggested the opposite. Their own analysis also concludes that corruption undermines firm performance, with stronger effects among smaller companies.

Anecdotally, there is some suggestion that firms that engage in corruption are making inefficient use of resources which could be more gainfully employed in improving business operations rather than flowing into the pockets of public officials. Other practices common in settings with a weak rule of law, such as nepotism or patronage (Rothstein and Varraich 20017), could result in contracting or recruitment processes being conducted on the basis of connections rather than merit, resulting in the hiring of incompetent employees or contractors who reduce a firm’s productivity.

Growth

A study of 10,032 SMEs and large firms from 80 countries found that enterprises which report being severely constrained by demands for bribes have been found to have a growth rate 3.95% lower than firms which are not so constrained (Batra, Kaufmann and Stone 2003). It is worth noting, however, that firms which engage in bribery may actually not view corruption as a constraint, so this indicator is an imperfect proxy for actual firm bribery.

Using sales dynamics as an alternative proxy for growth, a study of 10,457 SMEs and large firms operating in sub-Saharan Africa by Pelizzo et al. (2016: 236) finds that a firm’s propensity to bribe has little discernible impact on growth. Other studies (Athanasouli et al. 2012) which review firm-level data suggest corruption has a negative effect on sales growth.

In a study of a random stratified sample of 243 Ugandan firms, Fisman and Svensson (2007) found, after controlling for the endogeneity effect of high-profit or turnover firms being disproportionately targeted, that higher corruption at firm level is strongly correlated with lower firm growth, even in the short term. In fact, a 1% increase in the bribery rate is associated with a reduction of firm growth of more than 3%. Moreover, their evidence suggests that paying bribes is three times as harmful to firm growth than paying the equivalent amount in taxation.

Research looking at the factors of job creation in 70,000 enterprises across 107 countries concludes that corruption hampers employment growth in small, medium and large firms (Aterido and Hallward-Driemeier 2007).1bbb12ff7e6c The correlation remains positive regardless of whether corruption is measured as an incidence of bribes, bribes as percentage of sales, incidence of ‘gifts’ to government officials or gifts as percentage of government contracts.

Looking at a business survey of middle and top managers from 29 countries (predominantly in Latin America) representing firms with a range of characteristics in terms of age, size, sector and location,2386a65dee08 Gaviria (2002) finds that bribe payments are correlated with lower growth in sales, employment and investment at the firm level, rendering a company less competitive. Nichols (2012: 339) observes that, while lower growth rates among firms which bribe could be attributed to additional costs incurred by paying bribes, lower rates of sales growth indicate that paying a bribe triggers a vicious cycle where more bribes are demanded.

Staff morale

Even where corruption is not detected by relevant authorities, a pervasive corporate culture of rule-breaking, especially on the part of senior managers, can have a marked impact on an enterprise’s bottom line (Nichols 2012: 343). One survey of 1,286 municipal office workers in ten countries found that staff’s observation of managers engaging in bribery was the single greatest factor in driving staff’s own self-serving behaviour (Bruce 1994).

Similarly, another study revealed that even being exposed to tolerance of bribe-giving in a firm contributed significantly to employees’ malpractices (Weeks et al. 2005). Where staff look for kickbacks, firms may lose their competitive edge or be left with substandard goods and services, while employee theft or fraud can be even more damaging; on average US firms are estimated to lose 5% of their annual revenues to such practices (Association of Certified Fraud Examiners 2024:4).

In sum, there is a strong case that a firm’s decision to engage in bribery, when conceived of as taking place within dynamic relationships, is likely to bring at best limited short-term gains at the expense of long-term performance, growth and productivity, even where the transgression is not detected. Paying bribes is associated with higher transaction costs in terms of time and money relative to firms which act with integrity, even in markets with high corruption risks (De Rosa et al. 2010). All of this suggests that, if long-term performance, growth and productivity matter to a firm, then contrary to Williams and Martinez-Perez’s assertion (2016: 10) corruption does not represent a rational economic choice.

In many instances, it is typically the less productive firms facing stiff competition who are most likely to turn to corruption to expand or maintain market share (Faruq and Webb 2013). The evidence suggests, however, that corruption renders firms less competitive, triggering a vicious cycle (Nichols 2012: 339).

Therefore, corruption is unlikely to benefit a company unless it operates in a market characterised by state capture and is able to become a ‘captor’ firm able to set the terms of regulation and its enforcement at will (see Batra, Kaufmann and Stone 2003).

After detection

Where incidences of corruption are detected, there are additional negative impacts on a company’s competitiveness. Whereas prior to detection one only has to factor in the ‘insiders’ to a corrupt transaction (typically company employees and corrupt officials), once a transgression comes to light, the implications on a firm’s relationship with regulators, law enforcement, business partners and customers have to be considered. As discussed in the following section, where anti-corruption and competition laws are effectively enforced, detection typically causes a significant detrimental impact on firm competitiveness due to various regulatory and market forces (Serafeim 2014).

Businesspeople may be conscious of the likely risk and impact of fines, penalties and legal costs should evidence of corporate malfeasance come to light. There are, however, additional and potentially more grievous consequences which may not be immediately obvious as they tend not to appear in the ‘annual report, on the balance sheet, or in the income statement’ (Thomas, Schermerhorn and Dienhart 2004: 57).

As such, Thomas, Schermerhorn and Dienhart (2004: 57) contend that these indirect costs of integrity failures are ‘chronically undervalued in executive decision-making’. Yet where senior management is distracted by legal battles, staff are demoralised by corruption scandals, and business partners and shareholders lose faith in a company’s integrity, a firm is likely to experience lower competitiveness, productivity and market value.

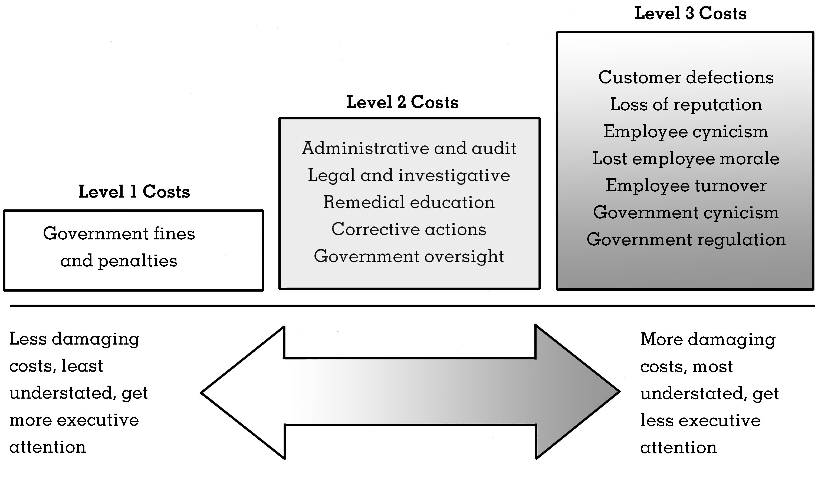

Thomas, Schermerhorn and Dienhart (2004) propose a hierarchy of business costs of ethics failures, according to which the most high-profile costs, such as fines and penalties, are actually the least damaging to firm performance.

Figure 2: Hierarchy of the business costs of ethics failures.

Source: Thomas, Schermerhorn and Dienhart (2004)

Level 1 costs

Level 1 costs are the easiest to calculate as they relate to those stakeholders which are foremost on the minds of senior management: themselves, the firm and the government (Thomas, Schermerhorn and Dienhart 2004: 58). These costs tend to relate to fines, penalties, sanctions and debarments imposed by regulators and the judiciary, but can also include concomitant civil suits.

Companies are subject to local legal provisions against corruption in the countries in which they operate, as well as a growing international legal regime able to prosecute firms for the bribery of foreign public officials, notably the US FCPA and the UK Bribery Act (PRI/UN Global Compact 2016). Increasingly, this can mean that firms which pay bribes find themselves liable in multiple jurisdictions, and recent years have seen jail sentences and spectacular fines for companies which have fallen foul of foreign bribery legislation.

In 2014, for instance, the French firm Alstom paid US$772 million in fines to settle its dispute with the US Department of Justice, while the UK’s Serious Fraud Office charged seven individuals involved in the case (United States Department of Justice 2014; FCPA Blog 2016).

In addition to fines and penalties, firms found to have engaged in bribery are increasingly subject to debarment from tenders for lucrative contracts, particularly those offered by the multilateral development banks who in 2010 agreed to mutually enforce and publish their debarment decisions. For further details, see a previous Helpdesk Answer Multilateral Development Banks’ Integrity Management Systems.

Level 2 costs

According to Thomas, Schermerhorn and Dienhart (2004), level 2 costs are largely administrative in nature and relate to ‘clean-up’ costs such as attorney, audit and investigative fees, as well as the cost of remedial actions. As such, these costs are often buried in company accounts as the cost of doing business, though they can run to millions of dollars and have an even more material impact on a company’s financial performance than level 1 costs.

With the advent of non- and deferred prosecution agreements, senior management from firms entangled in corruption cases spend considerable time crisis-managing their firms’ fraught negotiations with law enforcement, to the detriment of company’s day-to-day operations (Kukutschka and Chêne 2017).

Level 3 costs

Level 3 costs are significantly more difficult to quantify and are the least likely to be factored in to a firm’s decision on whether to behave in a corrupt fashion. Nonetheless, risks such as customer and shareholder defection, reputation loss and impact on employee morale can have severe implications for a firm’s bottom line.

Loss of shareholder and investor confidence

Where a firm is found guilty of corrupt practices, shareholders and investors are likely to lose confidence in the company’s profitability, fearing the kinds of level 1 and 2 costs described above. The result of sudden uncertainty in investor returns is likely to be a rapid decline in a company’s market value (PRI/UN Global Compact 2016). A study by Karpoff, Lee and Martin (2013) found that, on average, the stock prices of firms prosecuted for foreign bribery fell by 3.11% on the first day and by 8.98% over the course of an enforcement action.

Access to capital

Using data from three worldwide firm-level surveys covering thousands of enterprises, Kaufman and Wei (1999) find that bribe-paying companies experience higher costs of obtaining capital. Other studies, interrogating a dataset of 3,674 firms from 44 countries, support Kaufman and Wei’s finding that corruption generally raises the cost of accessing capital (Garmaise and Liu 2005; Lee and Ng 2005).

This finding also holds for small and medium-sized enterprises (SMEs). In his analysis of more than 10,000 SMEs from across 28 Eastern European and Central Asian countries, Ullah (2020) presents empirical evidence that ‘firm-level corruption hinders SMEs’ access to financing and seriously hampers their growth in transition economies’.

As well as writing off US$17 billion in losses due to overvalued assets as a result of corrupt practices, Petrobras experienced this phenomenon when issuing a Century bond to help it weather its corruption scandal; as a result of the downgrading of the firm’s debt rating, the company was forced to raise the bond at an estimated 8.45% which is around 30 basis points higher than comparable firms from Latin America (Centre for Responsible Enterprise and Trade 2015; Reuters 2015).

Reputational damage

Surveys of the public indicate that firms found guilty of malpractice can also expect customers to defect in droves. A Roper poll found that where a company was known to have behaved unethically, 91% of people would consider switching to another provider, 85% would condemn the company’s actions to friends and family, 83% would refuse to invest in a company’s stock, 80% would refuse to work at the company and 76% would boycott the firm’s products or services (Thomas, Schermerhorn and Dienhart 2004: 60). In addition, firms may struggle to maintain or establish relations with business partners who are understandably wary of being tainted by association as criminal liability can arise under the FCPA as well as some countries’ criminal codes200be61733f8 simply from entering into a business relationship with a bribe-paying entity (Nichols 2012: 350-1).

Staff morale

Serafeim (2014) looks at the fallout of a firm being found to have acted in a corrupt fashion across four pillars of competitiveness: corporate reputation, employee morale, business relations and regulatory response. Looking at a survey of how senior managers from 6,806 firms across 77 countries believed corruption would affect their firm, he found that a common assumption among those whose companies had not been implicated in corruption scandals was that the most severe impact on the firm would be in the area of firm reputation and business relations. Interestingly, however, those managers whose firms had experienced a corruption scandal reported that the greatest detrimental outcome was the blow to staff morale (Serafeim 2014).

This is highly significant as studies have shown that employee morale is directly related to a firm’s performance, including stock market returns. A study of 840 large companies40336ecb9341 found that companies at which more than three-quarters of workers reported ‘overall satisfaction with their company’ enjoyed markedly stronger year-on-year stock performance than companies with lower workplace morale (Harvard Business School 2013). Finally, a study of 480 large corporations from the world’s top 31 exporting countries found that those firms with integrity failings are less likely to be able to attract and maintain talented employees and many experience a severe brain drain after corrupt dealings surface (Healy and Serafeim 2016).

While corruption may intuitively seem to some businesspeople to be a low-cost, high-return activity, there is a strong body of evidence that corruption actually undermines a firm’s long-term performance prospects while exposing it to a range of potentially crippling risks, from fines, penalties and debarment to customer defection (Nichols 2012: 367-8).

The business case for integrity

Do companies’ anti-corruption, compliance and integrity management programmes bring a ‘return on investment’, and how can this be measured? Based on the above review of literature, it is clear that corrupt practices are generally detrimental to a firm’s long-term performance. The other side of the coin is whether firms that act with integrity reap additional rewards in terms of commercial success.

Corporate compliance and business integrity practices can, in principle, contribute to commercial success through either cost savings or revenue generation (Haugh and Bedi 2023: 561-564). In other words, companies can benefit from anti-corruption measures by:

- saving money that would otherwise be lost to fraud and corruption or paid in fines for corporate misconduct, or

- generating revenue through efficiency gains, improved access to capital, increased sales revenue and a motivated, ethical workforce

The following subsections explore each of these aspects in detail, after a short overview of key terminology and indicators used to test the effect of corporate compliance and anti-corruption measures on firm performance.

There are a variety of terms for the programmes and initiatives companies adopt to incentivise their employees and directors to act with integrity. Table 1 provides a short overview of the main terms and approaches.

Table 1: Glossary of key approaches to business integrity

|

Business ethics is defined as ‘application of ethical values to business behaviour’ (Institute of Business Ethics n.d.). |

|

Business integrity is defined as ‘responsible and compliant corporate behaviour and its orientation towards generally accepted ethical standards and principles’ (Global Compact Network Germany 2022:6). |

|

Corporate social responsibility (CSR) is defined ‘a management concept whereby companies integrate social and environmental concerns in their business operations and interactions with their stakeholders’ (United Nations Industrial Development Organization 2025). While relatively few studies explicitly address anti-corruption as part of CSR, there is a growing recognition and body of research that considers anti-corruption as an integral component of CSR (Arafa 2011; Arafa 2025; Nicaise and Rahman 2025). |

|

Compliance programmes: compliance is defined as ‘the mutual consistency of legal requirements and enterprise requirement’ (ël Hassan and Logrippo 2008: 42). Partly in response to the growth of government regulations in recent decades, many firms have now set up dedicated compliance programmes and departments, developing and enforcing the ‘company's internal framework of policies and procedures designed to ensure adherence to laws, regulations, and ethical standards’ (Investopedia 2022). As compliance programmes seek to ensure compliance with all manner of regulations, they are typically broader than anti-bribery and corruption programmes. |

|

Anti-bribery and corruption (ABC) programmes are a subset of compliance programmes specifically intended to prevent bribery and corruption in firm operations (Haugh and Bedi 2023: 572). These dedicated programmes have often been developed and introduced in the private sector in response to specific legislation such as the Foreign Corrupt Practices Act or the UK Bribery Act. Transparency International (2012:3) has described ABC programmes as encompassing ‘the whole of an enterprise’s anti-bribery efforts including values, code of conduct, detailed policies and procedures, risk management, internal and external communication, training and guidance, internal controls, oversight, monitoring and assurance’. Aiolfi (2025:100) notes that in practice these programmes typically encompass: (i) high level commitment to anti-corruption from management; (ii) an independent compliance unit or function; (iii) bribery risk assessments; and (iv) training and awareness raising. Organisations including the Wolfsberg Group (2023) and the MENA Financial Crime Compliance Group (2020) have issued practical guidance on implementing ABC programmes. |

|

Business integrity programmes (BIPs): another term for a comprehensive framework designed to embed ethical conduct and promote responsible business practices within an organisation. Business integrity programmes often promote policies, procedures and training aimed at preventing, detecting and addressing misconduct, fostering a culture of transparency, accountability and adherence to laws and regulations (World Bank 2023). As such, the focus of business integrity programmes may be slightly broader than solely considering corrupt practices. In addition, the emphasis in BIPs on actively promoting ethical conduct can mean that they differ somewhat in tone from compliance programmes, which concentrate on simply ensuring a company adheres to all types of government regulation. |

In terms of how scholars tend to assess the impact of corporate anti-corruption programmes on firm performance, a review of the literature shows that the following indicators listed in Table 2 are commonly used.

Table 2: Indicators used to assess the relationship between corporate anti-corruption and firm performance

|

Corporate anti-corruption |

Firm performance |

|

|

* Tobin’s Q provides a means of estimating a firm’s value by dividing the total market value of the firm by the total asset value of the firm.

Does business integrity save companies money?

Historically, many compliance professionals sought to demonstrate the return on investment of their programmes by ‘tallying the costs of a compliance program and comparing it to how much legal liability the company is avoiding by operating the program’ (Haugh and Bedi 2023: 561). The focus here has been on measuring potential costs avoided by reducing legal risk and exposure to enforcement actions.

Haugh and Bedi (2023: 562) point to the methodological difficulties of estimating the financial value of legal risk avoided, not least as fines imposed on corporations for infringements are subject to the discretion of prosecutors and regulators. Nonetheless, there is evidence that companies with solid integrity frameworks and stringent compliance systems are generally able to reduce their exposure to corruption, and thereby avoid the costs associated with bribe-paying discussed earlier in this Helpdesk Answer.

Risk reduction

Integrity and compliance systems typically seek to do two things: (i) minimise the likelihood of harmful events; and (ii) reduce the impact of such events should they occur.

Minimise likelihood of integrity failures

Transparency International (2016) has argued that corporate anti-corruption programmes and integrity systems can help a firm minimise the risk of corruption occurring. This claim is corroborated by studies that suggest that higher levels of firm integrity correspond with fewer compliance breaches. For instance, a recent study on US firms found that whistleblower protection and reward programmes introduced by companies in response to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 were effective in reducing insider trading at those companies (Raleigh 2024). Anecdotal evidence supports this view; research from the Corporate Executive Board (2017) showed that employees of firms with a strong culture of integrity are 90% less likely to observe misconduct in the workplace and are more likely to report misconduct they do see.

Where integrity programmes promote transparency and due diligence, they can potentially help a company to reduce risks in its supply chains and business relationships. Given that OECD data shows that three-quarters of foreign bribery prosecutions involved payments through intermediaries, knowing with whom one is doing business is vital (Transparency International 2016). Where companies put in place internal control systems able to vet and oversee often complex corporate structures, they are better placed to identify and tackle integrity risks.

Interestingly, stronger corporate governance has been shown to be especially beneficial to firms in more corrupt markets; where the external business environment is weak, internal governance mechanisms can help ensure that company and shareholder resources are protected (Dass, Nanda and Xiao 2014).

Minimise impact of integrity failures

Companies that are able to demonstrate a sincere commitment to acting with integrity are likely to suffer less severe consequences if corruption does occur, which can depend on factors like company size and reputation. An increasing number of countries, including Brazil, the United Kingdom and the United States, have passed legislation allowing for significant reductions or even suspensions of penalties imposed on firms for corporate malpractice where these companies are found to have robust internal control systems in place (Humboldt-Viadrina Governance Platform 2013). On the other hand, where a company is found to have inadequate integrity mechanisms, a common condition of any deferred prosecution agreement is that the firm in question strengthens its compliance and control systems (Sack 2015).c1f482ba7e65

Integrity systems are also a means of identifying and stopping integrity violations before they can wreak more damage. Serafeim (2014) finds that where bribery is exposed by a company’s own internal control mechanisms or whistleblowing channels, the negative impact of the bribery incident on the firm’s relations with regulators is considerably less severe than when it is uncovered by external bodies such as the media, competitors or law enforcement.fa75d1f23be5 Furthermore, when offending parties are promptly disciplined, dismissed or have business ties severed, the impact on firm reputation and consequent performance was lower still (Serafeim 2014).

Other cost savings

Beyond mere compliance and a concern with minimising potential legal penalties for integrity violations, there is some evidence that firms that act with integrity are able to save money in other ways, ranging from more favourable access to capital to reduced operational costs. Business leaders themselves acknowledge the value of integrity structures; an OECD survey found that 60% of companies35b881f19065 considered resources allocated to business integrity improvements to be a valuable investment, while only 18% viewed it primarily as an expense (OECD 2015: 36).

More favourable access to capital

While most firms view their integrity systems as a means of managing their financial and operational risks, the existence of such mechanisms is increasingly used by potential investors as an indicator of a firm’s risk profile, the strength of its management and corporate governance, as well as its ‘potential for long-term value creation’ (PRI/UN Global Compact 2016: 24).

In fact, companies that act with integrity and transparency typically enjoy the benefits of a lower risk profile; a number of studies conclude that corporate transparency is positively associated with cheaper access to capital (DeBoskey and Gillet 2013; Fecht, Fuss and Rindler 2014; Firth, Wang and Wong 2015).

While corporate social responsibility (CSR) is admittedly broader than anti-corruption programmes (see above pp21-22), research by Cheng, Ioannou and Serafeim (2014) on 2,439 publicly listed firms shows that companies with better CSR performance face significantly lower capital constraints. Importantly, the authors find that comprehensive CSR reporting generates a positive feedback loop, as increased transparency about firms’ governance structures can drive positive changes to their internal control systems, further improving compliance with regulations and the reliability of reporting. In addition, increased transparency and availability of data about a given firm reduces “informational asymmetry” between the firms and investors, ensuring they enjoy better access to finance (Cheng, Ioannou and Serafeim 2014: 3).

Reduced operational costs

Robust anti-corruption programmes imply that a firm has developed measurable indicators to track the integrity of its internal operations, which Transparency International (2016) suggests could generate beneficial side-effects such as a better understanding of core business processes and a consequent reduction in operational costs. Integrity mechanisms can also help reduce the impact of employee fraud or theft, which as noted above, is estimated to account for 5% of a firm’s annual revenue (Association of Certified Fraud Examiners 2024:4).

Does business integrity make companies money?

While much of the conversation on the value-for-money of corporate compliance has focused on its potential to save companies money (primarily by reducing their legal liability in cases of integrity violations), increasing attention has been paid in recent years to how business integrity can make companies money.

According to Nichols (2012: 368), companies with robust compliance and anti-corruption programmes can develop a competitive edge over firms that pay bribes. As Haugh and Bedi (2025:565) note, companies whose anti-corruption compliance programmes protect them from financial penalties and reputational damage can, in theory, invest this capital more efficiently and productively than firms that use available resources to pay bribes while exposing themselves to the risk of large fines. In addition, strong anti-corruption programmes may give firms confidence to do business in ‘high-risk but more lucrative markets’ and attract reliable vendors and business partners (Haugh and Bedi 2023: 565).

As such, on the basis of evidence presented below, it is plausible that companies with solid compliance programmes may experience better performance in terms of share price and market share relative to firms with weaker compliance programmes. While methodological challenges remain, an increasing number of studies find positive relationships between corporate integrity and higher revenue and stock market valuation.

Profitability

In recent years, a growing number of researchers have examined the statistical relationship between business integrity and firm profitability, with mixed results depending on the indicators, sectors and regions analysed.

Business integrity and stock market valuation

Numerous reports point to correlations between companies with robust compliance programmes and stock market performance. In 2014, an analysis of 1,600 companies in the MSCI World Index found that, on average, companies with strong corporate governance outperformed badly governed firms by 0.3% per month (Hermes Investment Management 2014). Similarly, a recent study by Ethisphere (2022: 8) argues that the most ethical companies in their sample outperformed their counterparts on the stock market by 24.6% in the previous 5 years.

Regardless of whether one looks at firm value or return on sales as a measure of firm performance, Guiso, Sapienza and Zingales (2015) identify a positive correlation with proxies for integrity among a sample of 679 large US companies. Companies with a strong commitment to integrity have been estimated to have 10-year shareholder returns 7% higher than companies with low integrity (Corporate Executive Board 2017), while another study found that European and US portfolios with high governance risksc7fa85d610fd generate negative long-term stock returns in the order of 3.5% per annum (Gloßner 2017: 27).

Moreover, a study of 480 large multinational firms found that sales growth in markets with low background risks of corruption has a greater positive effect on a firm’s profitability than sales growth in markets with high integrity risks (Healy and Serafeim 2016). Given that a survey of 824 multinational firms domiciled around the world and operating in a wide range of sectors indicates that compliance with anti-bribery measures is increasingly becoming a competitive advantage in low integrity risk markets (Control Risks 2015), firms with high-quality compliance systems are arguably better placed to enjoy sustainable growth.

These effects are particularly marked over the long term. Eccles, Ioannou and Serafeim (2014) observe that managerial focus on short-term profit maximisation for shareholders often leads to lower long-term value creation as needed investments are sidelined.6d1b2ee158ac While a strong culture of integrity can in some instances entail short-term costs and foregone profits, Guiso, Sapienza and Zingales (2015) argue that, at least for the large companies in their sample, such costs are outweighed by the long-term benefits.

For instance, a study of 180 publicly listed US firms found that those which proactively engage in sustainability reporting outperformed their competitors over the long-term with regard to stock market and accounting performance (Eccles, Ioannou and Serafeim 2014). Another study of 9,141 public firms with assets of more than US$10 million listed on the NYSE, NASDAQ and AMEX from 1990 to 2011 found a significant correlation between strong corporate governance and transparency with firm value, which was particularly marked in states judged to be more corrupt (Dass, Nanda and Xiao 2014). While companies in more corrupt states were generally found to have lower market value, good quality internal governance mechanisms and high integrity standards could partially compensate for high background levels of corruption (Dass, Nanda and Xiao 2014).

However, given the long germination of investments in a firm’s anti-corruption infrastructure and the fact that the stock market does not fully value intangible assets like integrity (Gloßner 2017), ‘it may be necessary to shield managers from short-term stock prices to encourage long-run growth’ (Edmans 2012: 1)

Haugh and Bedi (2023: 568) point to some of the methodological challenges of attempts to link the quality of firms’ anti-corruption and compliance programmes to stock market performance. They note that some studies like that published by Ethisphere (2022) rely partly on companies’ self-reported perceptions of their ethics and compliance programmes, and most studies document correlative rather than causal relationships. The authors point out that the risk of ‘omitted variables or reverse causality is great when trying to link compliance efforts based on surveys and self-provided documents with overall share price performance’ (Haugh and Bedi 2023: 568).

Return on investment of corporate integrity measures

A 2018 study by the International Finance Corporation, which examined 61 firms in emerging markets, found that improvements in corporate governance were associated with approximately 20% higher return on equity (ROE) and return on invested capital (ROIC). In a study of corporate firms in Pakistan, Shakri, Yong and Xiang (2022) suggested that stricter corporate compliance relates to higher firm performance, in terms of return of assets (ROA) and market performance (Tobin’s Q). Similarly, in a study of 217 respondents from Indian companies, Vashisht and Singh (2024) found corporate integrity is positively associated with firm profitability.

In sub-Saharan Africa, Jinjiri, Hamid and Ooi (2023) find that anti-corruption practices in Nigeria – such as management responsibility, the existence of a code of conduct and whistleblowing systems – are positively associated with firm investment and return on assets (ROA). In a study of hotel and manufacturing firms in Uganda, Eton et al. (2021) found that integrity demonstrated by corporate board members is positively correlated with firm performance.

Impact of corruption disclosure on profitability

Several recent studies have assessed the impact of complying with the Global Reporting Initiative (GRI) Standard 205 on Anti-Corruption, which encourages firms to publicly disclose information about: (i) the results of corruption risk assessments; (ii) the results of corruption awareness raising and training activities; and (iii) information about confirmed incidents of corruption. Here, evidence on the impact of firms disclosing corruption related data appears at first glance less encouraging, either having negative or insignificant effects on firm performance. A meta-review of 35 empirical studies on anti-corruption reporting conducted by Khelil et al. (2025) concluded that overall anti-corruption reporting is negatively associated with profitability.

For example, Asare et al. (2021) conducted a regression analysis of 27 firms in five African countries between 2006 and 2018, measuring the impact of compliance with GRI 205 on the profitability (the return on asset and return on equity) and financial stability of the companies in the sample. The authors found that disclosing information about confirmed incidents of corruption was associated with lower profitability. While disclosing information about the results of corruption risk assessments, awareness raising activities and training had no significant effect on profitability, disclosing this data was found to reduce the financial stability of firms.

In the banking sector, Nobanee, Atayah and Mertzanis (2020) used Joseph et al. (2019) anti-corruption disclosure index to analyse banks in the United Arab Emirates between 2003 and 2013. They found that anti-corruption disclosure had a negative impact on the performance of conventional banks, while no significant relationship was observed for Islamic banks.

In the case of mining firms in five ASEAN countries between 2017 and 2019, Zulvina and Setiawan (2022) found that disclosing data on a firm’s anti-corruption framework negatively affected return on assets (ROA) and market performance (Tobin’s Q) but had no significant impact on financial performance (ROE). Also in the extractive industry, Duho (2020) suggested in his MPhil thesis that while anti-corruption disclosure may reduce the return on assets, it has a statistically significant positive impact on the financial stability of these firms.

However, as Aldaz, Alvarez and Calvo (2015) observe, it is important to include a caveat about the direction of causality when discussing the negative correlation between companies disclosing information about corruption and firm performance. It may not be that a firm reporting information about corruption itself causes that company to become less profitable. On the contrary, it appears that companies with poor financial performance often disclose more corruption incidents. For instance, it could be the case that companies that experience more integrity violations are less profitable and therefore come under pressure to disclose information on corruption to shareholders, regulators and the public. This would be a sensible response to any reputational damage caused by corporate corruption, as Aldaz, Alvarez and Calvo (2015) find that reporting information about instances of corruption and management’s response enhances the perception of stakeholders about the company.

Attract more business

Companies with a reputation for acting with integrity may enjoy additional commercial opportunities over their competitors. Some public procurement agencies as well as potential business partners offer preferential terms for companies that adopt stringent anti-corruption and corporate transparency measures. In an interview conducted for Transparency International UK (2022:23) study, one investor pointed out that corporate integrity ‘increase[s] the pool of potential buyers for a business, […] and cash flows are valued very differently in a competitive process’.

More specifically, anti-corruption and corporate transparency measures can lead to reduced procurement costs, favourable payment terms, lower due diligence requirements, reduced tax inspections and audits, and faster issuance of permissions and licences (Transparency International 2016). A case in point is a recent study by Bao et al. (2024), which highlights the positive role of corporate integrity in credit rating assessments. The authors argue that this influence operates both directly and indirectly: integrity not only improves the assessment directly but also contributes indirectly by reducing financial risk.

Studies also show that firms that act with integrity can enhance their reputation with customers, which may also increase their revenue through price premium. In an empirical, experimental study, Haugh and Bedi (2023: 601) discovered that consumers are willing to pay more for products that came from companies with robust compliance programmes, including anti-corruption and fraud programmes. Indeed, consumers valued strong compliance programmes over some other product features in which companies invest significant resources, such as design (Haugh and Bedi 2023: 590). They conclude that, in addition to reducing firms’ legal liability, corporate compliance programmes also have the potential to make companies money by increasing their consumer sales revenue.

Non-financial benefits of business integrity

A range of research indicates that companies that operate with integrity are more likely to enjoy advantages in product, labour and capital markets (Cheng et al. 2014; Ioannou and Serafeim 2014).

Efficiency and innovation

Empirical research has shown that corruption at the firm level has a significant negative effect on innovation, and these effects are especially pronounced in the manufacturing sector (Lee et al. 2020). It is therefore no surprise that several recent studies demonstrate that firms that act with integrity are likely to outperform their competitors in terms of efficiency and innovation. A study by Vu, Dao and Hoang (2025), based on US firm earnings from 2001 to 2018, found a positive and statistically significant relationship between corporate integrity and company efficiency. The authors suggest that, in firms with a stronger culture of integrity, managers are able to optimise the use of resources to more efficiently generate revenue. In addition, Lan et al. (2024) show that the existence of internal whistleblowing channels had a positive effect on corporate innovation (measured in terms of patent applications) in Chinese public companies from 2009 to 2018. They theorise that by reducing opportunities for misconduct by executives, whistleblower mechanisms ensured that excess resources were channelled productively into research and innovation.

Retain motivated workforce

Advocates for business integrity contend that business performance is improved in companies with proactive or ‘heightened’ integrity frameworks that ensure staff are competent, act ethically and are held accountable through transparent delegation processes (Barlow 2017).

Guiso, Sapienza and Zingales (2015) find that among large US firms where employees perceive senior management as trustworthy and ethical, the firm’s performance is stronger in terms of productivity, profitability, industrial relations and attractiveness to prospective job applicants. This has a notable impact on a firm’s bottom line: one standard deviation increase in integrity equates to a 0.19 standard deviation increase in Tobin’s Q, and a 0.09 standard deviation increase in profitability.

Edmans (2012) measures the impact of job satisfaction on firm value by using future stock returns. In other words, to avoid reverse causality that could arise from high current market value leading to high reported job satisfaction, he relates the change in market value in a given year with reported job satisfaction from the previous year. Comparing market value fluctuations between the top 100 firms listed in the Great Place to Work Institute’s (GPWI’s) annual survey and a control group of their peers, Edmans finds that, between 1984 and 2011, the value of the top 100 companies increased each year 2.3% to 3.8% more than the general firm population. He explains the correlation between job satisfaction and firm value with reference to the view that companies with a higher level of staff satisfaction are better able to recruit, motivate and retain key employees (Edmans 2012: 1).

In addition, a number of studies examine the direct relationship between business integrity and the retention of employees. Using questionnaires circulated to more than 20,000 alumni from Midwestern State University in the US, Peterson (2004) showed that an individual’s “organisational commitment” to their employer – a proxy for their intention to continue working at the organisation – is associated with that person’s perception of their employer’s integrity and corporate social responsibility. In a more targeted and recent study of 377 accountants in Malaysia, Zainee and Puteh (2020) find a positive correlation between corporate integrity and talent retention.

Overall, the literature has documented positive effects of corporate integrity on employee morale and reputation, as well as negative effects of firm corruption on staff morale (Harvard Business School 2013), findings which are mirrored by recent studies of the public sector (Isaeva, Seki and Kakinaka 2025). As staff morale is a clear predictor of employee retention, this suggests that firms that act with integrity will be better able to retain key employees, itself a marker of a successful business.

Environmental performance

Business performance is increasingly being assessed not only in terms of firm profitability but also environmental performance. As reviewed by Gerged, Salem and Ghazwani (2024), this approach is grounded in stakeholder theory, that is, the idea that management should prioritise the interests of all stakeholders, rather than focusing solely on shareholder value.

Sarhan and Gerged (2023) analysed 214 companies in the FTSE 350 (London Stock Exchange). The authors found that anti-bribery and corruption (ABC) commitments have a positive impact on environmental management performances and policies. Also, in the ASEAN-5 countries, Enggaringtyas and Hermawan (2024) suggested that corporate anti-corruption commitments have positive effects on environmental performance indicators such as air, land and water quality, based on their analysis of 108 companies from 2017 to 2022.

The case of small and medium enterprises (SMEs)

Most of the studies on corruption and firm performance relate to large, publicly listed and multinational firms domiciled in OECD countries for which more data tends to be available. This suggests some selection bias in the findings presented in this Helpdesk Answer, as small and medium-sized enterprises are not the typical unit of analysis, although they are often included in many of the larger, cross-country business survey datasets referred to throughout the paper.

The literature indicates that smaller firms may be more vulnerable to extortion by public officials than larger companies (Pelizzo et al. 2016). Svensson (2003) showed that public officials tend to demand fewer bribes from firms with greater bargaining power, of which firm size is a key determinant (Hakkala, Norbäck and Svaleryd 2008: 638; Aterido and Hallward-Driemeier 2007).

Pelizzo et al. (2016) found in a study of firms in sub-Saharan Africa that, relative to larger enterprises, small firms are particularly susceptible to corruption as they suffer from a lack of robust internal procedures, poor corporate governance structures and inadequate accounting standards. Serafeim (2014: 21) concurs that smaller firms are less likely to have strong internal control mechanisms in place to detect corruption.

SMEs often face a dilemma when it comes to investing in compliance and integrity. Corporate anti-corruption policies can offer benefits, such as: (i) demonstrating commitment to stakeholders; (ii) fostering a culture of integrity; (iii) ensuring compliance; and (iv) improving operational efficiency. However, SMEs tend to have limited resources to develop and implement such programmes (Transparency International and the World Economic Forum 2024). Moreover, the burden of corporate anti-corruption measures can be disproportionately high for SMEs as compliance costs per employee tend to exceed those of larger companies (Crain and Crain 2011; Robbins, Harutyunyan and Onibokun 2025).

This raises an important question: if SMEs do invest in anti-corruption compliance, are they likely to experience the same kind of tangible advantages associated with business integrity from which larger firms benefit, according to the literature surveyed for this Helpdesk Answer?

There is growing evidence that business integrity measures, anti-corruption disclosures and broader corporate social responsibility (CSR) initiatives can enhance the performance of SMEs. A 2024 survey of Association of Chartered Certified Accountants, for example, revealed that 68% of respondents from SMEs answered that establishing an anti-bribery policy increases their chance of securing contracts with big companies or governments. Similarly, Doman and Sitorus (2023) conducted a questionnaire based survey of 362 participants and found that business ethics, including senior official commitment, are closely associated with sales growth and profitability among SMEs. A study by Houng et al. (2018) in Vietnam concluded that most forms of corruption have negative impacts on SMEs’ financial performance. On the flip side, Le (2022), through a questionnaire based study of Vietnamese firms, found a significant positive association between CSR and SME performance.

The APEC Small and Medium Enterprises Working Group (2021) found that companies with robust business ethics frameworks (such as training, awareness raising, disclosure, policy development and assessment) achieved greater revenue growth than those with lower levels of ethical engagement. Additionally, in a study of 288 SMEs in Nigeria, Adamu, Wan and Gorondutse (2020) also concluded that ethical sensitivity is associated with sustainable performance. In terms of CSR report disclosure on the part of SMEs, Ting (2021) found that disclosure had a more positive effect on firm performance in SMEs than in larger firms.

In terms of sectoral and regional differences, Oduro et al. (2021) found that while CSR is positively associated with overall SME performance, the relationship is stronger among service firms compared to manufacturing firms, and in developed countries compared to developing countries.

Communicating the benefits of business integrity

Although, as this Helpdesk Answer shows, there is substantial evidence that business integrity has a positive impact on commercial success, questions remain about how these benefits are accurately captured and effectively communicated to shareholders, regulators and the public at large.

A study of Italian businesses by Troise and Camilleri (2021) identified that a growing number of firms are using social media channels, notably Instagram and Twitter, to promote their CSR initiatives. Encouragingly, Khanal et al. (2021) found that small business owners in New Zealand were able to use social media to keep up with CSR trends and engage stakeholders. However, in a study of the oil and gas sector, Pizzi et al. (2021) argue that there is often a gap between the claims about CSR advanced by corporate social media accounts and the reality of large energy firms’ activities, which undermines the effectiveness of their outreach.

In terms of how to communicate a firm’s CSR engagement, Peifer and Newman (2020) evaluated the effects of companies justifying their CSR activities in terms of a business case (in other words, stating clearly that CSR activities are partly intended to increase profits). Interestingly, they found that where firms justify their CSR activities with a business case, this reduces the trust of employees in the company, increases the trust of investors in the company and has no effect on consumers’ trust in the company.

In the last decade, the expansion of corporate reporting to include more details about firms’ financial and tax affairs, such as via country-by-country reporting,21fecd8eac9d has received support from some investor groups who argue that this data helps them better assess investment risks (Eumedion 2015; Eurosif 2021). While some companies may contend that publishing sensitive data might constitute a commercial disadvantage, a study of 28 European and Indian multinational companies found no significant correlation between public disclosure of country-by-country reporting and standard measures of competitiveness such as revenue, earnings per share, price to earnings ratio, return on equity and return on assets (Transparency International EU 2016).

- It is worth noting, however, that the imposition of penalties and sanctions on a firm found to have engaged in corruption relies on the existence of a governance regime which actively enforces relevant anti-corruption provisions in its jurisdiction such as the FCPA or the UK Bribery Act.

- Transition economies refer to countries in Central and Eastern Europe, as well as the Commonwealth of Independent States (Asiedu and Freeman 2009; Batra, Kaufmann and Stone 2003).

- Dass et al. assessed Tobin’s Q as an indicator of firm value against local corruption using a proxy of corruption related convictions of public officials between 1900 and 2011. Tobin’s Q provides a means of estimating firm value by dividing the total market value of the firm by the total asset value of the firm.

- Survey results show that 51% of businesspeople felt corruption makes an economy less attractive to foreign investors, 90% felt it increases stock market volatility and discourages long-term investment, and 99% agree corruption undermines the level playing field to the benefit of corrupt competitors.

- Dutt and Traca find that only in very high tariff environments (5% to 14% of the observations) does corruption have a trade-enhancing effect where corrupt officials allow exporters to evade tariff barriers.

- The findings did reveal some regional differences. While 70% of Latin American firms agreed that if an illicit payment was made to one official, another government official would request payment for the same service, only 17% of firms in the OECD agreed.

- Aterido and Hallward-Driemeier (2007) consider access to finance, business regulations, corruption and infrastructure bottlenecks as variables of job creation.

- Of the firms surveyed, 33.5% employed between 5 and 50 people, 41.8% employed between 51 and 500 people, and 24.7% employed more than 500 people. Gaviria does note that the country samples were not intended to be representative of the universe of firms in any given country, and different sampling procedures were used in different countries.

- This is the case in Germany and Bulgaria, for instance.

- The regional breakdown of firms surveyed was as follows: North America (77%), followed by Europe, the Middle East and Africa (14%), Asia Pacific (8%) and Latin America (1%). See: http://www.sirota.com/wp-content/uploads/2016/03/TEE_AppA_final_071513.pdf

- Deferred prosecution agreements (DPAs) are settlements between prosecutors and firms which suspends the prosecution for a defined period of time, provided that the firm meets certain specified conditions. DPAs are mostly used in cases of fraud, corruption and other economic crime. For more information, see a 2017 Helpdesk Answer on deferred prosecution agreements, plea bargaining and immunity programmes.

- Serafeim uses a dataset of 244 firms who admitted in an anonymous PWC client survey that they had experienced a bribery incident in the past 12 months. Most of these firms come from emerging market economies, though firms from the US, the UK and Australia are also well-represented; 30% of the sample is composed of firms with more than 5,000 employees, 25% have between 1,000 and 5,000 employees, 25% have between 200 and 1,000 employees and 20% up to 200 employees.

- The respondent companies were mainly large privately owned or publicly listed multinationals headquartered in OECD countries (OECD 2015: 30).

- Gloßner uses a dataset of firm exposure to 28 environmental, social and governance risks provided by RepRisk. The governance issues include corruption, bribery, extortion and money laundering, fraud, tax evasion and anti-competitive practices.

- Interestingly, publicly traded firms are found to have a notably lower integrity value than similar private firms, suggesting that these firms’ paramount concern on short-term return on investment leads them to underinvest in integrity systems. See Guiso, Sapienza and Zingales 2015.

- Country-by-country reporting refers to the disclosure by a company, either publicly or in confidence to governments, of tax figures and, potentially, other financial data on a country-by-country basis.