Why focus on corruption risks and drivers in wind and solar energies?

A decarbonised global energy sector will not only better protect the world’s climate but will also require a significant financial commitment to become a reality. For example, the International Renewable Energy Agency predicts that a low-carbon energy system will require a cumulative investment of at least US$ 110 trillion by 2050.0b2b1688094d Given the huge amount of money at stake, it is likely that low-carbon energy systems will be vulnerable to corruption.

Important factors make the renewable energy sector uniquely suited to acts of corruption.5b22c906cd05 Renewable energy is a capital-intensive sector that is prone to consolidated control among a small number of actors, especially regulators, and therefore making it vulnerable to higher levels of regulatory capture or corruption in regulatory processes. Indeed, almost all renewable energy sources are far more capital-intensive than their fossil-fuelled counterparts.fc0850097da5 The International Energy Agency (IEA) shows that compared to fossil fuels, renewable energy sources require far greater amounts of finance.023a25aee2dc

The renewable energy sector sees a high amount of coordination between public and private actors. This gives rise to possible corruption across both the supply side and demand side and a ‘dual nature’ of corruption. Additionally, renewable energy is a sector featuring large amounts of public procurement, which can become prone to secrecy, bid rigging, price fixing, partitioning markets, or exchanging sensitive information.98da663a45d5

Previous U4 work has raised important questions about the role of context in addressing corruption risks in renewables. For instance, its anti-corruption primer on green energy argues that corrupt practices in green energy are no different from those already seen in fossil fuels, laying the groundwork for an exploration of corruption risks in diverse low-carbon energy markets.585938312546 Furthermore, its deep-dive into the political economy of renewables in Zambia explains that energy transition outcomes can be slowed down by conventional political arrangements.cd31d7e0e92b For this reason, anti-corruption practitioners should consider not only the legal framework but also the distribution of power among the institutions responsible for such outcomes.

Research on corruption risks in renewable energy has identified a need to establish whether corruption affects distinct renewable energies differently.cb62082fbd6e In response to these calls, this U4 Issue aims to provide an overview of corruption risks at the interface between private climate action, renewable energy, and international development. Hence, it asks: ‘Who are the main actors in wind and solar energy markets? To what extent do these actors face corruption risks? What measures can be taken to reduce corruption in renewable energy?’ This paper is guided by political economy analysis and comparative case analysis to address such questions and propose solutions to a wide range of actors.

Box 1. Research methods

This paper uses document analysis, comparative case analysis, and semi-structured interviews to examine corruption risks in two different types of renewable energy technologies in two distinct countries: commercial wind farms in the North American country of Mexico, and small-scale and off-grid solar power in the African country of Kenya. This enabled us to look for common corruption risks across very different technologies (wind and solar) at different scales (centralised versus smaller-scale and off-grid) in two important developing countries (both actively receiving development assistance for renewable energy.)

We interviewed 12 specialists with expertise in tackling corruption in, and knowledge of, our two case study countries. Interviewees were purposefully sampled from three stakeholder groups: private renewable energy companies; academic researchers on corruption and civil society groups; and providers of finance and financial services to renewable energy companies. Interviews were conducted during the first quarter of 2022, in the English language, and lasted between 25 and 90 minutes. Interviewees were assured of full confidentiality.

Based on our original semi-structured interviews, we identified a set of 11 corruption risks and practices in wind and solar energy in the two case study countries (see Table 1).

Table 1: Corruption risk clusters in wind and solar energy

|

Policymaking and regulation |

|

|

Community impacts |

|

|

Planning and delivery |

|

‘First-class anti-corruption rules but poor enforcement’: Wind energy corruption risks in Mexico

We identified seven corruption risks and practices in the Mexican wind energy sector:

- Power concentration on a small number of regulatory actors

- Weak oversight of land affairs, leading to bribery and kickbacks to gain access to energy investments

- Use of violent tactics against local communities and indigenous peoples

- Ignoring the Free, Prior, and Informed Consent process (FPIC) or its outcomes

- Conducting flawed social and environmental impact assessments and due diligence processes

- Non-compliance with, and lack of enforcement of, campaign finance rules at the local level

- Lack of public procurement transparency and data quality, leading to anti-competitive behaviour especially during auction schemes

Bribery and facilitation payments to bypass the rules or to speed up processes is the most pervasive practice. It spreads across land affairs (acquisition, possession, and use); project development (permits, licences, impact assessment, and due diligence); and implementation (ie through tender fixing). As the following section shows, corruption risks are also intimately associated with a lack of compliance with, and implementation of, rules and policies (as opposed to the lack of a normative framework). Hence, in the Mexican case study, the public and private sectors should focus on robust compliance and oversight approaches across wind energy development, but less so on filling normative gaps.

A powerful state electricity regulator

The centralisation of electricity tariff setting and policymaking, and the monopoly status of the state electricity regulator (Comisión Federal de Electricidad (CFE)), is a significant corruption risk in wind energy. The CFE oversees various tasks, from buying energy from all developers to contract negotiation, and this raises concerns over power concentration. Such a privileged position is believed to be ‘made for corruption’, according to our expert respondents.e3c22fe8f8a6

Subsequently, the CFE monopoly over the electricity market leaves it open to corrupt practices. Its design empowers bureaucrats and top executives to collect bribes and facilitation payments throughout the stages of project development, to issue permits, licences, and public contracts. According to expert views, given that profit maximisation drives private sector involvement in wind energy, the expansion of the sector suggests that the profit-to-corruption ratio is still favourable to private sector investments.74c94e3a1cdd

Box 2. Mexico’s wind energy market at a glance

Mexico makes up Latin America’s largest wind energy market, thanks to a combination of geographic factors and low operational costs. The Isthmus of Tehuantepec, in the southern state of Oaxaca, records winds of 200 km/h for half a year. In 2021, the North American country ranked as the fifth cheapest market for onshore wind producers, of 27 countries assessed(Millard, Stillman, and Kishan 2021). Atthe time of writing, wind power made up about 9% of the national electricity supply, sourced from almost 70 wind farms spread across 15 of its 32 states(Goytia 2022) (See Figure 1). The Mexican wind market’s installed capacity is expected to grow from 13 GW in 2020 to 50 GW by 2030. Such growth potential has also led to changes in the electricity sector, including evolving policy incentives, regulations, investment patterns, and transmission-and-distribution grid investments.

Despite major developments in the regulatory framework, wind energy still occupies a meagre 10–12% of all low-carbon electricity generated countrywide (IRENA 2019). Both a focus on fossil fuels and a policy shift towards restricted competition for electricity tenders, have placed the state electricity regulator at the heart of the market. Partly because of these changes, investment in wind power dropped by more than 60% between 2020 and 2021. By 2022, three foreign-owned wind companies – Gamesa (a Spanish/German corporation), Acciona (Spanish conglomerate) and Vestas (Danish wind power company) – shared 90% of the market. This represents a major challenge to the highly competitive market that emerged in 2013. At that time, an energy market reform encouraged businesses to bid for public tenders – centred around long-term auctions – and provided incentives for foreign companies to enter the market.

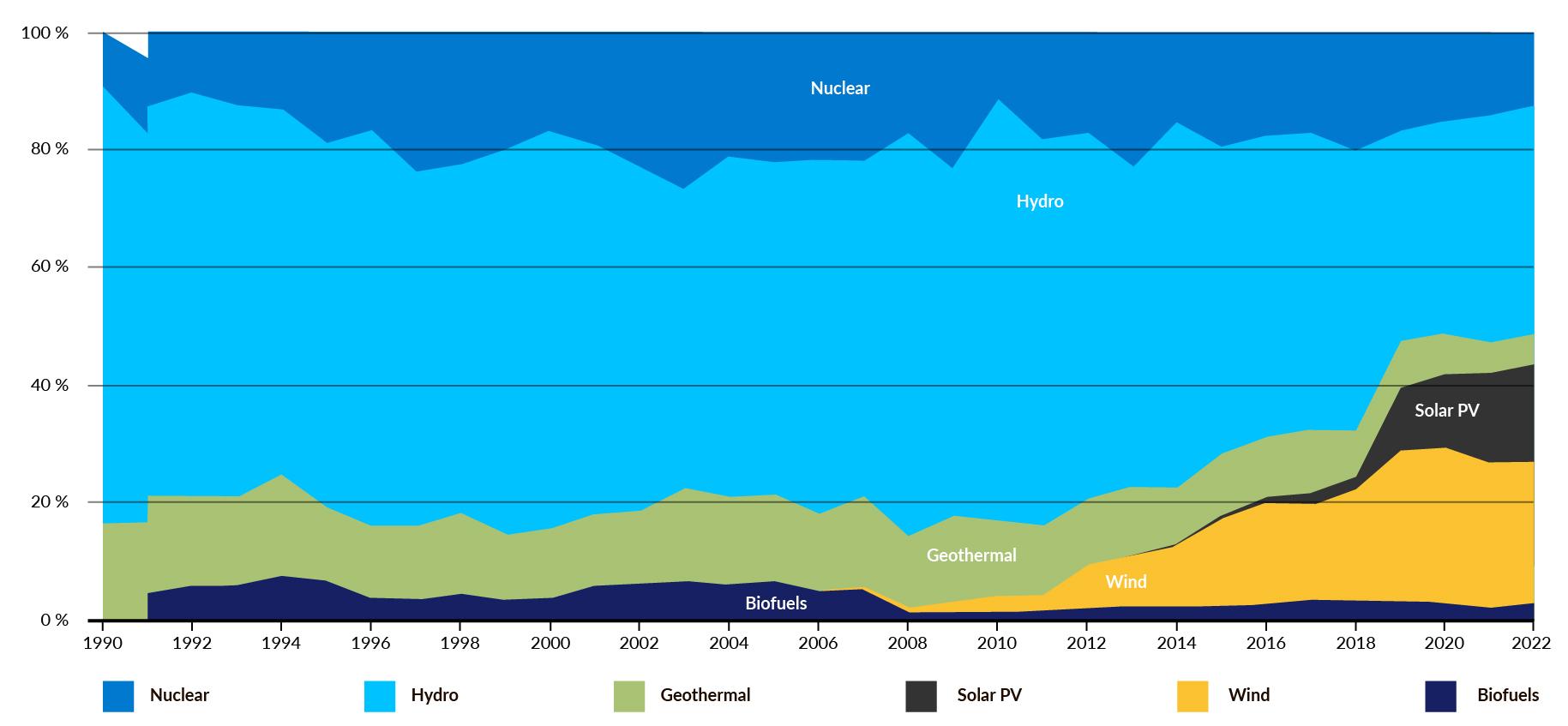

Figure 1: Wind – a growing part of the renewable energy mix (1990–2022)

Source: International Energy Agency (IEA) (n.d.)

Weak oversight of land affairs leads to bribery and kickbacks to gain access to energy investments

According to our evidence, bribes and illegal payments in land affairs – including petty forms of corruption such as exchanging favours – represent the second corruption risk in wind energy. In this context, bribes and illicit payments can be made to public officials to avoid the checking of permits, and this is facilitated by a failure to oversee the integrity of land dealings. Hence, corrupt business practices influence bureaucrats and networks up the value chain who have authority to advance or delay project development. The existence of such an expectation that bribes and kickbacks will be paid can thus slow down energy transition outcomes and reduce public support for new energy sources.

Use of violent tactics against local communities and indigenous peoples

Another corrupt practice lies at the interface of public authorities, local communities, and energy developers. It relates to unlawful tactics against ancestral landowners to advance land-related dealings (eg acquisition, property, and registers). Wind energy developers have resorted to deadly tactics already seen in extractive industries when operating, or aiming to operate, in indigenous and local community lands.1635eb18ca68 Unlawful grabbing, violence, and human rights abuses – including intimidation or threatening behaviour, disappearances, or the murder of indigenous and ancestral leaders – have been extensively reported by the media and human rights organisations. It is deeply concerning that foreign corporations based in countries which profess a dedication to human rights, then resort to such abuses in non-western settings.

One such investigation reports that wind energy projects in the lands of the Zapoteca indigenous group have been facilitated by collusion between developers and local public officials in land dealings. The former have received bribes and kickbacks to favour energy developers’ interests. Land dispossession has forced indigenous peoples and local communities from their homes to large urban centres. Weakened local autonomy and organisation are a significant cost of internally displacing local communities.7fd0431b3435

Ignoring or bypassing the Free, Prior, and Informed Consent process (FPIC) or its outcomes

Consultation with local communities and indigenous peoples is a crucial step towards ensuring sustainability goals and consistency between local and broader development actors. Failing to seek community authorisation for projects that involve ancestral lands and ecosystems not only represents a breach of law but also may open the door to corruption. Public and private actors may overlook the obligation to consult local communities but also dismiss or hide information, and change the outcomes of negotiations with communities in order to further their interests. These actions may be not only precursors but also manifestations of abusive practices aimed at extracting rents from renewable energy developments.

Flawed social and environmental impact assessments and due diligence processes

Interviewee R05 reported a dangerous practice of dismissing serious concerns raised through social and environmental impact assessments, which largely affects local communities and indigenous peoples. This undermines the value of impact assessment as an opportunity to mitigate and reduce harm to communities but also may constitute a facilitator of corruption risks and practices such as those described above. Manipulation of social and environmental impact assessments and consultation processes emphasises that corrupt acts can occur due to poorly implemented regulatory frameworks rather than an absence of rules.

Non-compliance with, and a lack of enforcement of, campaign finance rules at the local level

Interviewees R09 and R12 suggested that a sixth corruption risk is associated with political finance. Wind energy developers have advanced their vested interests by funding the electoral campaigns of local authorities in exchange for favourable decisions. Although sponsorship of campaign finance might not be illegal as such, with great interests at stake, private donors and local politicians might fail to disclose donations and break private donation caps. Private donors might also provide finance from unexplained sources (eg from tax evasion or organised crime). This corruption in particular poses major investigation and enforcement challenges, as illicit campaign finance is difficult to uncover through existing investigation methods given lax or poorly enforced campaign finance rules. It comes at a high cost to local communities and ecosystems, as it can result in the forgery of land contracts to deprive ancestral landowners of their legal land entitlement.

Lack of public procurement transparency and data quality restricts market competition

The fact that the Mexican wind-power market is prone to limited competition and also grants favourable access to a few connected firms, is a signal of public procurement corruption. A veil of opacity in the sector leads to tender fixing and rigging, cost overruns, and poor-quality assurance of delivered goods and services. Besides, a wind energy sector structured around a niche market leads to the risk of perpetuating practices of limiting access to a few actors through illicit campaign finance, nepotism, or influence peddling, which can lead to state capture-like practices. As wind energy development is expected to significantly grow, sustaining this type of systemic corruption will be in the interest of corrupt actors.

Given that respondents identified similarities in the practices of renewable energy actors and fossil fuel actors – including profit-driven business logics – there is widespread concern about a lack of transparency in the wind-power sector. In particular, a lack of information might affect state auctions of wind projects, with civil society organisations being ill-equipped to hold public and private actors accountable.

‘Everyone is aware of it’: Solar energy corruption risks in Kenya

Corruption risks and drivers in Kenya’s solar energy are manifold. Yet, our expert respondents R01 and R06 suggested that the main corruption driver in the private sector is ‘reverse corruption’. This concept denotes a highly corrupt political system that ‘corrupts’ the private sector, rather than the other way around. According to this view, a blurred line between the public and private sectors, visible through close political and business relations, and the existence of a conflict of interests give rise to systemic corruption practices and discretionary power.

We identified six corruptions risks and practices in the Kenyan solar energy sector:

- Power concentration on a small number of regulatory actors

- Weak oversight of land affairs, leading to bribery and kickbacks to gain access to energy investments

- Absence of conflict-of-interest management for politicians, top bureaucrats, and businesspeople

- Large investment flows to renewable energy development

- Social norms against speaking out about corruption

- Confusion over or lack of knowledge of the regulatory framework

Box 3. Kenya’s off-grid solar energy market

Kenya provides an example of both the potential for renewable energy and the challenges posed by corruption. Having achieved global prominence in the deployment of off-grid solar energy solutions, including microgrids and mini-grids, it simultaneously grapples with a surge in investment and financing, raising major concerns about abusive rent extraction practices around new projects.

The Kenyan off-grid solar market differs from the Mexican case study because of the presence of global donors and development banks, as well as new entrant firms specialising in innovative business models for solar, such as ‘pay as you go’ or ‘bundled services’(Rolffs, Ockwell, and Byrne 2015). In 2022, these included M-Kopa, Orb Energy, One Degree Solar, Dlight, and Mobisol. The World Bank and African Development Bank, along with bilateral agencies such as USAID or DFID (now FCDO), also finance solar projects.

The intertwining between the public and private sectors is also evident in the realm of energy policy formulation and execution. Private sector stakeholders have played a significant role in shaping renewable energy legislation around profit maximisation, such as promoting corporate social responsibility (CSR) instead of revenue sharing. The exclusion of profit sharing from draft regulations is particularly concerning, especially in light of an ongoing legal case in the wind sector69ce68e943aa that highlights how CSR can be used to greenwash corruption.64c775ab9b52

Government officials and businesspeople also reward preferential access to decision-making through nepotistic practices. For instance, common practice includes awarding public sector jobs to proxies or relatives of executives of connected firms, but also keeping people on payroll who do not have a job, known as ‘phantom workers.’ Confusion over or a lack of knowledge of the regulatory framework is also a risk of accidental corruption due to private actors misinterpreting the regulatory framework or fearing unpredictable backlashes.

Power concentration on a regulatory body

As in Mexico, monopoly-like entities that control various aspects of solar energy financing and policy create fertile ground for corruption. Observers, including R09 and R12, believe that these companies are in effect a ‘one-stop shop for corruption’, with some going so far as to claim that they are ‘made for corruption’.

Box 4. Kenya’s solar energy regulation

In Kenya, the energy market is characterised by a strong involvement of national government actors. For example, two bodies, the Ministry of Energy and Petroleum and the newly established Energy and Petroleum Regulatory Association (EPRA), dominate policymaking and standard-setting. The Ministry is responsible for the development, publication, and review of renewable energy plans and the provision of renewable energy services at minimum cost. EPRA is responsible for regulating the generation, conversion, distribution, and supply of renewable energy (Wako and Ngumo 2021). It also regulates marketing and data related to renewable energy. The Rural Electrification and Renewable Energy Corporation is responsible for the national distribution of rural electricity, and the Kenya Electricity Generating Company manages most renewable energy supply.

Bribery and kickbacks in land affairs

As with Mexico, land acquisition is prone to corruption. There are reports of the forgery of documents taking place within the process, and this is compounded by a lack of knowledge necessary to challenge the authenticity of such documents. Together with the bypassing or disregarding of Free, Prior, and Informed Consent (FPIC) processes, such practice renders land transfer as an area ripe with corruption.

Large investment flows to renewable energy development

Our expert respondents expressed concerns about the relationship between large investment and aid flows into the renewable energy sector and energy-access inequality. On the one hand increased funding for electricity expansion has led to a reduction in energy poverty, but on the other hand this has promoted the use of corrupt practices by energy developers. Electricity sector corruption has also expanded the geographies of corruption, creating uneven electricity tariffs and sometimes sub-standard energy services. Thus, more equality of access to energy, especially for those in remote areas, has led to higher costs for communities who need to resort to corrupt exchanges to access electricity. However, it has also imposed a cost due to a deficit in the service provided.

Social norms against speaking out about corruption and abuse of power

According to interviewees R08 and R06, representatives of renewable energy companies believe that it is not in their best interest to speak out against corruption because it could damage their market share relative to other competitors. This reflects a social norm against raising societal and group concerns, including corruption, abuse of power in the workplace, and human rights abuses. Such a norm may partly explain why company whistleblowing mechanisms remain underused. This contradicts broader views of private sector actors, who see corruption as counterproductive because of the potential loss of customers and donor funding. According to them, corruption is inevitable and part of doing business, with watchdog institutions playing a marginal part in curbing it.

Spot the overlap: Corruption risks in wind and solar energy intersect, but context is critical

Corruption is present in both the Mexican wind-power and Kenyan solar-energy markets. Corruption risks share some commonalities: they include the concentration of power in a public entity and restrictions on market competition; absence of conflict-of-interest management for politicians and top bureaucrats; and ignoring and/or conducting flawed environmental and social impact assessments and due diligence processes. They also involve allowing bribery, mismanagement, and inefficiency so as to gain access to energy investments, or failing to set proper standards or tariffs that prevent or minimise bribery. The overlap of corruption risks in such different settings indicates that reducing the world’s overreliance on fossil fuels might reproduce old governance challenges associated with corruption, rent-seeking, and state capture that are common in traditional energy systems. It also speaks to conventional literature that emphasises the corruption-enabling role of discretion and monopoly over decision-making.

Some risks are more specific to Mexico’s wind energy. Such an example is non-compliance with, and a lack of enforcement of, political campaign funding for local, provincial politicians, which can be used as a trade-off for the benefit of project development. Another risk is the use of unlawful tactics, such as human rights abuses, torture, threats, violence, and disappearance, for land grabbing. Corruption can also include failing to perform Free, Prior, and Informed Consent (FPIC) consultations with affected local communities, such as indigenous groups, in addition to lack of transparency in contract development, auctions, and policy direction.

Overall, corruption risks emerging in the Mexican context are associated with the bypassing of established regulatory frameworks, which invites an enhanced approach to implementation of such rules. Stronger enforcement and capacity to investigate illegal campaign funding, collusion, and tender rigging, would be worthwhile to reduce the negative impact of corruption on local communities and sustainability outcomes.

Kenya is more prone to corruption risks that encompass: entrenched social views which inhibit individuals to speak out against corruption (as this may lead to reprisal or damage to business interests); a lack of knowledge of the regulatory framework, leading to so-called accidental corruption; and an influx of investment and aid resources to diversify energy sources and tackle energy poverty in remote areas.

Given that engagement in renewable energy is determined by profit maximisation in both countries, it is expected that private actors decide to resort to corruption as part of the existing ‘rules of the game’ but offset the costs of corruption by inflating project costs and reducing revenue sharing with communities.Energy developers and public actors (officials and politicians) may also collude and share in-kind and monetary benefits. These may include awarding attractive positions, both in the public and private sectors, to the relatives and proxies of their associates; favouring connected firms to secure public contracts; and giving lavish gifts to buy off politicians amid crucial parliamentary votes.

Much of the extant literature on renewable energy and corruption is vague about connecting particular actors (especially private sector actor types) to particular types of corruption – perhaps intentionally so, due to fears about legal liability, possible reprisal, or restrictions on freedom of speech. The literature says little about what type of corrupt practices take place, how they are carried out, at which stage of the value chain they occur, what factors enable the corruption to happen, and who is involved in the private sector. An overview of corruption risks and country and energy source (see Table 2) might be a point of departure for those interested in diving deeper into possible different shapes and varying degrees of corruption in renewable energies.

Table 2: Corruption drivers and risks in wind and solar energy in Mexico and Kenya

|

Corruption risks and drivers |

Mexico |

Kenya |

|

|

Commercial wind farms |

Small-scale, off-grid solar power |

|

Policymaking and regulation |

||

|

Power concentration among a small number of regulatory actors |

X |

X |

|

Non-compliance with, and lack of enforcement of, campaign finance rules at the local level |

X |

|

|

Absence of conflict-of-interest management for politicians and top bureaucrats |

X |

X |

|

Large investment flows to renewable energy development |

|

X |

|

Confusion over or lack of knowledge of the regulatory framework |

|

X |

|

Community impacts |

||

|

Use of violent tactics against local communities and indigenous peoples |

X |

|

|

Ignoring the Free, Prior, and Informed Consent process (FPIC) or its outcomes |

X |

X |

|

Social norms against speaking out about corruption |

|

X |

|

Planning and delivery |

||

|

Weak oversight of land affairs, leading to bribery and kickbacks

|

X |

X |

|

Flawed social and environmental impact assessments and due diligence processes |

X |

|

|

Lack of public procurement transparency and data quality, restricting market competition |

X |

|

Mind the gap: More anti-corruption measures is a start, but implementation drives results

Our interview respondents identified a suite of recommendations for mitigating corruption risks and practices (see Table 3).

Table 3: Recommendations for mitigating corruption risks and practices in wind and solar energy

|

Recommendations |

Governments |

Private sector |

Local communities |

Civil society and academia |

|

Corruption risk mapping and tracking |

X |

X |

|

|

|

Better information systems and disclosure |

X |

X |

|

|

|

Enhanced systems for including and involving local communities |

X |

X |

X |

X |

|

Improved social and environmental impact assessment |

|

X |

X |

X |

|

Increased consideration given to community ownership models |

X |

X |

X |

|

|

More robust public procurement processes |

X |

|

|

|

|

Address the implementation gap |

X |

X |

|

X |

|

Learn from past attempts to improve governance outcomes |

X |

X |

|

|

|

Support academic and policy research |

X |

X |

|

X |

Corruption risk mapping and tracking

Corruption risk mapping, as well as remedial actions, might be a way to prepare companies for corruption risk mitigation. Through the use of risk maps, they might be equipped to identify areas of concern and hence potential actions to avoid corrupt practices from occurring in the first place. Companies should also include early-warning indicators in their mappings to identify when a change of course is needed. The set of corruption risks presented here can be used as a starting point for companies and public entities to periodically conduct their own corruption risk assessments of renewable energy projects.

Better information systems and disclosure

Improved data collection throughout the project cycle (including a follow-the-money approach) as well as evaluation and monitoring mechanisms emerge as critical inputs to deterring corruption. A system of red-flag indicators, coupled with clear guidelines on risk mitigation – covering cost overruns, permits, and financial aspects – should be adopted, requiring serious information disclosure measures by companies.

Enhanced systems for including and involving local communities

Renewable energy developers must guarantee that the voices of local communities and those affected by energy projects are heard and their decisions considered – especially with regard to land acquisition. This includes upholding local communities’ right to free, prior, and informed (FPIC) consent to its maximum standard, as it improves the accountability of projects.

Improved social and environmental impact assessment

To minimise social harm, assessments should in principle become more detailed and participatory and leave no doubt about transparency. Most importantly, governments and companies should strive to incorporate local communities and ancestral landowners’ suggestions for improvement, and reverse or reconsider projects that threaten to negatively affect communities and the environment.

Increased consideration given to community ownership models

New mechanisms that transfer profits from energy development to – or share them with – local communities could contribute to the development of those same communities and keep corruption and rent-seeking at bay. One such way could be for communities to commission private companies to build the energy infrastructure under community contracts, with the profits remaining within local communities.

More robust public procurement processes

As the Mexican case study shows, it is crucial to ensure transparency throughout public procurement, because a lack of it is usually a gateway to restricting competition and awarding contracts to connected firms. It will also provide better value for money because only the most qualified companies will deliver public goods and services. The Mexican case study also showed that attention on long-term auctions not only increased the participation of companies but also improved financial oversight, particularly increasing confidence in the sustainability of this renewable energy market.

Address the implementation gap

Development of regulatory frameworks has continued at such a pace that their implemention – and therefore compliance with – cannot catch up. Both the Mexican and Kenyan case studies, as well as other anti-corruption efforts, demonstrate a need to implement the rules rather than just create them. Independent bodies, including civil society watchdogs, may be instrumental in addressing the implementation gap, but also in monitoring progress.

Learn from past attempts to improve governance outcomes

For instance, lessons from the Extractive Industries Transparency Initiative (EITI ) indicate that mandatory efforts at curbing corruption through transparency measures may be more effective than voluntary ones. In addition, standalone active transparency measures are insufficient to reduce corruption except when accompanied by civil society capability to use data for advocacy, and strong penalties need to exist for non-compliance.

Support academic and policy research

Undertaking further research to more clearly distinguish corruption risks from practices, as well as exploring the factors that contribute to corruption (antecedents or inputs) and the consequences of corruption (outputs or impacts), would be highly beneficial. This would enable a more comprehensive understanding of the causes of corruption, help identify any overlooked variables, and enhance the rigour of corruption and anti-corruption analysis. An entire new research area could focus on systemic variants of corruption, including state capture.

- IRENA 2019.

- Rimšaitė 2019.

- Schmidt 2014.

- Rimšaitė 2019.

- Rimšaitė 2019.

- Kaaba and Hinfelaar 2022.

- Williams 2022.

- Sovacool 2021.

- Interviewees: R09 and R12.

- Interviewees: R02 and R09.

- Burnett 2016.

- Interviewee: R12.

- Mullard 2023.

- Gargule 2019.