Query

Please provide an overview of the impact of PFM interventions on corruption, including the role that PEFA has had during the last decade, with examples on how PEFAs have been used for improvements/changes.

Introduction

What is public financial management?

Public financial management (PFM) refers to the “set of laws, rules, systems and processes used by sovereign nations (and sub-national governments), to mobilise revenue, allocate public funds, undertake public spending, account for funds and audit results” (Lawson 2015: 1).

PFM is regarded as a central element of a functioning administration, underlying all government activities (Morgner and Chêne 2014: 2). As such, a sound PFM system is of great importance to the provision of public services as well as to the creation and maintenance of fair and sustainable economic and social conditions in a country.

As the PEFA Secretariat (2016) puts it, a robust PFM system is “the linchpin that ties together available resources, delivery of services, and achievement of government policy objectives. If it is done well, PFM ensures that revenue is collected efficiently and used appropriately and sustainably” (see also Kristensen et al. 2019: 2-4).

Improvement on the effectiveness of a PFM system is perceived to provide widespread and enduring benefits, and to assist in reinforcing “wider societal shifts towards inclusive institutions, and thus towards stronger states, reduced poverty, greater gender equality and balanced growth” (Lawson 2015: 2).

Conversely, weaknesses in PFM systems can result in a lack of fiscal discipline and macroeconomic instability, diminished alignment between the allocation of public resources and national policy priorities, and more opportunities for corruption and greater waste in the delivery of public services (Fritz et al. 2017: 1).

Over the past two decades, donors looking to promote state-led development through country PFM systems have faced challenges related to extremely weak PFM systems in recipient countries (Kristensen et al. 2019: 3). Such weak PFM systems expose donor funds to fiduciary risk or the more general risk of reduced impact. As a result, donors began providing more technical support targeted at improving the quality of PFM systems in partner countries through specific interventions and reforms (Kristensen et al. 2019: 3).

Initially, each donor organisation used its own diagnostic tool to assess partner countries’ PFM systems. However, the Paris Declaration on Aid Effectiveness of 2005 committed donors to develop and implement harmonised diagnostic reviews and performance assessment frameworks in the field of PFM (Kristensen et al. 2019: 3). This led to the emergence of the public expenditure and financial accountability (PEFA) framework as the instrument to harmonise these various diagnostic tools.

Public expenditure and financial accountability (PEFA)

PEFA is a PFM assessment tool initiated and managed by nine international development partners. These are the European Commission, International Monetary Fund, World Bank and the governments of France, Norway, Switzerland, the United Kingdom, Slovak Republic and Luxembourg. It is the most widely used PFM assessment tool in low- and middle-income countries (Kristensen et al. 2019: 4).

The PEFA framework was established with three goals in mind (Kristensen et al. 2019: 4):

- to strengthen the ability of governments to assess systems of public expenditure, procurement and fiduciary management, and contribute to a government-led reform agenda

- to support the development and monitoring of reform and capacity development programmes and facilitate a coordinated programme of support

- to contribute to the pool of information on PFM

The PEFA framework identifies seven pillars that define the key elements of a PFM cycle. These are budget reliability, the transparency of public finances, the management of assets and liabilities, policy based strategy and budgeting, predictability and control in budget execution, accounting and reporting, and external scrutiny and audit. Within the seven pillars, PEFA identifies 31 specific indicators disaggregated into 94 characteristics (dimensions) that focus on key measurable aspects of the PFM cycle (PEFA 2016a).

It is important to note that the PEFA framework was revised in 2016. The 2011 version had 28 indicators and three donor practices, whereas the 2016 version had 31 indicators with no donor practices. These three donor practices excluded in the 2016 PEFA framework are: the predictability of direct budget support; financial information provided by donors for budgeting and reporting on project and programme; and the proportion of aid managed through national procedures (PEFA 2011: 9). There were also six pillars in the 2011 PEFA framework, whereas there are seven pillars in the 2016 edition. The seventh pillar added in the 2016 edition is the management of assets and liabilities. The new pillar came with four PEFA indicators (PI): assessment of fiscal risk reporting (PI-10); public investment management (PI-11); public asset management (PI-12); and debt management (PI-13).

Other significant changes include the modification of baseline standards for good performance in many areas; a stronger focus on transparency and internal financial control; expansion of the scope for more coverage of central government performance, and greater attention to non-cash features of public finances. The latest framework also has a clearer and more harmonious structure for reporting PEFA findings as well as improved terminology and measurement. Finally, the current iteration has enhanced coverage of revenue administration to encompass both tax and non-tax revenues, and it has eliminated specific indicators of donor practices (Kristensen et al. 2019: 16-17).

Each PEFA indicator measures PFM performance against a four-point ordinal scale from D to A, with D as the lowest score and A as the highest. The outcome of the performance assessment, known as the PEFA report, is generally used as the basis for discussions on PFM reform strategies and priorities by development practitioners and partner governments (PEFA 2016a: v). The methodology can be repeated in successive assessments, providing a summary of changes over time and as a source of information that advances research and analysis of PFM more broadly.

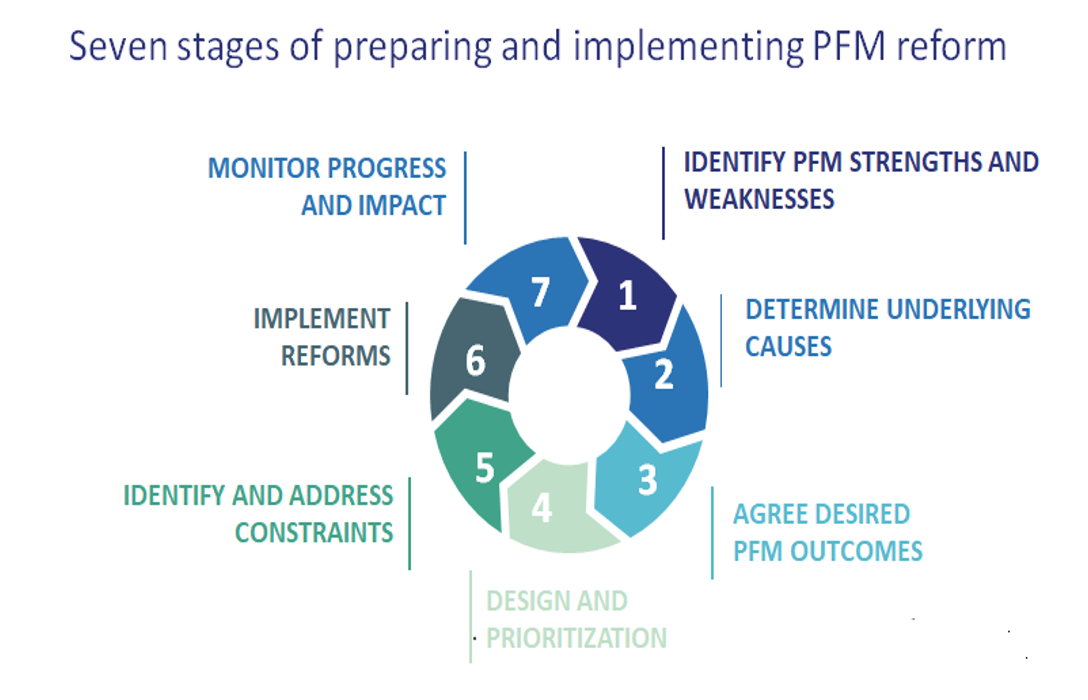

The PEFA Handbook: Using PEFA to support PFM Improvements outlines a seven-stage approach to developing and implementing PFM reforms. This includes the initial identification of PFM strengths and weaknesses, designing, sequencing and implementing the reforms, and monitoring progress achieved and impact.

Seven stages of preparing and implementing PFM reform

Source: Dhimitri, J. and Bowen, M. 2020. How PEFA Can Help Countries Develop their PFM Reform Strategy. PEFA.

Source: Dhimitri, J. and Bowen, M. 2020. How PEFA Can Help Countries Develop their PFM Reform Strategy. PEFA.

PEFA has received attention from anti-corruption practitioners in recent years. For instance, at the London Anti-Corruption Summit in 2016, leaders from 40 countries committed to use PEFA to improve fiscal transparency (PEFA 2016b).

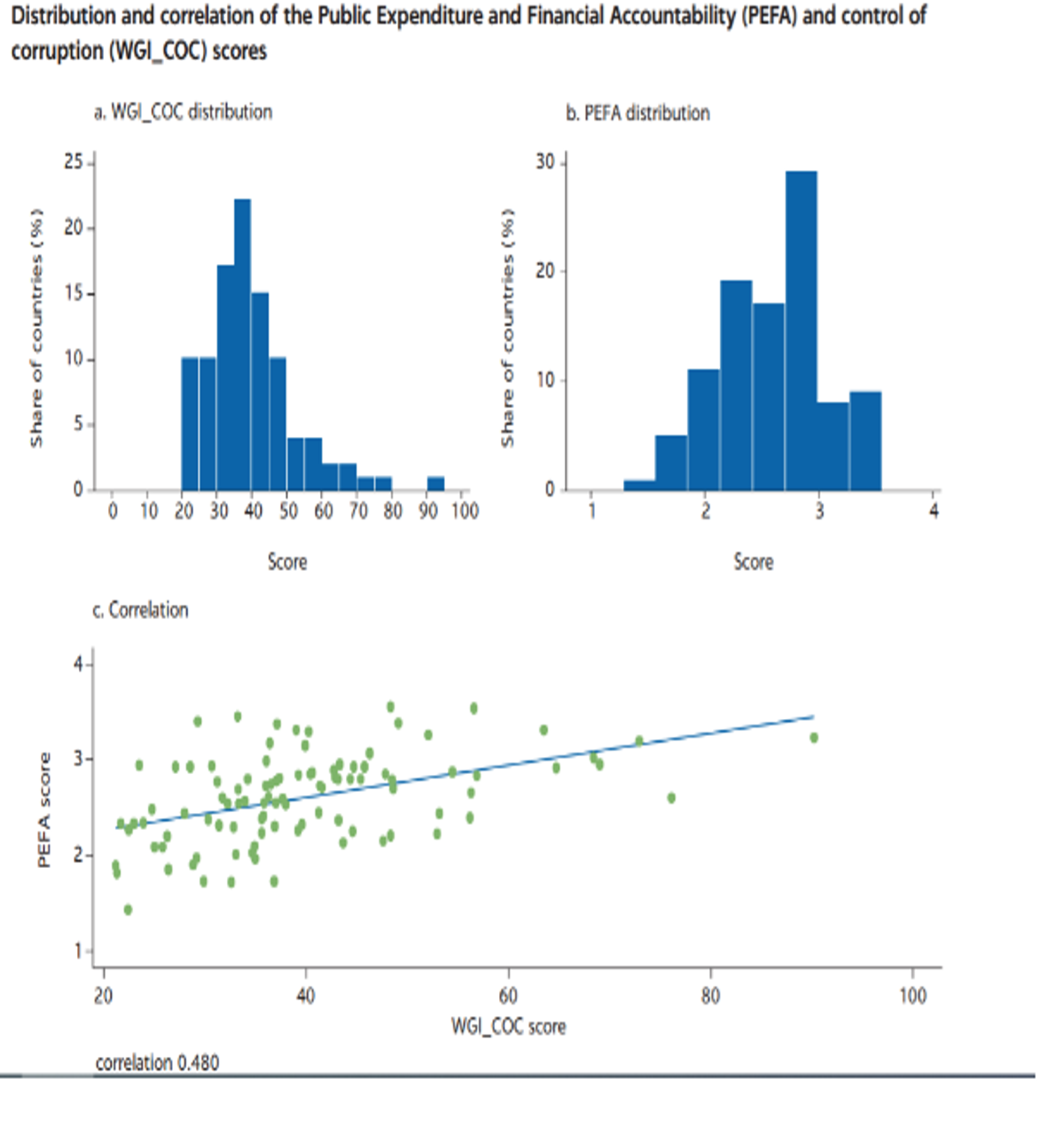

In 2019, the World Bank released a report exploring the relationship between overall PEFA scores and the World Bank’s Worldwide Governance Indicators for control of corruption (WGI-COC) in 99 countries (Long 2019: 99). The WGI scores are based on a scale from −2.5 to +2.5, with higher scores indicating better control of corruption, and negative scores representing worse control of corruption. However, for comparison with other indexes and easier interpretation, these were rescheduled to an index from 0% (representing a -2.5 score) to 100 (representing a 2.5 score). PEFA scores are usually from A (best score) to D (worst score). These PEFA scores were also converted to numeric values, ranging from 1 (representing PEFA score D) to 4 (representing PEFA score A).

The diagrams below show the results (Long 2019: 99):

Most countries had a WGI-COC score between 20% and 60%, which may be expected considering that most of these were low- and middle-income countries. The highest score recorded in the sample was 90.2% for Norway in 2008, whereas the lowest was 21.2% for Myanmar in 2012. Compared to distribution of the WGI-COC scores, the overall PEFA scores were skewed towards higher PEFA scores, with 75% of countries scoring 2 or higher, despite the lower-income bias in the sample.

The results (diagram c above) showed a notable relationship between the overall PEFA score and perceptions of control of corruption. The observed correlation coefficient is close to 0.5. However, the third diagram also shows quite a number of outliers. For instance, some countries perform negatively on the WGI-COC score (less than 50%) but at the same time perform quite well on the PEFA score (above 3 out of 4). Interestingly, the best performing country on the WGI-COC score (90.2%), which is Norway, has an overall PEFA score lower than some countries than some countries with WGI-COC scores below 50%. Nonetheless, the study demonstrated the correlation between better overall PEFA scores and lower perceptions of corruption.

Impact of PFM interventions on corruption

PFM reforms can be considered a type of indirect anti-corruption intervention, in the sense that their main purposes is not to address corruption per se, but they are still relevant to efforts to tackle the deleterious impact of corruption (Jenkins et al. 2020: 16). In contrast, direct anti-corruption reforms include the establishment of anti-corruption agencies and the development of national anti-corruption strategies specifically aimed at addressing corruption (Jenkins et al. 2020: 16).

According to Long (2019: 95), PFM reforms can reduce corruption in two broad ways. It can directly introduce controls that reduce opportunities for corruption, mainly though minimising the discretion of politicians and bureaucrats. It can also indirectly increase the probability of detection and punishment, mainly by increasing transparency.

Despite the fact that lower levels of corruption are typically a desirable by-product of PFM reforms rather than their chief purpose, the literature suggests that such measures can have a significant impact on addressing corruption. In fact, a recent literature review found that, in fragile settings, there is some evidence that PFM reforms are more effective at curbing corruption than direct anti-corruption interventions (Jenkins et al. 2020: 17). For instance, a study by the World Bank (2012: 55) in eight fragile countries showed that PFM reforms had led to better control of corruption and improved government effectiveness.

An important point to note is that though technical reforms to the PFM system are important, their successful implementation is often dependent on political commitments and interests. The frequent and implicit “functional” assumption that PFM reforms are in the public interest and therefore should also be of interest to political decision makers can easily overlook the fact that leaders tasked with authorising and implementing PFM reforms may well have divergent interests (Fritz et al. 2017: 5).

In some instances, political leaders’ interests have created pockets of effectiveness (PoEs) to achieve particular political or personal interests in PFM reforms. PoEs are “public organisations that function effectively in providing public goods and services, despite operating in an environment where effective public service delivery is not the norm” (Hickey 2019: 1). For example, after the 1994 genocide in Rwanda, the Ministry of Finance and Economic Planning received political backing to embark on PFM reforms, and became the linchpin of the country’s ambitious developmental project and a reference point for donors (Chemouni 2019).

However, pockets of effectiveness also depend on political commitment since a change in leadership may affect their efficacy. For instance, the Ministry of Finance in Zambia was a PoE between 2003 and 2008 due to political backing. However, since 2008, it has experienced declining PFM performance amid shifting political situations (Hinfelaar and Sichone 2019). Similarly, the Kenyan National Treasury was regarded as a PoE between 2003 and 2007, but was later undermined by changing political situations in the country (Tyce 2020).

Hence, Lawson (2015: 3) argues that a combination of political and technical commitment is one of three critical ingredients required for successful PFM reform. The other two are policy space for developing appropriate reforms, and “adaptive, iterative and inclusive processes – where monitoring, learning and adaptation are key”.

The available literature also emphasises that ultimately, political support is a necessary condition for PFM reform to have a significant impact, particularly when it comes to addressing corruption (World Bank 2012: 5,6, 18; French 2013: 1; Fritz et al. 2017). Without high-level political support, PFM reforms are likely to have a larger influence on curbing petty corruption than grand corruption, which French (2013: 22) argues is “influenced more by sanctions against corrupt behaviour than changes to the opportunities and incentives for corruption”.

As such, a key issue is whether such government commitment to PFM reforms can be measured. According to Fritz et al. (2017: 22), one way to capture political commitment is through indications related to reforms in electoral campaigns, the nature and strength of a government’s mandate, and preparedness of political leaders to support PFM reforms through, for instance, their previous experience in government or any existing reform plans. The World Bank study used these indicators to evaluate political commitment to PFM reforms in Georgia, Nepal, Nigeria, the Philippines and Tanzania (see Fritz et al. 2017: 22-35). Overall, the message that emerges from the literature is the need to keep in mind that even supposedly technocratic PFM reforms require political backing to have a significant impact.

The following section examines the impact of reforms at each stage of the PFM cycle on corruption. For each phase of the PFM cycle, the paper outlines the relevant PEFA indicators and provides a synthesis of the relevant literature.

Revenue mobilisation

The PEFA indicators (PI) used to assess revenue mobilisation include:

- PI-6: the extent to which government revenue and expenditure are reported outside central government financial reports.

- PI-19: the procedures used to collect and monitor central government revenues. It relates to the entities that administer central government revenues and agencies that administer revenues from other significant sources, such as natural resources extraction.

- PI-20: the procedures for recording and reporting revenue collection, consolidating revenues collected and reconciling tax revenue accounts. It covers both tax and non-tax revenues collected by the central government.

Literature review

Revenue mobilisation is critical to fund government activities and to support development. However, it is vulnerable to corruption, ranging from bribery and extortion to embezzlement and misappropriation (French 2013: 6; Martini 2014: 3-4). Such corruption lowers the tax-to-GDP ratio and causes long-term damage to the economy by diminishing fiscal space and investments, distorting tax structures and corroding public trust in the government (Nawaz 2010: 1; Yohou 2020: 7). It also raises “black money”, which is hidden income used for furthering illicit activities to, for example, pay bribes related to other government regulations, procurement and informal economic activities (Rahman 2009: 1).

Evidence indicates that improvements in tax and revenue collection systems and processes can have an impact on corruption. According to Rahman (2009: 2), interventions intended to simplify, standardise and harmonise tax procedures can minimise tax officials’ discretionary powers and abuse of tax laws as well as lessen the burden for firms to comply with cumbersome procedures.

Burdensome tax regulations can be a determinant of corruption as taxpayers’ behaviour tends to be influenced by the perceived fairness of the tax system. A fair and simple tax system can reduce incentives for taxpayers to engage in corruption, whereas a cumbersome tax system can incentivise taxpayers to engage in corruption to bypass bureaucratic hurdles (Child 2008: 2; Fanea-Ivanovici et al. 2019).

In addition, establishing a transparent and simplified revenue collection system means that the public becomes increasingly aware of their obligations, thereby reducing opportunities for exploitation and corruption by tax officials (French 2013: 7; Zuleta 2007).

Empirical findings support the relationship between tax simplification and corruption, with less complex tax systems associated with lower corruption in tax administration. For instance, a study by the World Bank between 2002 and 2012 examined 104 countries from different income groups and regions. It predicted that the combined effect of a 10% reduction in the number of payments and the time needed to comply with tax requirements contributed to lower levels of tax corruption by 9.64% (Awasthi and Bayraktar 2014: 4).

The introduction of electronic tax systems is also associated with lower levels of corruption due to the reduced frequency of in-person interactions that can engender collusion and other corrupt practices, as well as allowing for better monitoring and data analysis. Bribe coercion is more difficult in systems that utilise e-filing as it becomes more difficult for officials to impose arbitrary delays on taxpayers, which can cause them to submit their declarations late and incur fines (Okunogbe and Pouliquen 2018: 14; Araki 2018).

Another World Bank study used cross-country data on e-government systems to analyse whether e-filing of taxes improves the capacity of governments to raise and spend resources through the lowering of tax compliance costs and reduction of corruption. It found that the adoption of transactional e-filing reduces the probability of paying bribes to tax officials by 5% (Kochanova et al. 2016:10).

Another World Bank study used experimental variation and data from Tajikistan firms to determine the impact of e-filing on firms. It concluded that firms with a lower risk of tax evasion appreciate e-filing as it reduces tax payments and also lowers bribe rates due to the reduced opportunity for extortion by tax officials. Conversely, e-filing is likely to double the tax take from high-risk firms, likely by disrupting collusion with officials (Okunogbe and Pouliquen 2018: 5, 8, 14).

Another reform measure is the establishment of semi-autonomous revenue authorities (SARAs) that enjoy greater independence from governments and politicians. In general, there is an expectation that the fact that SARAs offer better pay and management and are isolated from the rest of the civil service will result in improvement in revenue collection processes, reduction of political interference in revenue collection and limited opportunities for corruption (French 2013: 8).

SARAs have been regarded by some observers as relatively successful in reducing incidents of corruption in tax administration in a number of developing countries (Martini 2014: 5-6). Prior to the SARAs, revenue authority in Africa was dispersed among a number of uncoordinated departments, which offered ample opportunities for rent-seeking, and the introduction of SARAs had a positive impact on reducing corruption (ATAF 2012; Martini 2014: 6). Results from a survey conducted in 1998-1999 in four countries in Latin America also showed that more than half of the respondents in three countries believed that SARA reforms had a positive impact on countering corruption (Manasan 2003: 6).

However, the impact of SARA reforms on corruption remains ambiguous. For instance, studies have shown that, in African countries such as Uganda, new SARAs were successful in improving revenue collection and even in reducing corruption for some time, until politicians and tax officials became familiar with the new system, at which point reports of political interference, bribery and extortion re-emerged (Fjeldstad 2005; Junquera-Varela et al. 2019: 15). This also points to the importance of political will in PFM reforms. For instance, in Uganda, the initial success of the SARA was associated with political support from the executive, and the subsequent drop in support and increased interference from the executive resulted once more in increased corruption (Junquera-Varela et al. 2019: 15).

A good case study is Georgia, which prior to 2003 faced challenges such as rampant corruption, tax evasion, illegal tax credits and embezzlement of tax revenue, practices which had left public finances in a shambolic state (Akitoby 2018: 19). A number of tax reforms were established after the 2003 Rose Revolution, including a revised tax code which simplified the tax system, reduced rates and removed a series of minor local taxes that had been generating little revenue (Akitoby 2018: 19).

The government also introduced efficient tax payment measures, such as an electronic tax filing system. The introduction of technology in tax collection “both improved efficiency and reduced opportunities for corruption” (Akitoby 2018: 19). In addition, the government created the State Revenue Service which brought customs and tax administration into a single organisation. Any corrupt practice was no longer tolerated and a number of tax officers were prosecuted and jailed for corrupt behaviour (ITC and OECD 2015: 18). The tax administration reforms and anti-corruption measures led to a significant and sustained decline in the number of bribery cases involving tax officials (ITC and OECD 2015: 19).

Budget formulation

The PEFA indicators (PI) relevant to the PFM stage of budgeting include:

- PI-4: the extent to which the government budget and accounts classification is consistent with international standards.

- PI-5: the comprehensiveness of information provided in the annual budget documentation, as measured against a specified list of basic and additional elements.

- PI-9: the comprehensiveness of fiscal information available to the public based on specified elements of information to which public access is considered critical.

- PI-17: the effectiveness of participation by relevant stakeholders in the budget preparation process, including political leadership, and whether that participation is orderly and timely.

- PI-18: the nature and scope of legislative scrutiny of the annual budget. It considers the extent to which the legislature scrutinises, debates, and approves the annual budget, including the extent to which the legislature’s procedures for scrutiny are well established and adhered to.

- PI-21: the extent to which the central ministry of finance is able to forecast cash commitments and requirements and to provide reliable information on the availability of funds to budgetary units for service delivery.

Literature review

Risks of corruption in budgeting increase where individuals enjoy high discretion to allocate funds, which can be set aside for later misappropriation (Morgner and Chêne 2014: 13). In addition, opaque budgeting without public input and oversight from responsible institutions exacerbates opportunities for corruption.

An important PFM intervention is improving fiscal transparency. Fiscal transparency is defined as “openness toward the public at large about government structure and functions, fiscal policy intentions, public sector accounts, and projections” (Kopits and Craig 1998: 1).

Considering the central role played by budgeting in government operations, disseminating information to the public on how government revenues are being planned to be spent discourages unethical behaviour and contributes to a culture of openness and intolerance for corruption. Enhanced fiscal transparency limits opportunities for dishonest officials to use their position for private gain and increases the risk of corrupt acts being detected (Chen and Neshkova 2019: 16; Akitoby et al. 2020: 1-2). It also limits the use of political power to allocate resources to pet projects as a form of political patronage, or to allocate resources to contracts that have a high potential for illicit personal gain (Morgner 2013; Dorotinsky and Pradhan 2007).

Two key components of improved fiscal transparency are clear budget classification and complete reflection of all expenditures in the budget (French 2013: 9). It is also generally acknowledged that a “robust budget classification enables more transparent information on government activities for reporting, control, audit, and ex-post accountability for revenue collection and public spending” and is an important aspect in improving the transparency of public finances (Dorotinsky and Pradhan 2007).

French (2013: 10) pointed to the limited amount of empirical evidence that demonstrated clear links between improved transparency in public finances and a reduction in corruption. Nonetheless, a number of studies have since been published that provide some empirical analysis on budget transparency and perceptions of corruption. For instance, a study on 95 countries using data from the Open Budget Index and corruption indicators such as the Bayesian Corruption Index and Control of Corruption Index from the Worldwide Governance Indicators collected between 2006 and 2014 strongly demonstrated that more fiscally transparent countries are perceived as less corrupt (Chen and Neshkova 2019: 15).

Cimpoeru and Cimpoeru developed a multiple regression model to examine the relationship between budgetary transparency for the years 2006-2012 using the Open Budget Index, GDP per capita and control of corruption. The authors concluded that budget transparency and GDP per capita have a positive and significant effect on the level of corruption control in a country, adding weight to the hypothesis that high budget transparency results in a reduction of corruption and improved government policies (Cimpoeru and Cimpoeru 2015).

Long (2019) tested the hypothesis that countries with a more transparent and orderly budget process will have lower levels of corruption by analysing PEFA scores related to budget transparency and WGI-COC ratings in 99 countries. The results showed a positive correlation (0.285) between more transparency in budget preparation and lower perceived levels of control (Long 2019: 101-102).

Participatory budgeting is another essential intervention aimed at strengthening the voice of the citizens in the budget process. Though primarily targeted at citizen engagement, budgetary participatory reforms may reduce opportunities for corruption through enhanced transparency (OECD 2017: 83). As participatory budgeting reforms increase the number of citizens monitoring public resources and their distribution, this may also help deter and detect corruption (Wampler 2000: 18).

A good case study on PFM reforms related to budgetary participation is Kenya. After the 2010 constitution and the devolution of government to 46 counties, programmes aimed at increased public participation in county budgets were initiated. A World Bank report found that the introduction of participatory budgeting likely reduced or hindered corruption due to enhanced citizen engagement and the availability of public information to hold public officials accountable. For instance, citizens were seen to demand explanations from the relevant officials for incomplete projects (Cameron 2019: 191).

According to Johnsøn et al (2012), cross-country studies have demonstrated that countries with strong budget management and with greater participation of external stakeholders through participatory budgeting have lower scores on the Corruption Perceptions Index (Johnsøn et al. 2012 2012), demonstrating a correlation between PFM interventions and corruption (French 2013: 9). In addition, parliamentary oversight ensures that the preparation and allocation of the national budget is transparent and provides safeguards against the misuse of public funds and resources (Mason 2021: 10).

French (2013: 11) concludes that reforms in budget preparation and planning are mostly likely to reduce grand corruption. This is based on the assumption that improvement in information management and budget preparation can reduce ineffective spending and possibly opportunities for corruption “by eliminating spending pressures at the end of the fiscal year and creating more predictability” (Morgner 2013). However, he points out that technical reforms are not enough, and there is a need for political will for significant influence (French 2013: 11).

Budget execution

The relevant PEFA indicators (PI) for budget execution include the following:

- PI-11: the extent to which the government conducts economic appraisals, selects, projects the costs and monitors the implementation of public investment projects, with emphasis on the largest and most significant projects.

- PI-7: the transparency and timeliness of transfers from central government to subnational governments with direct financial relationships to it.

- PI-23: how the payroll for public servants is managed, how changes are handled and how consistency with personnel records management is achieved.

- PI-24: key aspects of procurement management, including transparency of arrangements, use of open and competitive procedures, monitoring of procurement results, and access to appeal and redress arrangements.

- PI-25: the effectiveness of general internal controls for non-salary expenditures.

Literature review

This stage of the PFM cycle is considered the most vulnerable to corruption due to the vast influx of transactions involving a large number of individuals in various ministries, public institutions and at various levels of the administration (Morgner and Chêne 2015). Resources approved at the budgeting stage are disbursed to cover salaries, running costs of the administration, public procurement for goods and services, infrastructure development and debt management, among others.

Evidence shows that the absence of control over expenditures, public procurement, the storage of equipment and a lack of segregation of duties in expenditure may significantly increase opportunities of corruption as well as limit the ability to detect corrupt practices (Dorotinsky and Pradhan 2007; Chêne 2009). The absence or suspension of such controls during times of crisis, such as the ongoing COVID pandemic, has also been identified as a critical area that exacerbates corruption (Khasiani 2020).

Two of the most vulnerable areas to corruption are payroll and public procurement, and PFM reforms in these areas are believed to help address corruption (French 2013: 13).

Payroll systems are essential to provide salaries to officials. However, human resource systems in low- and middle-income countries face corruption challenges in payroll management such as payment to ghost workers and falsification of timesheets (Chêne 2015; Water Integrity Network 2019). PFM reforms in this area are usually related to establishing better links between personnel systems, social welfare systems and payment systems, which often includes enforcement of data sharing across government entities (Long 2019: 98).

Transparency in payroll systems can be increased through the use of electronic payment methods. An automated payroll system will directly deposit money into individual bank accounts and thereby reduce the risk of ghost workers (World Bank & USAID 2017; French 2013: 13). Examples include the Dominican Republic, where the government saved US$6.2 million from identifying ghost workers. In the Democratic Republic of Congo, the integrated human resources information system (iHRIS) led to the identification of a significant number of ghost workers on the government payroll (27%), and an even larger number (42%) receiving a risk allowance (WHO 2020). The adoption of such computerised and no-cash-in-hand policies can reduce fraud, misuse or misappropriation of public funds through salary payments.

An automated payment system also increases opportunities for detection due to controls and digital traceability, thereby deterring individuals from engaging in corruption (French 2013: 13). A staff survey on the perception of public officials in the Rivers State of Nigeria showed that the Integrated Payroll and Personnel Information System (IPPIS), which is a computerised payroll system, was believed to reduce the incidences of corruption in government ministries and state-owned enterprise in the state (Chukwuma et al. 2017: 17).

Public procurement is regarded as one area most vulnerable to corruption (OECD 2016: 6). At every stage of the procurement process, ranging from pre-tendering to order and payment, there are corruption risks. Reforms to the procurement process are aimed at fostering integrity, transparency, stakeholder participation, accessibility, e-procurement as well as oversight and control are thought to directly or indirectly reduce corruption (OECD 2016: 10).

According to French (2013: 4), procurement process reforms can reduce petty corruption in procurement and mitigate corruption issues such as kick-backs and bid rigging. This is because public procurement tends to involve a limited number of politically important and high-value contracts that require the discretion of high-level individuals. However, grand corruption and widespread petty corruption can only be significantly addressed with political will, and the strengthening of sanctions (French 2013: 15).

Regulatory controls on public procurement are regarded as limiting discretion over the award and management of the related contract and reducing opportunities for corruption, for instance, where bribes are extracted as a percentage of the contract (Long 2019: 98). Using PEFA indicators and firm-level survey responses, Knack et al. (2017) found that firms usually pay less in kick-backs in jurisdictions with better procurement systems.

Long (2019) tested the hypothesis that countries with more transparent budget execution reporting will have lower levels of corruption, using overall PEFA scores for related indicators and WGC-COC scores in 99 countries. The results confirmed the hypothesis by showing a positive correlation (0.400) between better PEFA scores on budget execution transparency and lower perceptions of corruption (Long 2019: 102-103).

E-procurement reforms have become increasingly visible in recent years. E-procurement eliminates direct and physical interaction between bidders and responsible public officials, thereby limiting opportunities for collusion and corruption (Pictet and Bollinger 2008).

E-procurement can also lead to standardisation and consistency of rules and procedures thereby increasing predictability and easy access to bidding documents and information about the process (Luijken and Martini 2014:3). In addition, it increases internal efficiency in government departments, and reduces levels of bureaucracy, time and costs that could otherwise incentivise bidders to resort to corruption to speed up and work around bureaucratic bottlenecks (Martini 2012).

One of the main benefits of e-procurement systems highlighted in the literature is the improved accessibility to key documents and information. More transparency and access to information help to improve fairness, efficiency and competition as well as reducing the opportunities for corruption (Transparency International 2014). Better record keeping can be useful in cases where bidders that lose out challenge the outcome.

In addition, e-procurement can centralise data to improve audit and analysis. Electronic systems may allow the detection and prevention of corruption in public procurement if data on tenders, bidders and contractors are collected and stored in a structured way and is accessible for investigation and analysis. For instance, this data could allow ex-ante monitoring and ex-post analysis of indicators of corruption, and data mining techniques could be used to detect anomalies in the data, revealing potential cases of fraud or corruption (PricewaterhouseCoopers 2013).

A case in point on procurement reforms and its impact on corruption is from Bangladesh. In 2011, the government established a comprehensive e-procurement system that brought every step of the procurement cycle online, including registration, procurement planning, tendering evaluations, award, contracting and payments. It also added features to further increase transparency, such as the creation of a citizen portal to disclose procurement and contract management data using the Open Contracting Data Standard and procurement performance information (World Bank 2020: 35). Efforts were also made to increase public monitoring through campaigns, education programmes and engagement with different stakeholders on public procurement (World Bank 2020: 36).

The impact of e-procurement in Bangladesh has been fairly positive. For instance, the average duration from tender invitation to contract signing was decreased from 95 days in 2011 to 59 days in 2019, thereby limiting opportunities for unscrupulous individuals to try to illicitly expedite the process. An online survey based evaluation of officials, private sector firms, civil society members, media and financial institutions also showed that the majority of respondents mentioned an increase in transparency (World Bank 2020: 37).

Three corruption risk indicators were evaluated: single bidding, non-local suppliers and winning rebates. All of these indicators showed significant improvements as a result of the switch from manual to e-procurement. For instance, the rate of contracts being awarded in a tender process with only one bidder was almost halved from 33% in 2011 to 17%. Similarly, the rate of suppliers from outside the district of the buyer increased from 13% to 21%. In addition, the average winning rebate greatly increased from 0.5% to 7% (World Bank 2020: 38, 39), which means procurement costs were lowered.

Accounting and reporting

The applicable PEFA indicators include the following:

- PI-1: the extent to which aggregate budget expenditure out-turn reflects the amount originally approved, as defined in government budget documentation and fiscal reports.

- PI-27: the extent to which treasury bank accounts, suspense accounts and advance accounts are regularly reconciled and how the processes support the integrity of financial data.

- PI-28: the comprehensiveness, accuracy and timeliness of information on budget execution. Consistency of in-year budget reports with budget coverage and classifications, which allows monitoring of budget performance and, if necessary, timely use of corrective measures.

- PI-29: the extent to which annual financial statements are complete, timely and consistent with generally accepted accounting principles and standards.

Literature review

Public accounting is considered to play a vital role in the monitoring and control of public resources. While disbursing or collecting public resources, agencies are required to record and account for all of their financial activities. Any weak, flawed or opaque reporting and accounting practices are likely to decrease chances of corruption being adequately prevented and detected (Morgner and Chêne 2014: 3).

Strong accounting and reporting systems are vital instruments to detect corruption, especially in terms of enabling oversight institutions and the public to hold the government to account (French 2013: 17). Malagueño et al. (2010) conducted a cross-country analysis using data from 57 countries to assess the relationship between accounting and perceived corruption. The results showed that there is a negative relationship between the perceived quality of accounting in a country and perceived level of corruption in countries. The findings strongly supported the hypothesis that better accounting is related to reduced levels of corruption (Malagueño et al. 2010: 385-387).

Accounting is an information system, and ensuring accurate, timely and transparent records of the government’s financial activities is important in reducing corruption (U4 Anti-Corruption Resource Centre, no date). Where government information is available and clear, this makes it easier for the public and responsible authorities to monitor government decisions, and ensure early detection of irregularities that may indicate corruption.

An important intervention is the adoption of international standards on accounting as well as the implementation of robust accounting information systems (French 2013: 17). For instance, the integrated financial management information systems (IFMIS) establishes four basic quality criteria in public accounting, which are (U4 Anti-Corruption Resource Centre, no date):

- timeliness and regularity of accounts, reconciliation and reporting

- availability of information on resources received by service delivery units

- quality of in-year budget reports

- quality and timeliness of annual financial statements

While French (2013: 18) pointed to limited evidence base on the impact of accounting reforms on corruption, recent work has begun to address this gap. Cuadrado-Ballesteros et al. (2020) analysed the impact of accounting reforms (the adoption of International Public Sector Accounting Standards, or implementation of accrual-basis systems) on corruption in 33 Organisation for Economic Co-operation and Development (OECD) countries for the period 2010 to 2014. The results showed that, where governments improve public sector accounting, corruption is reduced (Cuadrado-Ballesteros et al. 2020: 738-743).

Ultimately, it appears that improvements in accounting and reporting systems – particularly with a focus on ensuring timely availability of reports to oversight institutions – is essential to both the smooth functioning of the PFM system as well as to anti-corruption efforts.

Auditing and oversight

The relevant PEFA indictors include the following:

- PI-30: the characteristics of external audit, including the audit of the government’s annual financial reports and the independence of the external audit function.

- PI-31: the extent to which legislative scrutiny of the audited financial reports of central government is timely, significant and transparent. It also assesses whether the legislature issues recommendations and follows up on their implementation

Literature review

While the mandate of supreme audit institutions (SAIs) is not tackling corruption per se, their ambit to oversee government revenue and expenditure bestows on them a vital role in deterring and detecting corruption within the PFM system (Chêne 2018). They act as watchdogs over the country’s financial integrity and assess whether public funds have been managed in an effective and efficient manner in compliance with existing laws (McDevitt 2020: 3).

Auditing and oversight increase the probability of detection and hence may disincentivise people from engaging in corruption in the first instance (see Johnsøn et al 2012; Menocal and Taxell 2015). For instance, Olken (2007) found that increasing the external audit rate from 4% to 100% in 600 Indonesian village road projects reduced missing expenditures from 27.7% to 19.2%, and pointed out that audits might have had an impact.

A study that analysed Chinese provincial panel data from 1999 to 2008 found that audit institutions were able to detect corruption and take corrective action (Liu and Lin 2012). It found a positive correlation between the number of irregularities detected in the provincial reports and the level of corruption. Furthermore, in provinces where greater corrective action was conducted, auditing became more effective and the level of corruption was reduced (Liu and Lin 2012).

PFM reforms aimed at developing or strengthening independent oversight institutions play a role in reducing corruption. A study by Ramirez and Perez (2016), using a sample of 78 countries, indicated that strong SAIs have a notable impact on reducing corruption, particularly where the SAI has greater powers to impose sanctions for non-compliance. Another study based on survey data from over 100 countries also found that independent and professional audit institutions have a significant impact on reducing public sector corruption (Gustavson and Sunstrom 2016).

Another important intervention relates to the dissemination of information by oversight institutions. Where wrongdoings are disclosed in published audit reports, this can have a deterrent effect and discourage public officials from engaging in fraudulent or corrupt behaviour (Gherai, Tara & Matica 2016).

A study by Ferraz and Finan (2008) found that the dissemination of audit reports in Brazil revealing corrupt practices to the general media reduced the possibility of the incumbent mayors for getting re-elected. Where two and three violations related to corruption were detected and reported, this reduced the possibility of the responsible mayor’s re-election by 7% and 14% respectively. In addition, they found that where there was a local radio station, the incumbents’ likelihood of re-election was further reduced where corruption was detected by audit bodies and reported widely.

A more recent report on auditing at the local level in Brazil also showed that audits can be an effective tool to reduce corruption since elected public officials may refrain from corruption due to a concern that published audit reports would expose their corrupt behaviour to voters and compromise their re-election (Avis, Ferraz and Finan 2018).

Long (2019) tested the hypothesis that countries with more transparent audit institutions will have lower levels of corruption, using relevant PEFA scores and WGI-COC data for 99 countries. The results confirmed the hypothesis, showing a positive correlation (0.225) between better PEFA scores on transparency in auditing and lower perceived levels of corruption (Long 2019: 102-103).

However, the effectiveness of an SAI also depends on the extent to which its recommendations are acted upon by the relevant actors, whether they are public accounts committees, courts or law enforcement agencies (Chêne 2018: 9).

PFM reforms that ensure that audit reports are submitted in a timely manner to, and arereviewed by, parliament as an oversight institution can be instrumental in curbing corruption (Morgner 2013). However, as pointed out by French (2013: 19), there are challenges such as non-compliance or inaction in response to the findings of reports by audit bodies. Again, it is clear that political backing is crucial to ensure that audit findings and recommendations are followed-up on effectively.

Conclusion

PFM is regarded as a central element of a functioning administration and underpins all government activities. Hence, improving the efficacy of PFM systems providee widespread and enduring benefits for a country, including transformation towards better governance, reduced poverty, improved gender equality and balanced growth.

This paper has shown that interventions at every stage of the PFM cycle have a high potential to reduce corruption. It is nonetheless important to bear in mind that the literature notes that, ultimately, political support is a necessary condition for PFM reform to have a significant impact on curbing corruption.