Query

Please provide an overview of corruption and anti-corruption efforts in Nigeria’s electricity sector.

Introduction

With a population of 211 million, Nigeria is the most populous country in Africa (Heritage Foundation 2023). Its economy is projected to grow by 2.9% on average between 2023 and 2025, while the estimated population growth rate is 2.4%. (World Bank 2023). The country is faced with serious development challenges, such as the need to reduce dependence on oil for both exports and revenues (World Bank 2023).

Nigeria was ranked 150 out of 180 countries in the 2022 Transparency International's Corruption Perception Index (2023), marking one of the highest perceived levels of public sector corruption in the world. State capturea47c5fd679c0 is deeply embedded in the country’s politics and facilitated by the strong influence of informal networks on decision-making processes (Akinduro and Masterson 2018).

The capture and misallocation of public resources, whether through wasteful spending or outright theft, are widespread (Prusa 2021), including within the electricity sector. Moreover, corruption has been recognised as one of the primary factors hindering Nigeria’s ambition to achieve the 2030 Agenda for Sustainable Development (UNODC 2019).

A growing body of literature has documented evidence of corruption negatively affecting economic development through inhibiting the effectiveness and performance of the electricity sector (Wren-Lewis 2015; Imam et al. 2019). For example, by increasing transmission and distribution losses (Estache et al. 2009). The impact of corruption on electricity sector is particularly pressing in sub-Saharan Africa (Imam et al. 2019). Namely, settings with weak institutions, sectors with big infrastructural projects, government intervention and a lack of competition can provide fertile ground for corrupt practices (Imam et al. 2019).

Corruption is present in Nigeria’s electricity sector. A recent study published by the Socio-Economic Rights and Accountability Project (SERAP) has estimated that Nigeria’s electricity sector lost 11 trillion naira39b4c860a7ba to corruption since 1999. These losses encompassed public funds, private equity and social investments or divestments in the power sector (SERAP 2017: 17; Premium Times 2022). Moreover, a survey conducted by SERAP in 2019 showed that police and the power sector were perceived by respondents as the most corrupt public institutions in the country (Ewodage 2019).

The first section of this Helpdesk Answer addresses Nigeria’s electricity sector, focusing on its historical development, its current structure, the key actors involved and the main challenges it faces. The section that follows addresses corruption in Nigeria’s electricity sector by describing the main forms of corruption, key actors and institutions implicated in corruption, as well as its effects. The final section addresses policy and regulatory responses to corruption in Nigeria’s electricity sector and identifies the specific corruption risks that may emerge during the green energy transition in the country. An annex lists several initiatives by international donors and partners to support Nigeria’s electricity sector and highlights how these initiatives addressed corruption risks.

Nigeria’s electricity sector

The development of Nigeria’s electricity sector

The electricity sector in Nigeria has undergone several reforms. Between 1972 and 1998, the generation, transmission and distribution of electricity in Nigeria was under the monopoly control of the federal electric utility body called the National Electric Power Authority (NEPA) (Audu et al. 2017). In 1998, the National Council of Privatisation (NCP) tasked the Electric Sector Reform Implementation Committee (ERIC) to devise guidelines for promoting the liberalisation of the electricity sector (Adoghe et al. 2009).

In 2001, during the administration of President Obasanjo, the National Electric Power Policy (NEPP) was approved, recommending the wider privatisation of the electric power sector (Audu et al. 2017: 1222).

After the federal legislature passed the Electric Power Sector Reform Act in 2005, the electricity sector in Nigeria was restructured into 18 publicly-owned companies: six generating companies (GENCOs), eleven distribution companies (DISCOs), and the Transmission Company of Nigeria (TCN) (World Bank 2021). The Act also established the Power Holding Company of Nigeria (PHCN) that took over assets, liabilities, employees, as well as rights and obligations from NEPA, and set up the Nigerian Electricity Regulatory Commission (NERC) to act as an independent regulator of the electricity sector (Audu et al. 2017: 1223).

The privatisation of the electricity sector in Nigeria took place in 2013, with the stated aim of modernising the sector and meeting increasing demand for electricity in the country (Roy et al. 2023). The federal government privatised the 11 DISCOs and six GENCOs, though it retained minority shares in them as well as full ownership of the TCN (International Trade Administration 2023). Following the privatisation, the PHCN ceased to exist (Shosanya 2013).

The current state of Nigeria’s electricity sector

The national grid is currently managed by the state-owned TCN. Another state-owned company, Nigerian Bulk Electricity Trading Company (NBET) serves the role of a bulk trader by engaging in the purchase of electricity from independent power producers (IPPs) and GENCOs under long-term power purchase agreements (PPAs). NBET then resells this electricity to 11 distribution companies (DISCOs) under vesting contracts0ab272e72a81 (World Bank 2021; Omonfoman 2021). DISCOs are responsible for delivering power to consumers as well as for billing and revenue collection. The on-grid energy mix is dominated by gas fired thermal power plants, accounting for around 80%, and hydro, making up the other 20% (International Trade Administration 2023).

Key actors

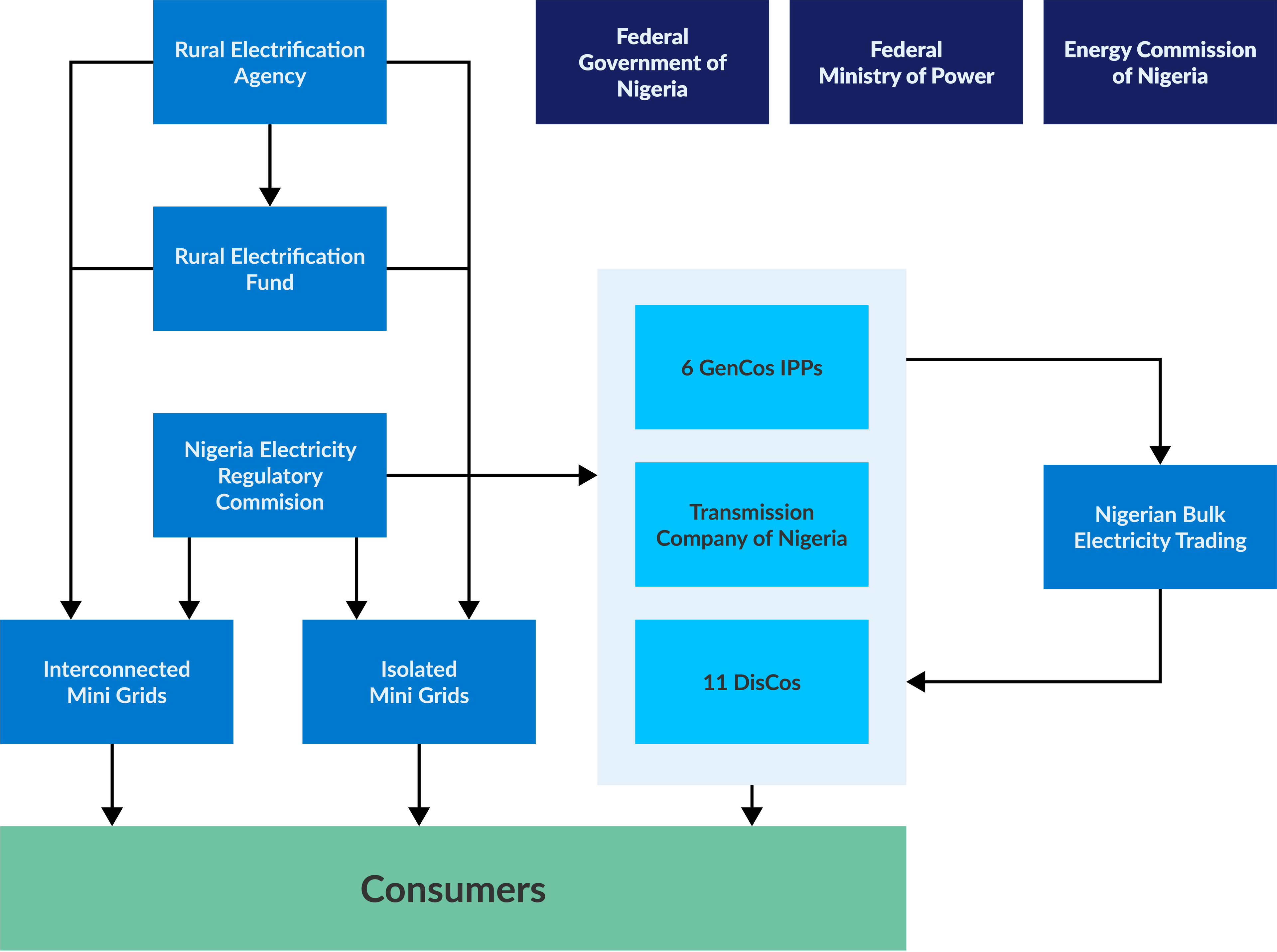

Key actors in the Nigerian electricity supply industry are as follows (see Figure 1):

State-owned companies:

- Transmission Company of Nigeria (TCN): manages the electricity transmission network

- Nigerian Bulk Electricity Trading (NBET): performs the role of bulk trader

- Gas Aggregation Company of Nigeria (GACN): in charge of gas allocation for domestic use, among other duties (GACN no date)

Private companies:

- GENCOs: companies generating electricity through hydro (water) and thermal (gas) generation. There are currently 23 such companies in Nigeria (NERC no date b)

- Independent power producers (IPPs): contracted to produce power at a particular time and are protected by using power purchase agreements (PPAs) (Havenhill Synergy no date)

- DISCOs: 11 companies delivering electricity to end-users0b351c2428be

Regulatory agencies (see: Vincent and Yusuf 2014: 222; International Trade Administration 2023):

- Federal Ministry of Power: in charge of policy formulation and providing general direction to other agencies within the power sector

- Nigerian Electricity Regulatory Commission (NERC): with an independent mandate to regulate the power sector since 2005

- Energy Commission of Nigeria (ECN): tasked with strategic planning and coordination of national policies related to the energy sector

- Rural Electrification Agency (REA): has a mandate to promote, support and provide access to electricity to rural and semi-urban areas in Nigeria

- Nigerian Electricity Management Services Agency (NEMSA): set up in 2015 with a mandate to enforce technical standards and regulations, including through inspections, testing and certification of electrical installations. (NEMSA no date)

Figure 1: Key actors in the Nigerian power sector

Source: Adeyanju et al. 2020: 5.

Key challenges

One of the sector’s major challenges is that low access to electricity remains a large constraint to economic growth in Nigeria (World Bank 2021; Roy et al. 2023). An estimated 43% of Nigeria’s population do not have access to an electricity grid (World Bank 2021: 3). In 2019, 90 million people in Nigeria lacked access to electricity, constituting 12% of the global access deficit (IEA et al. 2021: 36). There are significant urban-rural disparities in access to the grid (Ekwo 2013: 7).

Another major challenge is the inadequacy of energy supply to meet demand. Power outages in Nigeria are frequent: in 2018, levels were recorded as the highest across the continent (Berahab 2021). The annual economic losses that result from the lack of reliable power reportedly amount to 2% of the country’s GDP (Dapel 2021). Moreover, the Manufacturing Association of Nigeria has reported that, within a decade, 820 manufacturing firms folded or left the country due to the inadequate power supply (Dapel 2021).

The electricity sector faces different kinds of financing challenges. For example, distribution companies report aggregate commercial, technical and collection losses of around 50%, which is significantly higher than the international good practice benchmark of 15% (World Bank 2021: 3). TCN’s maximum transmission capacity is 7,500 MW, far lower than the installed generation capacity is of 12,522 MW (NERC no date a). Furthermore, the tariff policy is reportedly inconsistently applied, making sustainable electricity operations difficult (World Bank 2021: 52). Lastly, a reason compounding the low supply of electricity is the high levels of debt owed to the GENCOs by NBET (Vanguard 2022).

Partially in response to such challenges, electricity theft is widespread in Nigeria’s sector, reportedly affecting every part of the supply chain, including generation, transmission and distribution (SERAP 2017; Kingsley 2022).

One manifestation of electricity theft is illegal tapping into distribution lines by consumers (Roy et al. 2023). Such theft reportedly accounts for the largest percentage of the DISCOs’ financial losses, with 40% of distributed electricity reportedly lost to theft. (Stakeholder Democracy Network 2017: 7)

Corruption in Nigeria’s electricity sector

Overview of the main forms of corruption in Nigeria’s electricity sector

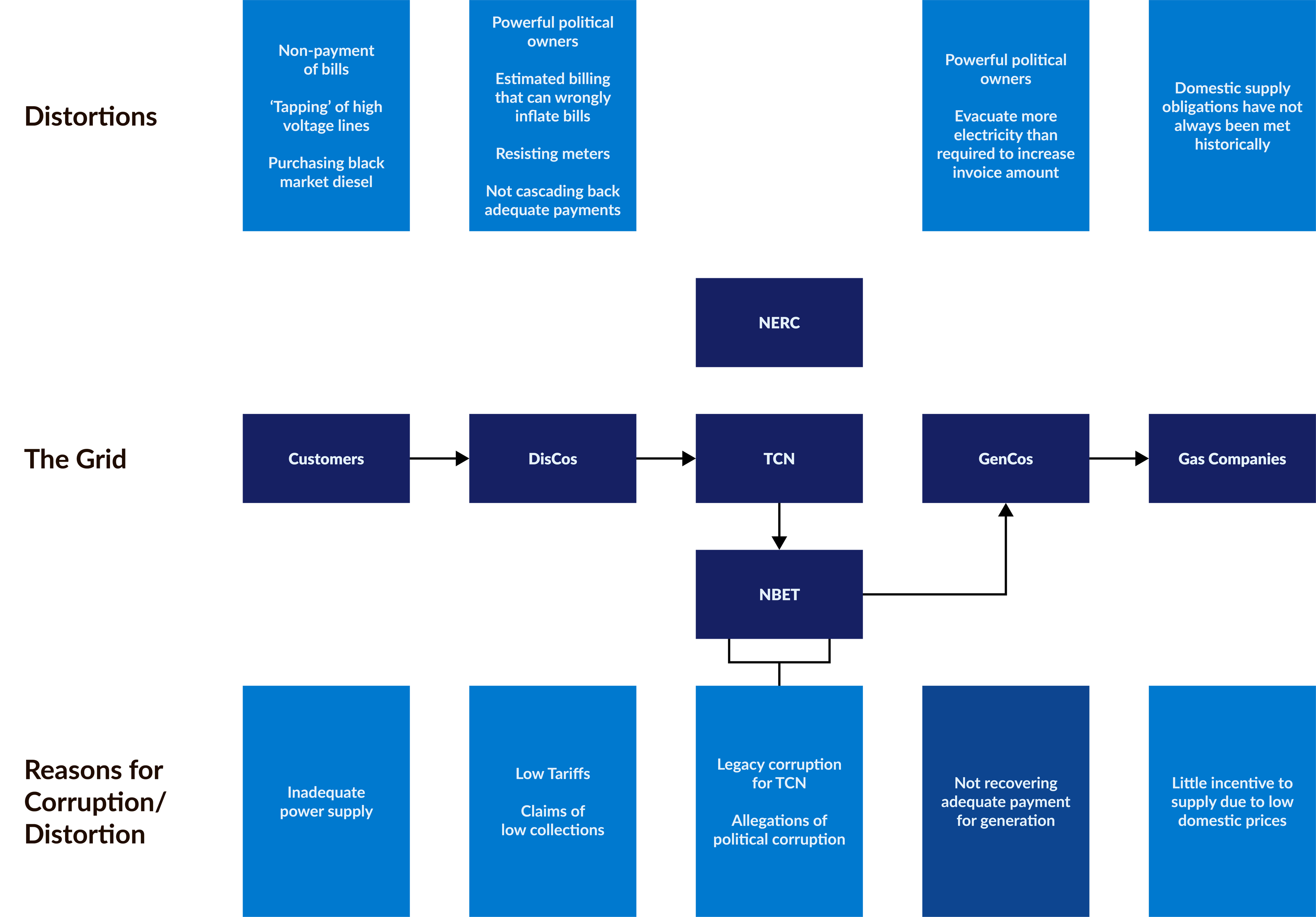

The ecosystem of actors in Nigeria’s electricity sector is complex and actors operating at varying levels are complicit in corruptionRoy et al. (2023: 5) stress the networked characteristics of corruption in Nigeria’s electricity sector (see Figure 2 for a detailed overview of identified distortions), finding evidence of corruption across all sections of the national grid, ranging from gas supply to the end customer. The main forms affecting Nigeria’s electricity sector include:

- Political corruption: the “manipulation of policies, institutions and rules of procedure in the allocation of resources and financing by political decision makers, who abuse their position to sustain their power, status and wealth” (Transparency International 2009: 35). Political corruption has a networked character, and when it becomes widespread, it can become institutionalised.

- Petty corruption: the “everyday abuse of entrusted power by low and mid-level public officials in their interactions with ordinary citizens”, who try to access basic public services (Transparency International 2009: 33). It is closely linked to bureaucratic and administrative corruption.

- Private-to-private corruption: corrupt practices within and between legal entities outside the public sector (Martini 2014). This form is relevant due to the predominance of private companies in Nigeria’s electricity sector.

Figure 2. Corrupt practices and distortions in Nigeria’s electricity sector

Source: Roy et al. 2023: 6.

Political corruption

Several scholars have highlighted the issue of political corruption during the privatisation process.

Albert et al. reviewed the awarding of contracts and procurement in the sector during the late 2000s and early 2010s and found that the beneficiary companies were often associated with persons who had financed the ruling Peoples Democratic Party. They thus concluded that contracts were awarded and the privatisation of companies was largely carried out on the basis of cronyism (Albert et al. 2021: 21).

Similarly, Ekwo concluded that many procurement activities in the electricity sector during this period were carried out without any tendering process and evaluation of any of the contractors (Ekwo 2013: 9).

Such practices reportedly resulted in several GENCOs and DISCOs ending up being privatised to politically connected actors (Roy et al. 2023: 4). Specifically, although they did not have a technical background, these companies would join forces with international partners who had technical capabilities to satisfy formal criteria in the bidding process. However, the equity participation of these technically capable partners after the privatisation contracts was signed remained low (Games 2020; Roy et al. 2023: 4).

The role of international actors such as multinational companies and capital outflows appears to play less of a role in corruption in the electricity sector as opposed to other Nigerian sectors such as the extractive industries.Nevertheless, there allegations in this vein have been made.

A Canadian company, Manitoba Hydro International, was selected through a bidding process in 2012 to manage TCN, which remained under the ownership of the federal government. It has been alleged by some that the awarding of the contract was made without “recourse to any budgetary procedures or formalities and control by any institution” (SERAP 2017: 39; Vanguard 2016).

However, TCN’s contract was not renewed after 2016 (Ampofo and Agyeman-Togobo 2016; Roy et al. 2023). While no official reason was given, the interim managing director of the TCN criticised Manitoba for failing to address inefficiencies in the company (Nnodim 2017). There were allegations that the Transmission Company of Nigeria did not execute most of its approved 44 projects in 2016 (Vanguard 2016). As a result, TCN management returned to the Nigerian government. Since then, Senator Dino Melaye has accused Manitoba Hydro International of further offences such as fraudulently diverting funds, and has sought for the company to be investigated by the Economic and Financial Crimes Commission (Vanguard 2016).

In addition to political collusion, there are also risks of large-scale misappropriation in the sector. One local electricity market analyst claimed many DISCOs and meter asset providers were misappropriating funds made available by the government for a meter procurement scheme (Kingsley 2023). In 2015, the Chicago Tribune collected reports in Nigeria of “bribery of electricity workers by some diesel generator and fuel suppliers to organize household and business blackouts in order to boost sales” (Kay 2015).

Petty and private-to-private corruption in the distribution part of the supply chain

Petty and private-to-private corruption are reportedly widespread in Nigeria’s electricity sector, particularly in the distribution part of the supply chain. Employees of DISCOs have been repeatedly accused of engaging in various corrupt practices, such as over-billing, refusing to install pre-paid meters and deferring payments (SERAP 2017: 20). DISCOs have further faced accusations of manipulating meters and billings to extract more profits from clients (Tope 2023). In April 2023, Jos Electricity Distribution Plc (JED) – a DISCO active in the states of Benue, Bauchi, Gombe and Plateau – reportedly terminated the contracts of 20 employees for corrupt practices, singling out the defrauding of consumers as a main offence (The Cable 2023).

There is also evidence of DISCO officials demanding consumers pay additional payments for services by, for example, installing pre-paid meters for customers (Uzodinma 2018). According to the latest edition of the Global Corruption Barometer Africa (Pring and Vrushi 2019: 49), 34% of Nigerians who used public services had paid bribes to utilities officials in the previous year. In some regions, the issue may be more pronounced; for example, 58% of respondents in a survey of 720 electricity consumers from the distribution area of the Benin Electricity Distribution Company (BEDC) said they had paid a bribe to a BEDC worker in the last 12 months (Stakeholder Democracy Network 2017: 13). Other reports suggest that Abuja Electricity Distribution Company (AEDC) staff frequently demands bribes from customers before installing meters (CISLAC Nigeria 2019; Olu 2021).

Additionally, evidence based on informant interviews in Nigeria suggest that small and medium enterprises (SMEs) tend to resort to bribing state institutions. This is because waiting for services such as installing transformers takes too long (Roy et al. 2023).

Furthermore, SERAP argued that electricity theft is not just led by consumers but is enabled with the support of various actors, ranging from end-users through to utility staff, labour union staff, political leaders, bureaucrats and high-level utility officials (SERAP 2017).Electricity theft may not only be a form of corruption but also indicative of it. Smith (2004) found that higher levels of electricity theft correlate closely with governance indicators such as high levels of corruption.

Effects of corruption on the electricity sector

Some argue that corruption is one of the key factors for explaining the poor conditions and performance of the electricity sector (Ogunleye 2016).

First, despite the allocation of substantial funds to improve the electricity sector, misappropriation of public funds leads to frequent electricity outages and limited access to electricity (Nextier 2023).

Second, reliable electricity supply is essential for economic development. However, due to low levels of power generation, many businesses decide to either leave the country or close down (Onuoha 2010). This was particularly evident in mid-2000s when many industries and enterprises ceased operation (Onuoha 2010).

Third, political favouritism during the privatisation of the power sector led to adverse selection of investors, who had little or no technical background in the sector, resulting in suboptimal effects of privatisation (Roy et al. 2023).

Fourth, corruption in the distribution part of the supply chain directly harms consumers, who are forced to pay bribes to gain access to electricity.

However, it is worth emphasising that the reasons for the lack of access and power outages can be manifold and one should be wary of overstating the role of corruption (Bergin 2023). A recent World Bank (2021: 52) report summarises four main factors: operational efficiency; state of infrastructure; the policy and regulatory environment; and sustainable fiscal support. Other identified factors include transmission/distribution bottlenecks and the rejection of loads by distribution companies (Oke 2015; Ikeanyibe 2020: 8). Lastly vandalism of gas supply lines, including by insurgent actors, is frequently reported (Stakeholder Democracy Network 2017: 6).

Case studies

This answer identified no high-level convictions for corruption in the electricity sector in Nigeria. However, allegations have been made and investigations have been carried out. While some of these allegations are outlined below, this should not be considered as implying that any of the parties were guilty of offences. Indeed, corruption allegations within the electricity sector may be politicised and therefore entirely groundless.

The case studies below indicatethat corruption were present in the period both prior to and after privatisation, and that a myriad of high-level actors have been accused of corruption.

A 2017 report from SERAP outlines corruption allegations made against several high-level Nigerian public officials and lawmakers. In 2009, the former head of Nigeria’s power regulatory agency NERC with six others, was arrested on a 196-count charge. The charges included alleged criminal conspiracy and the illegal use of public funds (Reuters Staff 2009). The documents presented before the court suggest that corruption manifested through unnecessary overseas trips, with close to US$1 million spent on travel allowances alone between January 2006 and December 2008 (SERAP 2017: 25). However, this case did not result in any criminal conviction (SERAP 2017: 25).

In 2009, two Nigerian lawmakers were detained for allegedly misappropriating 5.2 billion naira from the Rural Electrification Agency’s (REA) (Eboh 2009; SERAP 2017). This was reportedly done through a scam involving electricity contracts for rural electrification by the Ministry of Power (Eboh 2009; SERAP 2017). The accused officials were allegedly involved in manipulating public procurement procedures to obtain undue advantage in contract awards with REA (SERAP 2017: 29). Other allegations in this case include the diversion of REA’s funds for personal gain, breaking the public procurement rules, as well as awarding fictious and unnecessary contracts (SERAP 2017). However, in 2012, the charges were dismissed (SERAP 2017).

Another case involves the investigation of NBET and its managing director by the House of Representatives. (Busari 2019). The allegations of corruption included NBET’s violation of the public procurement act which reportedly cost the federal government more than 90 billion naira. Specifically, two firms were suspected of lacking essential documents when bidding for a power purchase agreement (PPA), while many contractors and vendors that engaged with NBET were reportedly not registered with the Bureau of Public Procurement, which would be a violation of the Act’s provisions. Another allegation against the managing director was related to an alleged overpayment to two power generating companies within the PPA. The independent regulator NERC reacted by claiming that all payments were in line with the law (Busari 2019) and cleared the managing director of any transgressions.

In a separate case, NBET had funds allocated in its 2017 budget for the purchase of operational vehicles. A report by the auditor general showed that only three out of twelve procured vehicles were for project monitoring, while other nine were luxury vehicles distributed to the management. The report recommended sanctions for gross misconduct in line with the relevant legislation (Adebayo 2020).

Another case of alleged corrupt behaviour took place in one of the DISCOs, the Abuja Electricity Distribution Company (AEDC) (SERAP 2017). While the company struggled financially, some officials reportedly received disproportionately high salaries, reaching 36 million naira per month, after their salaries were increased in 2014 (Udo 2015). This resulted in a labour crisis over the allegedly fraudulent allocation of excessively high salaries to a few officials (SERAP 2017: 31). The Nigeria Union of Electricity Employees requested prosecution of officials receiving disproportionately high salaries (Tukur 2015).

In October 2022, employees of the TCN petitioned the Minister of Power, accusing the general manager of TCN of corruption (Shosanya 2022). Specifically, they accused him of collaborating with training consultants for kickbacks (Shosanya 2022).

In May 2023, operatives of the anti-graft agencya003f92cb6d1 arrested the former minister of power, Sale Mamman, on corruption allegations related to 22 billion naira fraud (Oyero 2023). He is accused of conspiring with the staff of the ministry in charge of implementing the Zungeru and Mambilla hydro electric power projects and diverting 22 billion naira (Oyero 2023). The investigation was, as of September 2023, ongoing. While in office, Mamman himself reportedly claimed that a “cabal” existed in the Ministry of Power that was “bent on denying Nigerians electricity” and suspended several officials (Adebulu 2020).

Responses to corruption in Nigeria’s electricity sector

After becoming president following the 2015 general election, Muhammadu Buhari announced he would take decisive measures against corruption (Tade 2021). Although there have been some achievements including the recovery of stolen assets, and the arrests of high-level political figures, the anti-corruption efforts of his administration have been criticised by some for being selective and politicised (Tade 2021; Ejekwonyilo 2023). Moreover, some authors consider Nigeria’s anti-corruption bodies to be poorly coordinated, have conflicting mandates and in need of improved protocols (Amenaghawon and Ilo 2016; Ogunleye 2016).

Nigeria has a number of anti-corruption bodies: Independent Corrupt Practices and other Related Offences Commission (ICPC) with a mandate to investigate, prosecute and prevent corruption. It recently established the anti-corruption and transparency units (ACTUs) across select ministries, departments and agencies as a strategy to counter corruption in the public sector. The ACTUs report on suspected corruption to the ICPC (World Bank 2020: 42).

In 2021, the acting CEO of the TCN singled out corruption as one of the key factors in undermining the revenue generating potential of the agency and inaugurated an ACTU in TCN as an in-house anti-corruption mechanism (Ogunyemi 2021). The ACTUs appear to be gaining momentum within the electricity sector, with similar units having been set up within the NELMCO and NERC.

The civil society sector has also been vocal in promoting anti-corruption strategies targeting corruption in the electricity sector. SERAP (2017) suggested several reforms, including:

- introducing transparency in the public procurement process and strengthening independent regulatory institutions

- addressing petty corruption, considering how widespread it is in the electricity sector

- conducting regular financial audits for all electricity companies.

CISLAC Nigeria – a CSO and member of Transparency International's global movement – has also called attention to corruption within the sector and promoted more accountability.

Corruption risks in Nigeria’s green transition

Notwithstanding Nigeria’s current reliance on hydro and thermal power plants, Nigeria has vast renewable energy resources to tap, particularly with regards to solar energy (IRENA 2023b) (see Figure 3).

Nigeria is one of the signatories of the Paris Agreement, which it ratified in 2017, committing to develop its energy system in line with the agreement’s goals (IRENA 2023b: 19). At the 26th Conference of the Parties (COP26), the then President Muhammadu Buhari pledged that Nigeria will cut emissions to net zero by 2060 (IRENA 2023b: 19).

Figure 3. Renewable energy sources’ potential in Nigeria

|

Energy resource |

Unit |

2015 |

Total |

Percentage utilised in 2015 |

|

Large hydro |

GW |

1.9 |

24 |

8 % |

|

Small hydro |

GW |

.06 |

3.5 |

2 % |

|

Wind |

GW |

0 |

3.2 |

0 % |

|

Bioenergy |

PJ |

1 229 |

29 800 |

4 % |

|

Solar PV |

GW |

0.017 |

210 |

0 % |

|

CSP |

GW |

0 |

88.7 |

0 % |

Source: IRENA 2023b: 28

There are several initiatives aimed at transitioning to renewable energy in Nigeria including:

- In 2011, the government launched the Renewable Energy Master Plan, with an aim to increase the share of renewable energy sources to 36% by 2030. (International Trade Administration 2023).

- In 2016, Nigeria signed a power purchase agreement (PPA) worth US$2.5 billion with 14 IPPs for solar power plants throughout the country (International Trade Administration 2023).

- In the Economic Sustainability Plan (ESP) of 2020, the Nigerian government adopted a solar power strategy committing to the electrification of 5 million households (Climate Policy Database no date). The strategy encourages private solar photovoltaic companies to participate by providing incentives in the form of low-cost financing (Climate Policy Database no date).

- Through the Rural Electrification Agency (REA), the federal government has been pushing for the use of renewable sources, including biomass and solar, for electricity production mostly in rural and semi-urban areas of the country that cannot be reached by distribution companies (International Trade Administration 2023). The REA’s strategy has shifted from expanding grid access to deploying solar mini-grids (International Trade Administration 2023).

- IRENA, in collaboration with the Energy Commission of Nigeria, developed a renewable energy roadmap for Nigeria finding that by 2050 up to 60% of Nigeria’s energy demand could be met with renewable sources of energy (IRENA 2023a, 2023b).

Taking into account the Nigerian experience in the electricity sector discussed in this Helpdesk Answer, the process of a green transition can be considered as vulnerable to corruption risks.

There are also specific risks associated with energy transitions, which inevitably disrupt the existing power structures, creating new winners and losers. Therefore, it is important to keep in mind that contextual factors, such as the quality of institutions, can determine how powerful political and business actors influence green energy transition initiatives (Resimić 2022).

Specifically, powerful business actors, in concert with political elites, may sabotage the policies related to the green transition, if they go against their business interests. For example, IRENA (2018) suggests that there is a trend of political and other resistance to renewable energy manifesting in the forms of institutional corruption and anti-renewables lobbying. This is relevant for Nigeria, considering that the country is the world’s 12th largest producer of oil and has the largest natural gas reserves on the continent (EITI no date). For example, fossil fuel subsidies have been identified as one of the barriers towards the renewable energy transition (Aliyu et al. 2018).

Energy and electricity are capital-intensive sectors, making them prone to capture by a small number of actors, and they rely on high cooperation between political and business actors, leading to opportunities for collusion. Lastly, it involves large public procurement contracts that can be vulnerable to corruption risks (Rimšaité 2019: 265; Sovacool 2021).

Corruption risks may differ based on the type of renewable energy. Namely, Sovacool (2021: 5) points out that hydropower projects are particularly vulnerable to corruption in the design, tender and implementation phases because of their size, complexity and huge investments involved. Nigeria currently draws approximately 20% of its on-grid energy from hydropower.

Studies in other contexts have documented evidence of corruption in solar energy subsidies or procurement (Moliterni 2017; Klusáček et al. 2014; Rignall 2016; Biswajit and Mourshed 2018). This may be relevant for Nigeria considering its strong concentration on solar energy.

Finally, there are several important anti-corruption strategies that may be used to minimise corruption risks in the green energy transition that are relevant for Nigeria (see Rahman 2020: 10-13):

Corruption risk mapping is a strategy to limit corruption in renewable energy transition. This can help relevant stakeholders identify the most vulnerable parts of the system, and consequently design appropriate policies to minimise corruption risks (Gordon 2018). This should identify structural factors incentivising corrupt behaviour. For example, Boamah and Williams (2019) attribute corruption in the energy sector in Kenya to poor planning and the inability of electricity market to expand access, turning people to corruption to solve their issues with access to the grid.

An area of concern for potential investors, particularly in sub-Saharan Africa relates to a lack of transparency at the design stage of projects, including project appraisal, selection, design and budgeting. Accordingly, strategies to improve governance at the project preparation stage (Sobják 2018) include capacity building in the relevant institutions and improving transparency in decision-making processes.

Considering the alleged politicised nature of Nigeria’s power sector privatisation, another strategy could be to introduce beneficial ownership transparency as part of licensing requirements, as suggested by EITI (2018). A study by Ikejemba et al. (2018), focusing on failed renewable energy projects in sub-Saharan Africa, found that corruption in the award phase of a project was typically crucial for project failure. This may have a bearing for Nigeria, where it would be essential to counter political favouritism in the allocation of public funds during a green energy transition.

Annex

The following is a non-exhaustive list highlighting several initiatives of international donors and partners to provide technical assistance to Nigeria’s electricity sector and highlights if and how these initiatives have addressed corruption.

Initiatives of international donors and partners to provide technical assistance to Nigeria’s electricity sector

|

Donor/partner |

Initiatives |

Addressing corruption risks |

|

Foreign Commonwealth and Development Office (FCDO) and the UK’s International Climate Finance |

Renewable Energy Performance Platform (REPP): founded in 2015 to mobilise private sector development activity in sub-Saharan Africa’s renewable energy sector. |

In all their projects, REPP integrates environmental, social and governance (ESG) considerations, through, among other aspects, assessments to prevent corruption, money laundering and terrorist financing (REPP 2022: 24). |

|

GIZ |

The project aims to improve electricity supply in Nigeria, including by creating an enabling environment for investment in renewable energy through energy efficiency measures in buildings and industries, access to finance and quality standards. |

|

|

MacArthur Foundation |

Nigerian Electricity Regulatory Commission (Abuja): improving accountability and public knowledge about the power sector in Nigeria (MacArthur Foundation 2018: 2). Association of Nigerian Electricity Distributors (Abuja): building awareness about the newly privatised electricity sector and accepted standards and practices in the sector (MacArthur Foundation 2018: 2). |

Targeted support for strengthening accountability and reducing corruption. In the electricity sector, the focus is on the distribution, as this has greatest impact on the everyday lives of Nigerians. Ultimate goals are to strengthen transparency and accountability practices of distribution companies and customers having decreased tolerance for corrupt practices, such as bribery and illegal connections. |

|

Technical support to four DISCOs between 2016-2018 to improve revenue collection, among other goals (Power Africa 2022). |

Countering electricity theft by engaging with local community leaders. |

|

|

The Presidential Power Initiative (PPI) |

The Presidential Power Initiative (PPI) was launched by President Buhari in 2018 to “rehabilitate and expand the electricity grid through improved generation, transmission, and distribution”. The Federal Government of Nigeria established a special purpose vehicle, the FGN Power Company, to implement the PPI with technical assistance from by Siemens AG with the support of the German government.

|

The PPI Project Book sets out the principles for the PPI, including transparency, integrity and due diligence. |

|

The UK’s Department of Energy and Climate Change and Department for International Development |

Green Africa Power (GAP) |

The initiative aims to tackle constraints to power sector investment in renewable power generation in Africa as a long-term source of financing (Rahman 2020). The initiative also envisions anti-corruption safeguards (Department for International Development 2012: 48). |

|

The World Bank |

One of the result areas refers to strengthening governance and transparency, and specifically stresses the need for DISCOs to have an appropriate governance and anti-corruption framework in place that would support achieving value for money and discourage the abuse of procedures (World Bank 2020). |

|

|

The project appraisal document considers the level of corruption risks for planned public procurement contracts within the project, and includes several safeguards against corruption, such as assessment of corruption risks of the relevant agencies and steps to ensure capacity building in the implementing domestic agency. |

||

|

This project also incorporates measures for strengthening governance and anti-corruption, through technical assistance, among other channels. |

- State capture refers to efforts of powerful individuals, firms or groups to influence the formation of rules, laws and regulations to benefit their own private interests at the expense of public interest (see Transparency International 2009; Natural Resource Governance Institute, no date; Resimić 2022: 3).

- 1 Naira=0.0013 US$, based on the exchange rate as of August 2023. See: https://www.xe.com/currencyconverter/convert/?Amount=1&From=NGN&To=USD

- A vesting contract is a written agreement between the bulk trader and the DISCOs, authorising DISCOs to purchase electricity from the bulk trader (Business Day 2020).

- These are: Abuja Electricity Distribution Company (AEDC), Benin Electricity Distribution Company (BEDC), Eko Electricity Distribution Company (EKEDC), Enugu Electricity Distribution Company (EEDC), Ibadan Electricity Distribution Company (IBEDC), Ikeja Electric (IE), Jos Electricity Distribution Company (JEDC), Kaduna Electricity Distribution Company (KAEDC), Kano Electricity Distribution Company (KEDC), Port Harcourt Electricity Distribution Company (PHEDC) and Yola Electricity Distribution Company (YEDC) (Business Day 2023).

- Economic and Financial Crimes Commission (EFCC).